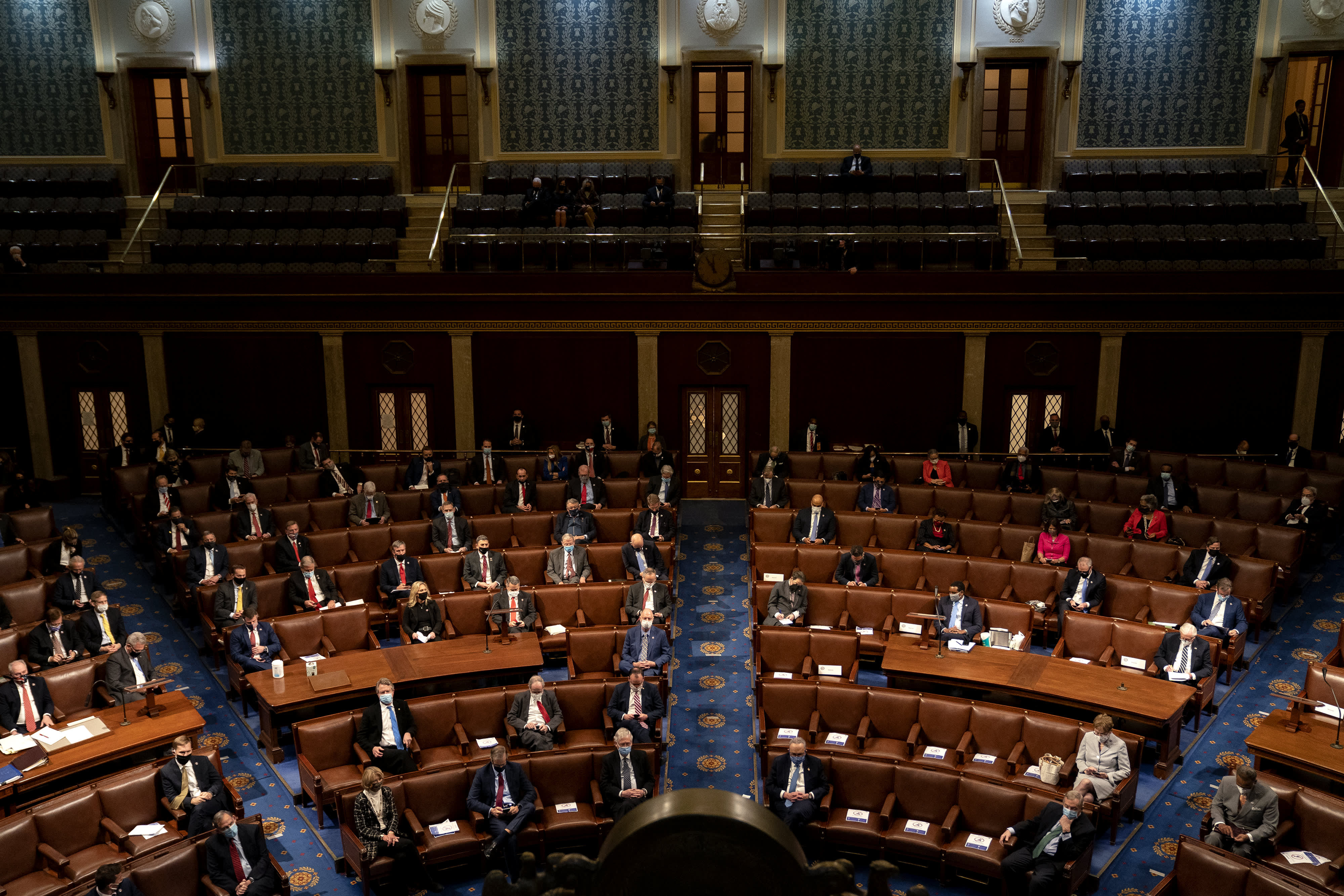

Bloomberg | Bloomberg | Getty Images

Now that Democrats are in control of the White House and Congress, canceling student debts is a better chance of becoming a reality for millions of Americans.

Yet there are obstacles.

Will canceling the debt be a priority for the fledgling Biden government, which finds itself in the midst of dueling and unprecedented health and economic crises?

“They’ve probably created a hierarchy of legislation that they care about,” said Richard Semiatin, an assistant professor at American University. “This is unlikely to be on the first tier.”

On the campaign trail, President-elect Joe Biden pledged to forgive $ 10,000 in student debt to all borrowers in response to the economic pain caused by the pandemic, and the rest of the loans to those attending public colleges or historically black colleges and universities and earn less than $ 125,000 per year.

“We expect him to keep that promise,” said Persis Yu, director of the Student Loan Lender Assistance Project at the National Consumer Law Center, a nonprofit advocacy group.

A recent survey found that 58% of registered voters are in favor of forgiveness of student debt.

Administrative or legislative forgiveness?

Some Democratic senators pressured Biden to bypass Congress and cancel the debt himself.

Senator Elizabeth Warren, D-Mass., Recently described student debt cancellation as “the most effective economic stimulus available through executive action.” Meanwhile, the Senate’s top Democrat, Chuck Schumer, DN.Y., is calling on Biden to forgive $ 50,000 per borrower on the first day of his presidency. “All you need is a simple flick of the pen,” said Schumer in December. “You don’t need a conference.”

Not everyone agrees. Experts say Biden would likely face court if he forgave the debt himself.

And now that the Democrats have gained a majority in Congress, the legislative path may seem more hopeful. Still, there is a long way from hopeful to borrowers who see their debt diminished or removed.

Even with the two senate seats taken over by Democrats in Georgia, the party has just gained a majority and will need elected Vice President Kamala Harris to rally 51 votes to 50 from Republicans.

Not all Democrats may be on board for student debt cancellation, and even if they were, senate procedural rules generally require legislation to garner 60 votes. It will be hard to get nine Republicans to support a debt anniversary.

“With democratic control of the government, Republicans are likely to reassert their interest in the federal deficit and government spending,” said Laurel Harbridge-Yong, associate professor at Northwestern University.

More from Personal Finance:

Covid makes it more difficult to get a top education

Here’s how delaying college can affect your future earnings

College can cost as much as $ 70,000 per year

Still, there may be a way to get around those rules. A once-a-year legislative process called budget reconciliation will allow Democrats to pass bills with their simple majority. That’s how the Democrats passed the final version of the Affordable Care Act in 2010. It’s also how the Republicans pushed through their massive tax cuts in 2017.

But there are limits to this method, said Ryan D. Doerfler, a law professor at the University of Chicago. Democrats can only use reconciliation procedures three times in the next two years, he said. Since this process can only be used once a year, there is usually a lot of competition over what to include, and that will be especially the case during the pandemic.

Reconciliation laws must also be linked to budget changes, and senators can try to block any provisions they claim they are not.

Given all the uncertainty in passing legislation to get rid of student debt, lawyers and Democrats continue to call on Biden to cancel the loans administratively, saying borrowers cannot afford to wait for the relief.

“President Biden has a historic opportunity to improve the lives of tens of millions of American families struggling in the midst of a national crisis,” said Seth Frotman, who served as student loan ombudsman for the Consumer Financial Protection Bureau during the Obama administration.