Non-replaceable tokens, or NFTs, have become an overnight investment phenomenon, with $ 60 million in sales on Tuesday– exceeds total sales for the whole of 2020. An NFT is a type of cryptographic token used to make digital media unique and therefore collectible, be it a GIF or even a sports highlight. If you’re wondering why everyone has suddenly forgotten how to take a simple screenshot, or is otherwise baffled by this, you’re not alone.

What are NFTs?

Using blockchain technology, NFTs designate an official copy of digital media, which can then be sold by artists, musicians, or sports entities to monetize content that would otherwise be cheap or free. NFTs differ from cryptocurrencies in that they are not interchangeable – each one is unique.

If you buy an NFT through a cryptocurrency marketplace, you can keep it in your digital wallet or list it for sale on the marketplace. When sold, all computers on a decentralized network record the transaction in a shared ledger, which is essentially a certification of authenticity that cannot be changed or deleted.

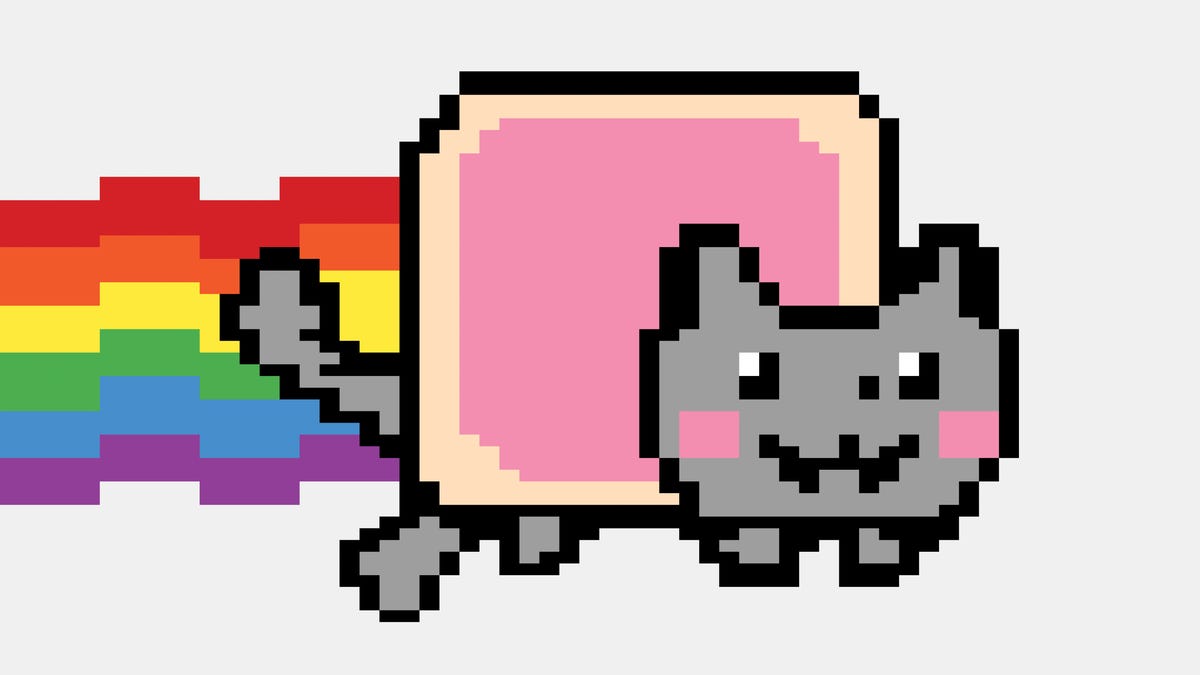

NFTs have a wide variety of uses, including collectibles sports cards, digital art and virtual real estatePer Yahoo, brands such as Nike Louis Vuitton, and the NBA has already begun to generate NFT-based assets, with the NBA launching a dedicated aggregator site called NBA top photoLast week, artist Chris Torres sold a unique version of Nyan Cat, a popular meme of a flying cat with a Pop-Tart body that leaves a rainbow trail, for the equivalent of about $ 580,000, according to the New York Times Rick and MortyJustin Roiland has too jump in NFTs

G / O Media can receive a commission

Why would anyone spend money on this?

It may seem bizarre to buy the “authentic” version of something you can easily screen from your desktop, but it’s easy to overlook the emotional value of collecting, especially when it comes to original art. Part of the appeal is owning an authentic item created by an artist you like, and the bragging rights that go with it. In essence, this isn’t all that different from owning an original Andy Warhol painting that can be displayed, sold, or shared – it just happens to be digital. In addition, crypto art is finally unlocking the problem of artists getting paid, as the creators can program these assets to pay them royalties every time the collectible is sold.

Additionally – and perhaps more importantly (if we explain the renewed interest in N.FTs, which have been around for years) – people are increasingly seeing these digital assets as speculative investments, as they can be bought and sold on online marketplaces (an NBA Top Shot digital collectible card from basketball star LeBron James recently sold for $ 100,000, for example).

The increase in recreational investing during the pandemic is also likely to be a factor: most of these exchanges naturally accept cryptocurrencies, meeting the demand of individual investors who have a stash of cryptocurrency and who want to spend on something both fun and fun. potential to make more money later. Whether this stake will continue to support the half-million dollar flying cat GIF valuations remains to be seen.