The move this week focused on the bond market, not the stock market, as government bond yields have risen in response to the progress of a new stimulus package and the global rollout of COVID-19 vaccines.

The S&P 500 SPX,

has fallen for three consecutive days, but by only 0.5% – suggesting that the stock market has not panicked over the movements that caused the return on the 10-year Treasury TMUBMUSD10Y,

up to about 1.30%, and the return over 30 years TMUBMUSD30Y,

up to 2.10%.

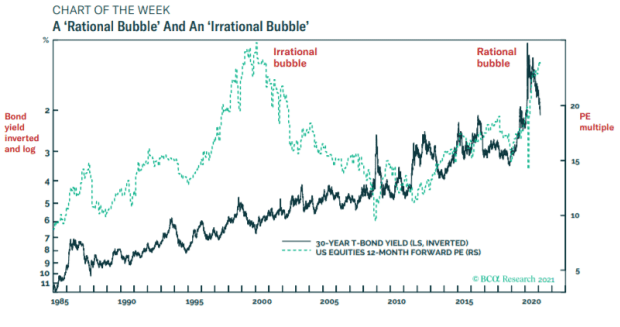

Dhaval Joshi, chief European investment strategist for BCA Research, has been saying for a while that low returns meant a rebound in stocks and other assets, a rational bubble, if you will. “Rational, because the nosebleeds ratings are justified by a fundamental motivation. And not just any fundamental driver, but the most fundamental driver of all: bond yield, ”he writes.

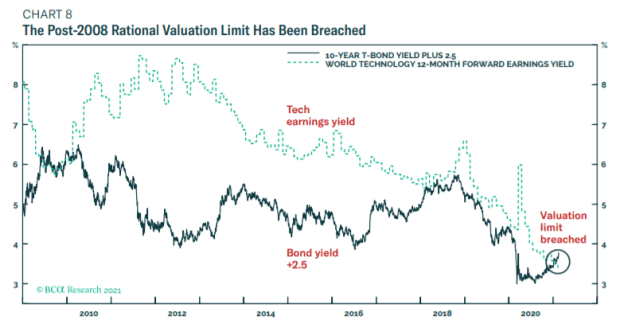

But not now. Forward price-earnings multiplications have gone up, even when interest rates have gone up. Earnings yield in the most growth-oriented sector, technology, has now been outpaced by bond yields plus a fixed amount, as the chart shows.

This can be solved in three ways. One is that stock prices are falling; another is that bond yields are falling; a third is that neither is moving, but earnings are rising, to improve stock valuations. (That third factor seems unlikely at the end of the earnings season for now.)

“Our current recommendation is to remain tactically neutral for the coming weeks to see if risk asset valuations can return to rationality. This means keeping existing investments in the market, but keeping fire on new use of cash, ”says Joshi. “If valuation returns to rationality in any of the three ways listed above, investors can safely put new money in the market.”

And if not? Joshi says that if the market becomes irrational, the key will be to see if investors with longer horizons join the party. “As investors with longer and longer time horizons enter the irrational bubble, there will be well-defined moments of heightened vulnerability where correction risk increases. This is what burst the irrational bubble in 2000 and will burst every new irrational bubble. “

The buzz

Uber Technologies UBER,

dropped by 2% in premarket trade after the UK Supreme Court ruled that drivers are employees and not self-employed, entitling them to minimum wages and paid holidays.

Facebook FB,

Chief Executive Mark Zuckerberg was said to speak with Australian treasurer Josh Frydenberg after the company blocked sharing of Australian-produced news, in response to measures to make online companies pay publishers. Faced with the same potential law, Alphabet’s GOOG,

Google has made settlements with publishers including News Corp., owner of MarketWatch, the publisher of this report.

Technology services giant IBM IBM,

according to The Wall Street Journal, it is considering selling its loss-making IBM Watson Health unit.

Streaming Device Maker Roku ROKU,

reported a surprising profit on higher than expected sales. Cloud service provider Dropbox DBX,

reported better than expected revenues and revenues for the fourth quarter. Materials used AMAT,

the microchip equipment manufacturer, exceeded fiscal earnings expectations for the first quarter and led to better estimates for the current quarter than analysts had estimated. Manufacturer of agricultural machinery Deere & Co. THE,

climbed into premarket trading after easily beating analyst estimates.

French car manufacturer Renault RNO,

fell in Paris, scraping the dividend after reporting a loss of € 8 billion for 2020. Renault also said that the peak of the microchip shortage facing car makers should be reached in the second quarter.

The flash version of Markit’s purchasing managers indexes should be released at 9:45 am, followed by existing home sales.

The latest development from Senator Ted Cruz leaving electricity-poor Texas for Cancún, Mexico – for which he apologizes – is the report that he left his poodle, Snowflake, at home in Houston.

The markets

US Equity Futures ES00,

NQ00,

Advanced.

Oil CL.1,

fell below $ 60 a barrel, and the US dollar DXY,

slipped.

Random reads

Now that NASA’s Perseverance rover has landed safely on Mars, it is tasked with collecting rock samples that may contain evidence of a past life.

A 3D printer that produces vegetarian steaks? That’s the goal of this startup that just raised $ 29 million.

Need to Know starts early and will update until the opening bell, but sign up here to get it in your email box once. The emailed version will ship at approximately 7:30 a.m. East.

Do you want more for the day ahead? Sign up for The Barron’s Daily, a morning investor briefing that includes exclusive commentary from Barron’s and MarketWatch writers.