Initial claims for unemployment insurance rose to 965,000 last week amid signs of a slowdown in hires due to pandemic restrictions, the Labor Department reported Thursday.

The total was worse than Wall Street’s estimates of 800,000 and higher than last week’s total of 784,000.

The markets responded little to the number as the slowdown in economic activity is expected to be met with more stimulus from Washington. President-elect Joe Biden announced later Thursday that he hopes for another package likely to exceed $ 1 trillion.

Futures prices continued to indicate fractional opening gains on Wall Street.

Still, the unemployment rate for the week ending January 9 was another sign of economic turmoil caused by restrictions in activities aimed at fighting the pandemic. The total was the highest since the week of August 22, when just over 1 million claims were filed.

Persistent claims were also higher, up from 199,000 to 5.27 million. That figure is a week behind the weekly damage total and has increased for the first time since the end of November.

The total of public benefit recipients has fallen sharply despite the increase in weekly figures. That level dropped from 19.2 million last week to 18.4 million. The data is two weeks behind the weekly claims total. The decrease was mainly due to a drop in the number of claims for an emergency pandemic, although it was still well above the 2.18 million benefits a year earlier.

The increase in claims was spread across a handful of states, mostly those with tighter restrictions on businesses.

Illinois, where Chicago has curtailed restaurants, saw a jump from 51,280, according to unadjusted data. Other big winners were California, which doesn’t even allow alfresco dining and saw claims rise 20,587, up 13%. New York was up 15,559.

However, several states with relatively loose restrictions also saw noticeable benefits. Florida saw its claims more than double to 50,747, while Texas saw an increase from 14,282.

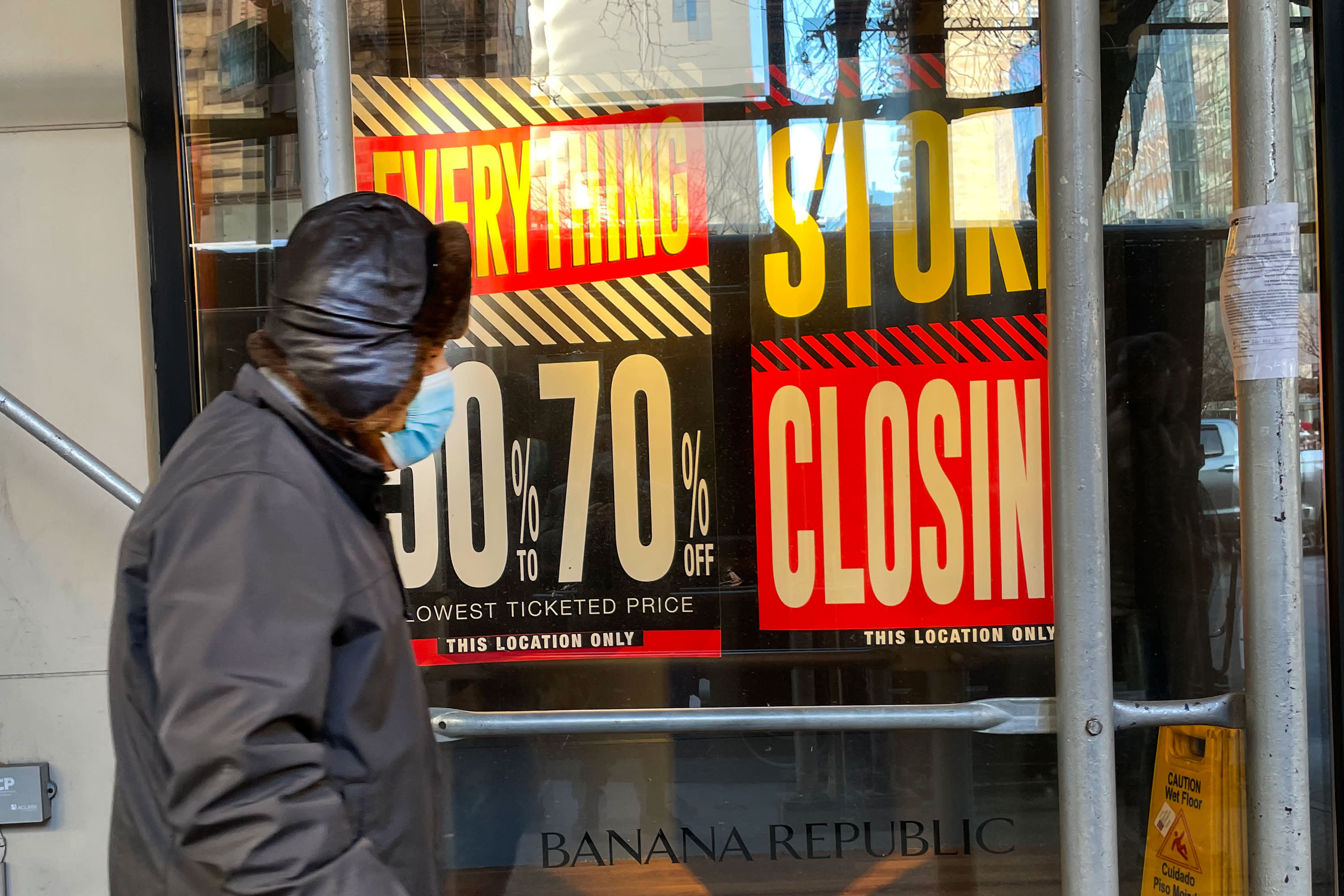

Lately there have been signs that the job supply that started in May is starting to cool.

In December, nonfarm payrolls fell for the first time during the recovery from the Covid market lows, by 140,000 while the unemployment rate remained at 6.7%.

The Federal Reserve said on Wednesday that business contacts in the central bank’s 12 districts reported a reduction in hires and difficulties filling positions. Economists believe that the 2021 economy will start off sluggishly, but will then gain momentum as the year goes on and the Covid-19 vaccine spreads.