“The timing could be more challenging this time, but the IRS could likely begin disbursing the money in January,” said Howard Gleckman, a senior fellow at the Urban-Brookings Tax Policy Center.

Details of what will be in the final draft of the bill – and when it will be passed – were still uncertain on Friday, as lawmakers fought against an impending closure.

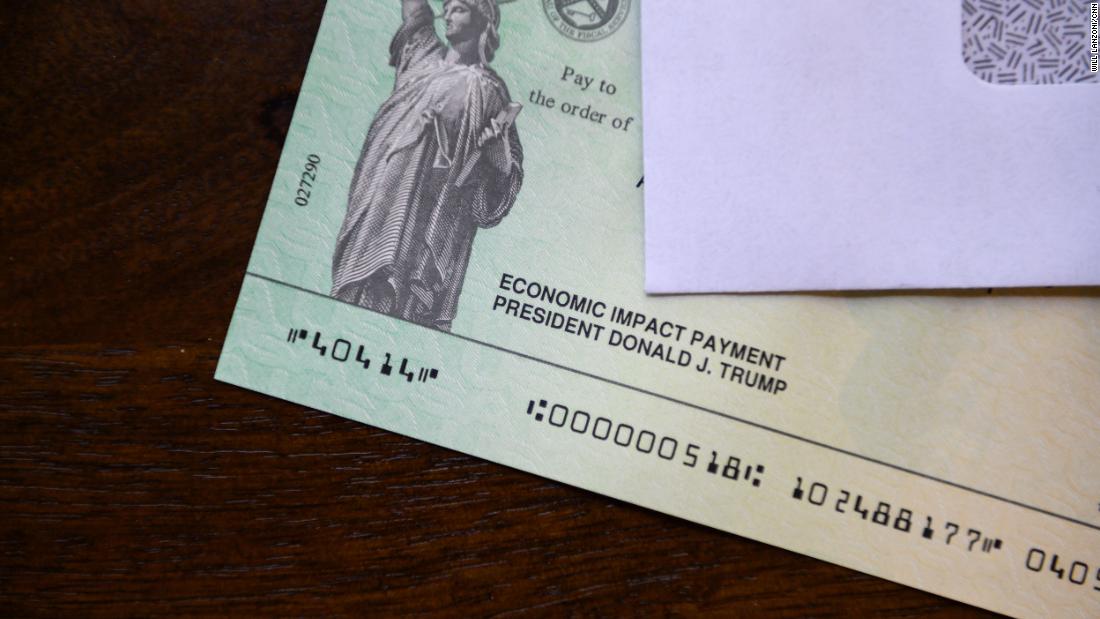

In March, Congress provided individuals with $ 1,200 direct payments and couples $ 2,400 plus $ 500 per child under the $ 2 trillion CARES Act. That payments began to phase out for singles earning more than $ 75,000 a year and those earning more than $ 99,000 got nothing. Income limits were doubled for couples.

Who will get the money the fastest

The payments are not all made at the same time. Those whose bank details are who is registered with the IRS will likely get the money first because it is deposited directly into their account. Others receive paper checks or prepaid debit cards in the mail.

IRS under pressure

If Congress keeps the entry requirements the same as for the first round of scrutiny, the process can be almost as simple as pushing a button. But it can complicate things if the parameters are changed, especially if Congress is adding restrictions in addition to income.

Additional checks may be delayed the start of the 2020 tax return season. A second incentive check means that the agency must make changes to the tax return forms, some of which have already been sent to the printers.

December is not an ideal time to increase the workload of the IRS. It is usually the month of preparation for the upcoming filing season and due to the holidays there may be more staff on leave than usual.

“I think the IRS will deliver incentive checks in a timely manner. It could well be at the expense of the filing season start date,” said Chad Hooper, the executive director of the Professional Managers Association, who advocates for more than 30,000-union IRS -employees.