Stocks appear to be starting Tuesday’s session a little lower as we make our way into the long holiday weekend. Investors finally have a US stimulus bill, but a new Covid-19 strain in the UK that could be more contagious remains troubling.

If a pandemic year has shown us anything, it is that investors keep returning to technical stocks, which have performed this year. Apple AAPL,

and Amazon.com AMZN,

more than 70% each, Netflix NFLX,

60% and Alphabet GOOGL added,

29% up.

But our call of the day Michael Loukas, CEO of publicly traded funds provider TrueMark Investments, suggests that investors dig a little deeper into younger, hungry tech companies. Because, as he says, what happens when that larger technology supply runs out?

“We’ve been through several waves of technology, and you are now looking at some of the mega caps in technology, and are they really innovating? Not necessarily at this stage. So we’re looking for these newcomers who are category killers, who embrace innovation, who bring some kind of competing technology like artificial intelligence to the table, ”Loukas told MarketWatch in an interview.

Sure enough, those big corporations, Netflix and the like, have enjoyed years of dominance as “category killers,” dominating their fields and developing ecosystems upon which individuals and companies depend.

The newcomers in which Loukas invests also fit into another theme that he would like to enter in 2021: working from home after a lockdown. That is, the view that the end of lockdowns will not substantially slow growth for cybersecurity and cloud computing companies benefiting from the trend.

Regarding his stock selection, he points to Okta OKTA,

a corporate identity management service that anyone can connect to any device and works in the cloud. Cyber technology company CrowdStrike CRWD,

is another, and then there is Zscaler ZS,

a security platform that connects users and their apps.

These are the stocks he places in TrueMark’s ETFs: TrueShares Structured Outcome ETF DECZ,

and the TrueShares Technology, AI and Deep Learning ETF LRNZ,

”

As for the view that some think valuations are being stretched, he says this is one more reason to look at secular growth stories – that’s when an industry shifts and there’s new demand. “They lead you to these category killers and smaller companies that are gaining market share and have plenty of room to grow in the coming years,” Loukas said.

The markets

Equity Futures YM00,

ES00,

NQ00,

points lower, with European equities also under pressure, despite some gains after Monday’s heavy losses. And the Nikkei NIK,

led Asian markets to the south. Concerns about virus-related lockdowns keep pressure on oil CL00,

The buzz

A second major aid package for the coronavirus was pulled through Congress late Monday, after nine months of haggling, but a future battle for another aid package is looming. A Democrat suggests throwing in an additional $ 300- $ 400 as a reward for Americans getting vaccinated against Covid-19.

In US economic news, we expect a revision of third-quarter growth, a consumer confidence index and existing data on home sales.

Taiwan has broken the world’s longest period of free from new Covid-19 cases – more than 8 months – after a pilot tested positive.

Platoon Interactive PTON,

has agreed to buy rival fitness equipment manufacturer, Precor, in a $ 420 million deal, in the hope that it will help catch up on all those pandemic-driven backorders.

An unexecuted draft lawsuit reportedly said technology groups Facebook FB,

and Alphabet GOOGL,

have pledged to work together if they ever get an antitrust lawsuit over online advertising.

Major US technology groups, Cisco CSCO,

Intel INTC,

and Nvidia NVDA,

be added to the list of companies that have been victims of the suspected Russian hacking of IT management group Solar Winds SWI,

MGM, the studio behind the James Bond films, is reportedly investigating a sale.

The graph

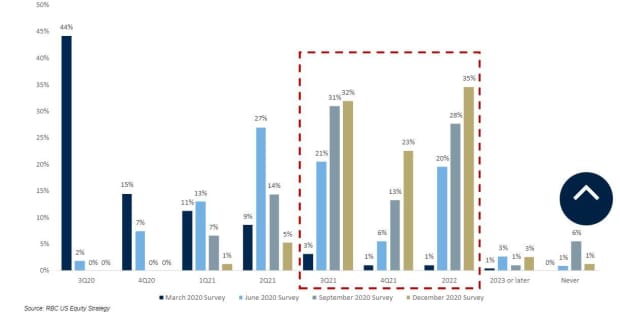

An RBC investor survey in December found that the date some investors expect life to return after COVID 19 has shifted. “Overall, 61% of investors think normalcy will return sometime in 2021, and another 39% say 2022 or later,” said Lori Calvasina, head of US equity strategy.

RBC

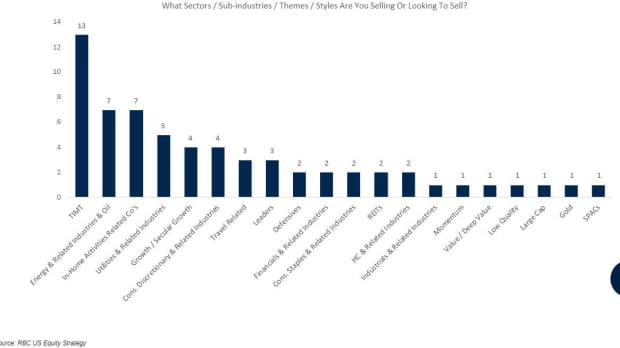

Also in that study, here are the stock sectors investors wanted to sell:

RBC

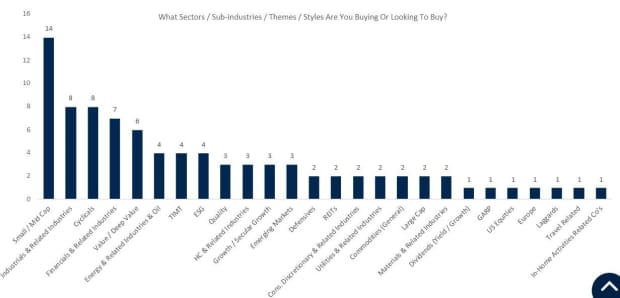

And buy:

RBC

Random reads

Illegal winery caught on Alabama sewage treatment plant

Wisconsin dentist accused of breaking teeth in fraud scheme

Need to Know starts early and updates to the opening bell, however Register here to get it to your email box once. The emailed version will ship at approximately 7:30 a.m. East.

Do you want more for the day ahead? Sign up for The Barron’s Daily, a morning investor briefing, including exclusive commentary from Barron’s and MarketWatch writers.