Are you looking for a contrary game? Try great energy – fossil fuels, to be specific.

A combination of supply cuts and rising demand have contributed to crude oil prices rising over the past 2½ months. Meanwhile, redlining by banks – more on that later – points to what may prove to be a particular benefit for the largest players in the industry.

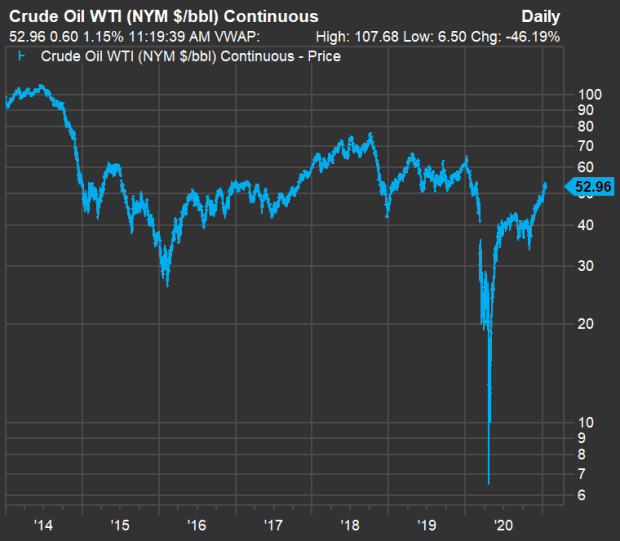

First, let’s see what’s going on with the raw material. Here is a chart showing the movement of monthly continuous futures contracts for West Texas crude oil (WTI) since late 2013:

(FactSet)

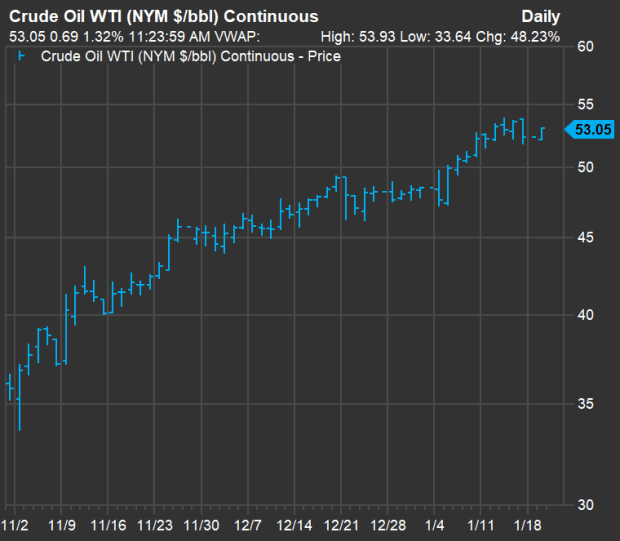

Here’s the action since the end of October:

(FactSet)

That’s a 51% jump in 2½ months.

Investors have believed in the rally. This is how the 11 sectors of the S&P 500 Index SPX,

of the largest US stocks that performed in the first half of January, along with data for previous periods:

Covid-19 vaccines give hope that the world can return to a normal economic growth path, perhaps later in 2021. However, the winter spike in coronavirus cases has caused the International Energy Agency to lower its demand forecast for 2021. On the other hand, the IEA report was published Tuesday, and WTI for delivery in February CLG21,

was up 1.3% for the day.

Of course it is easy to give up oil. The short-term path for oil and natural gas supplies can be rocky from here – until the pandemic appears to be ending. And for the very long term, the increasing use of electric vehicles does not bode well for gasoline demand.

But all the electricity needed for the new electric fleet must come from somewhere, including power plants that use fossil fuels. Oil and natural gas producers will continue to fuel heavy vehicles, aircraft and ships.

A new form of redlining

Redlining, the old practice of some banks to avoid lending to entire regions, is illegal. But in the world of ESG investing – which stands for environmental, social and good governance – companies are trying to make investors believe that they are doing everything they can to avoid activities that harm the environment and at the same time help society in different ways to improve.

This has resulted in many major US banks, including Morgan Stanley MS,

Wells Fargo & Co. WFC,

Goldman Sachs Group Inc. GS,

JP Morgan Chase & Co. JPM,

and most recently Bank of America Corp. BAC,

Decide not to provide financial support for the oil drilling machine business in the Arctic National Wildlife Refuge (ANWR) in Alaska.

The Biden administration may try to reverse President Trump’s decision to open drilling in the ANWR. But that doesn’t mean the big banks won’t limit their loans to oil companies drilling in other areas.

In his Jan.15 daily energy report, Phil Flynn, a senior market analyst at Price Futures Group, wrote that smaller shale oil producers would be the victims of banks’ reluctance to lend to the industry.

In other words, the much-derided ‘Big Oil’ companies will get bigger and stronger, while smaller independent companies will burst under the weight of more regulation and the inability to secure capital, ”he wrote.

Wall Street’s favorite oil stocks

So what does all this mean for investors? You have the resources – oil and natural gas – that have come under tremendous pressure. The price of crude oil is less than half of what it was not long ago. Meanwhile, US shale producers had a long chance of breaking even last year. Looking ahead, OPEC countries and Russia are motivated to keep pushing prices up by managing supply.

When the pandemic finally ends, a euphoric reaction in the market could even push oil up from current levels. Sustained economic growth could also support significantly higher prices.

Looking at the S&P 500, there are 25 energy reserves. Here are them all, ranked by percentage of ‘buy’ or equivalent ratings among Wall Street analysts. The table contains consensus price targets.

The table contains a lot of data – you have to scroll to see it.

In addition to the assessment information, there are price targets for 12 months. Some of the targets are not much higher than current stock prices, even for the companies with the most “buy” or equivalent ratings. A year may not be long enough for a price target for a long-term investor, especially considering the recovery of commodities that is partly dependent on the end of the pandemic.

The dividend income is included in the table. Shares of Exxon Mobil Corp. XOM,

have a yield of 7.27%. In any case, the company surprised some investors by not cutting dividends during the pandemic, even when oil prices were much lower. Exxon’s rival Chevron Corp. CVX,

also has an attractive dividend yield – 5.60% – with a much lower ratio of long-term debt to equity (the rightmost column on the chart).