The S&P 500 index was about to record its best 12-month performance in the history of the index’s release on Tuesday, following its spectacular bear market downturn a year ago.

Like the S&P 500 SPX,

avoids a 2.9% decline on Tuesday, which seemed likely, it will represent the index’s largest 12-month gain since its publication in 1957, according to Tim Edwards, director of index investment strategy at S&P Global, who owns the index Dow Jones Indices.

But after the first anniversary of the US stock market hitting the lows of last year following the start of the coronavirus pandemic, the S&P 500 could also be poised for its second flag year of gains.

“After falling nearly 34%, it took only five months for the S&P 500 to recoup its losses,” Ryan Detrick, chief market strategist at LPL Financial, wrote in a note Monday, referring to the S&P 500’s plunge to rock bottom. March 23, 2020 from its earlier peak of February 19, 2020.

The full rebound was marked last August with the fastest bounceback ever for the S&P 500 of more than 30% loss, while earnings for the year surpassed previous periods of turmoil in the financial markets.

“The circle is now complete as equities have staged a furious rally, with new highs around the world as the economy recovers at a record pace,” said Detrick. “To put things in perspective, the S&P 500 also lost 34% in 1987, but that recovery took 20 months to hit new highs again.”

Last year’s IPO began in the US in February with the confluence of growing coronavirus infections and new restrictions on travel and business activities, which first included the S&P 500 SPX,

Dow Jones Industrial Average DJIA,

and Nasdaq Composite Index COMP,

10% down in correction mode, then quickly 20% down in bear market area.

To help avert a financial crisis, the Federal Reserve lowered its benchmark interest rate to a range of zero to 0.25%, a level it expects to maintain through 2023, and restored central bank bond purchases for a amount of $ 120 billion per month. It also unleashed an unprecedented array of pandemic credit facilities, including buying corporate debt for the first time ever.

After that, according to Dow Jones Market Data, it took little time for the US stock market to find its position, with the S&P 500 entering its current bull market on April 8, 2020. The Dow’s recovery started earlier on March 26, while the Nasdaq Composite followed on April 14.

For Dow Jones, a bull market starts when stocks rise 20%, while a 20% fall marks the beginning of a bear market. According to his methodology, stocks are always in bear or bull market region up to a reversal of 20%.

Bear to Bull

More optimistic views about the US economic recovery also started to strengthen last summer as progress was made in the development of COVID-19 vaccines.

In July, Moderna Inc. MRNA,

offered updates on its vaccine candidate, and a month later all three major stock indices hit new record highs.

So what now? The US vaccination effort has outpaced Europe, where German Chancellor Angela Merkel on Tuesday called the dominant British variant of the virus a “new pandemic,” while tougher measures were also proposed for the upcoming Easter holidays.

But if history can guide today’s market, the S&P 500 could still be poised for a second year of banal gains.

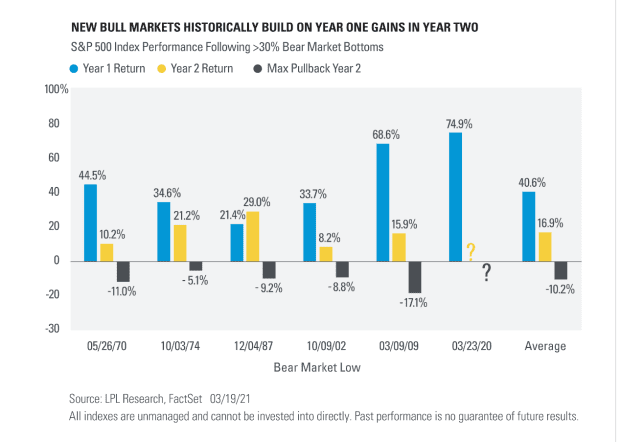

This chart shows first-year market gains averaging 41% for the S&P 500, following the six bear market reversals of more than 30% since World War II.

Bull markets, after a decline of more than 30%

LPL research, FactSet

But the chart also shows that second year earnings averaged nearly 17%, while the decline averaged 10.2%.

Reflation phase

Mark Haefele, chief investment officer at UBS Global Wealth Management, said in a note on Tuesday that he expects risky assets to see more upside as the market enters a “reflation phase” of the recovery.

The CIO also said investors should “hunt for yield,” while also bracing for high growth, rising inflation and low policy interest rates.

According to the ICE BofA Corporate Index, yields in the investment-grade segment of the approximately $ 10.5 trillion US corporate bond market were last seen near 2.27%, after a pandemic low of about 1.79% in January .

Investors are concerned about the potential for rising government bond yields to weaken some of the massive pandemic gains in the technology and high-growth sectors of the stock market, even though banks and financial firms could take advantage of the opportunity to invest more charge interest for borrowers.

Matthew Bartolini, head of State Street Global Advisors’ SPDR Americas research, pointed out on Tuesday that interest in value-focused and cyclical parts of the market will go to $ 8 billion in new assets. Financial Select Sector SPDR fund

XLF,

so far in 2021. The fund was 13.3% higher than the S&P 500 on Tuesday, about 9% better than the S&P 500.

The 10-year treasury yield TMUBMUSD10Y,

was close to 1.65% on Tuesday, after rising to 1.729% for seven consecutive weeks on Friday, close to its high in a year.

“While a rebound in volatility would be normal as this phase of a strong bull market, we think suitable investors might consider buying the dip,” said Detrick. “Vaccine distribution, fiscal and monetary stimulus and a robust economic recovery all have our confidence high.”