While the S&P 500 SPX,

and Nasdaq Composite COMP,

set new records on Monday with the $ 908 billion US stimulus bill finally signed into law, there were a few segments that didn’t get to the party.

First, the small-cap Russell 2000 RUT,

closed lower, after a three-month period when that index rose 33%.

Another segment that didn’t participate in Monday’s rally was recent listings. The IPO of the Renaissance IPO exchange-traded fund IPO,

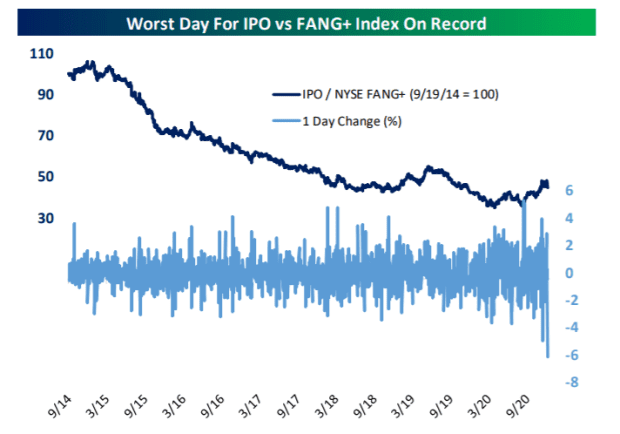

tripped almost 5%. Analysts at Bespoke Investment Group point out that this is the worst relative performance against the NYSE FANG + index NYFANG,

– the Facebook FB grouping,

Amazon AMZN,

Apple AAPL,

Netflix NFLX,

and Google owner Alphabet GOOG,

along with a few other technology giants including Alibaba BABA,

and Tesla TSLA,

– in its history.

Companies including exercise bike manufacturer Peloton Interactive PTON,

Zoom Video communication ZM,

social media site Pinterest PINS,

and data analysis provider Palantir Technologies PLTR,

each struggled.

“That is by far the worst relative performance in the history of the NYSE FANG + index, and could be a sign that the market is re-evaluating aggressive bets on unproven companies that have also been playing out as part of the SPAC craze” , the Bespoke analysts said. SPACs are special acquisition companies called blank check companies that intend to buy up other companies in order to disclose them.

The Defiance Next Gen SPAC-derived ETF SPAK,

with components including sports betting DraftKings DKNG,

and space flight company Virgin Galactic SPCE,

also closed lower on Monday.

The buzz

The House voted to override President Donald Trump’s veto on the defense bill, while Senator Bernie Sanders threatened to file a decision to do so in the Senate unless a vote is taken on the $ 2,000 stimulus proposal that the lower house releases.

Companies that have experienced major falls in price could get more pressure in the coming days as investors record losses for capital gains tax purposes.

According to the COVID-19 tracking project, U.S. hospital admissions from COVID-19 reached a record 121,235 Monday. The number of deaths has decreased significantly since Christmas, probably due to delays in holiday reporting.

According to a minister, more Israelis have received a vaccination than contracted the corona virus. In the US, 2.13 million people have received a dose, according to the Centers for Disease Control and Prevention, or 11% of the number who contracted the disease.

The European Union and China are approaching a trade agreement that will improve European access to Chinese production and China’s access to the European energy space.

The market

US Equity Futures ES00,

NQ00,

YM00,

pointed to further gains.

The FTSE 100 UKX,

surged in London on its first move since the UK agreed on a trade agreement with the European Union to continue tariff-free access.

The dollar DXY,

was lower against major rivals, notably the euro EURUSD,

The return on the 10-year Treasury TMUBMUSD10Y,

was 0.95%. Bitcoin BTCUSD,

traded below $ 27,000 in further turbulent action.

Random reads

A Japanese company, Sumitomo Forestry 1911,

has started making wooden satellites to reduce space debris.

Two widowed penguins comfort each other as they gaze at the Melbourne skyline.

Need to Know starts early and will update until the opening bell, but sign up here to get it in your email box once. The emailed version will ship at approximately 7:30 a.m. East.