A grim reality for the euphoric stock market? The next week may be the closest thing to a bullish investor settlement so far in 2021.

It’s the busiest week of the fourth quarter earnings season, culminating in the long-awaited results from heavyweight companies such as AT&T T,

Apple Inc. AAPL,

Facebook FB,

and Tesla TSLA,

In total, approximately 118 companies will report quarterly results in the last trading week of January, including 13 components of the blue-chip Dow Jones Industrial Average DJIA,

John Butters, a senior analyst at FactSet Research, told MarketWatch.

And more than 60% of that weekly attack will occur between January 27 and January 28.

The frenzied period could become a pivotal period for a market that may be looking for its next spark as the newly minted administration of President Joe Biden’s administration unfolds its policy initiatives and plans to address the COVID-19 pandemic.

So far, optimism has been sky high among equity investors, with sentiment data from Ned Davis Research of 74.4%, a level it has only reached 7.4% of the time since 1994.

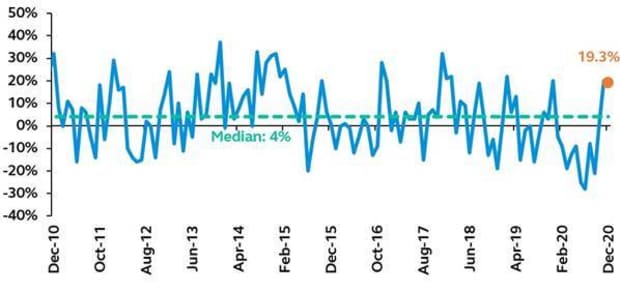

Likewise, the bull-bear spread stands at 19.3% versus a median of 4% on Dec. 31, according to a study by the American Association of Individual Investors.

Source: American Association of Individual Investors, Principal Global Investors

Ned Davis Research says the buying mood has apparently reduced the appetite for bearish bets that stock prices will undergo a meaningful correction in the near term. “One thing investors have done less is short selling,” analysts Ed Clissold and Thanh Nguyen wrote in a Jan. 19 research report.

According to data from the NDR, the short selling ratio, the number of shares sold divided by the total number of issues traded, reached the lowest level since 2011 in November.

You don’t have to search long to find evidence of the treacherous path short sellers are facing today.

Example: GameStop’s stock GME,

is on track for its best monthly rise in its history, up 245% as retail investment fanatics tout the stock and push users on financial platforms like Reddit to buy the stock to squeeze activist investor and noted short-seller Andrew Left’s Citron on Research.

The actions of fanatic investor groups went beyond swearing and hacking to include what Left described as “serious crimes such as harassment of underage children, ”Wrote MarketWatch’s sister publication Barron’s.

For some, this is the exuberance of the market at its peak. Short sellers huddled and retail investors trying to demonstrate their newfound power.

Is this what the precursor to a bubble feels like? Are we in one? When will it pop, if so?

The Fed

Those are all the questions that can be asked of the Federal Reserve as it sets the stage for next week’s other major event: the latest monetary policy update.

Fed Chairman Jerome Powell has often been blamed for both helping to prevent a calamity in the financial markets during the start of the coronavirus pandemic in March last year and for taking too much risk.

The Federal Open Market Committee, headed by Powell, quickly cut interest rates to nearly 0% and pumped trillions of dollars of liquidity into the financial market that had been turned upside down by COVID-19.

But Fed policy has promoted some risk-taking, some critics argue. Bears also argue that the endless money printing will affect the US dollar, the economy and ultimately the financial markets in the long run.

Biden is proposing an additional $ 1.9 trillion in federal government spending to help free the U.S. economy from recession, as coronavirus cases and deaths hit a new peak this month.

All of that may add extra meaning to next week’s Fed meeting.

All eyes will be on Chairman Powell at next week’s FOMC meeting. We are looking for him to strike a more optimistic, but more cautious tone, ”economists Lydia Boussour and Gregory Daco of Oxford Economics wrote in a research note on Friday.

In recent speeches, Powell has already indicated that the Fed is not keen to revert to monetary policy anytime soon, such as raising interest rates from historic lows or tapering off asset purchases, a source of support for financial markets.

The Fed meeting kicks off Tuesday, with Powell & Company delivering its policy update Wednesday at 2:00 p.m. Eastern Time, followed by a press conference hosted by the chairman.

American economic growth?

On Thursday, a day after the Fed’s decision, market participants await the official report on the health of the US economy.

According to consensus estimates among US economists surveyed by MarketWatch, the US economy may have grown by about 4% year-on-year in the last three months of 2020 in the last three months of 2020, which would normally be phenomenal, but follows an increase of 33 , 4% in the third quarter.

But if the GDP measurement continues to show upward progress, it could underline that the economy is moving in the right direction even as the coronavirus pandemic continues to rage.

After all, that’s said and done as the Dow, the S&P 500 index SPX,

and the Nasdaq Composite COMP,

are still at a spitting distance of record highs, the bulls may feel even more encouraged themselves.