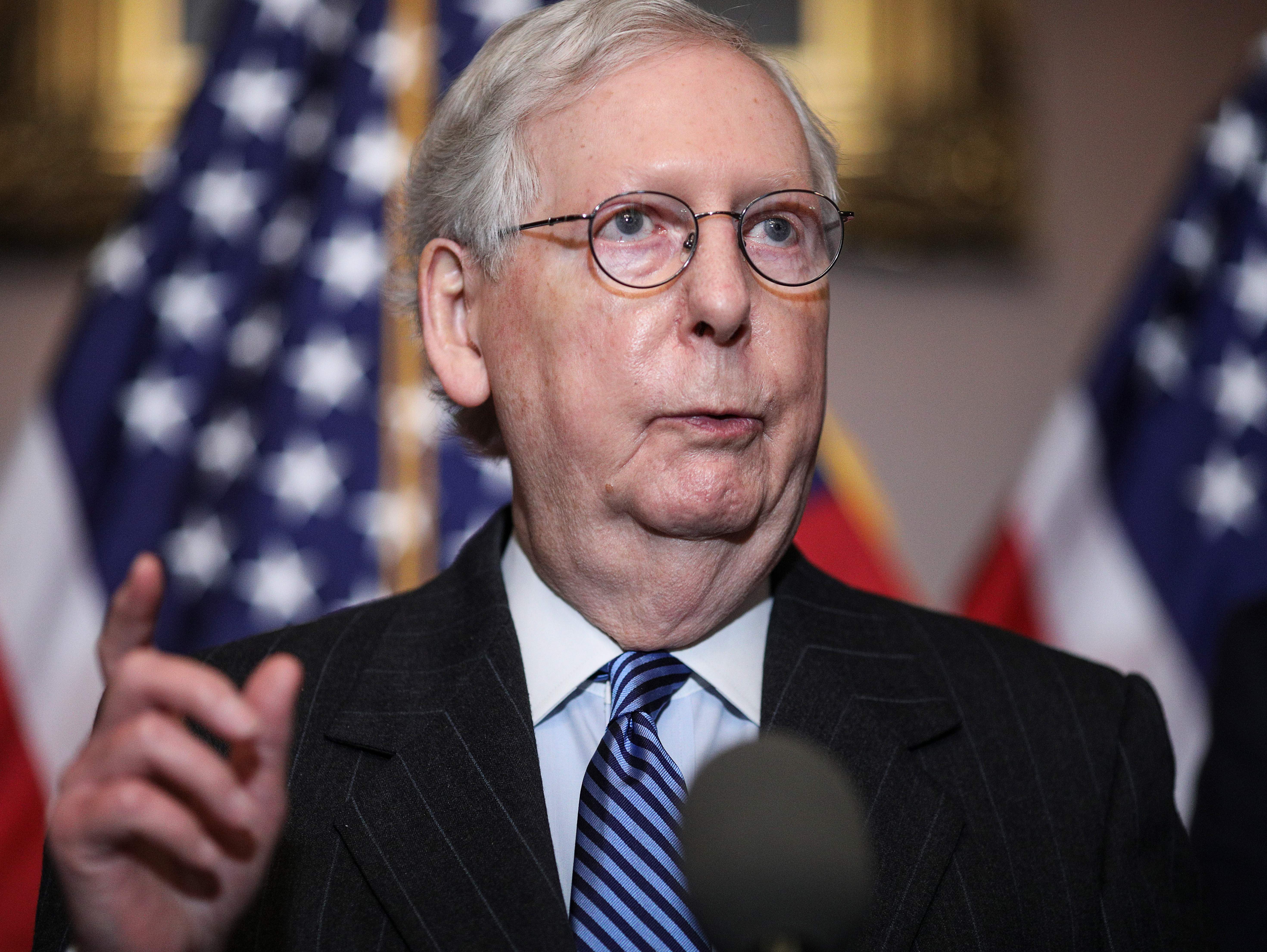

Mitch McConnell, Majority Leader of the United States Senate, speaking at a press conference with other Senate Republicans at the US Capitol in Washington, DC on December 15, 2020.

Tom Brenner | AFP | Getty Images

Stock futures surged in overnight trading on Sunday as Congress managed to negotiate a coronavirus stimulus deal hours before a closing deadline.

Futures on the Dow Jones Industrial Average hit 100 points. Futures on the S&P 500 were slightly up and futures on Nasdaq 100 were up 0.2%. At Monday’s open, Tesla will enter the S&P 500 with a weighting of 1.69% in the index, the fifth largest.

Senate Leader Mitch McConnell said lawmakers have agreed on a $ 900 billion aid package that would provide direct payments and unemployment relief to struggling Americans. The announcement came after negotiators resolved a major bottleneck by reversing the Federal Reserve’s powers to issue emergency loans.

To avoid a government shutdown that would begin at 12:01 a.m. ET Monday, Congress is seeking to approve a one-day spending measure on Sunday. The lawmakers will then vote on the emergency and financing law on Monday.

Major averages have recently risen to record highs amid optimism about new coronavirus incentives and vaccine rollouts. Moderna is shipping its first batch of vaccine doses after FDA approval for emergence use. Meanwhile, Pfizer and BioNTech vaccines are being distributed to primary care health professionals across the country.

“In the eyes of stocks, the inexorable vaccination process, which has just begun, is more powerful than current trends in cases and lockdowns, and will prevent markets from plunging too deep into a source of pandemic despair,” said Adam Crisafulli. , founder of Vital Knowledge, said in a note on Sunday.

“Remember, the three pillars of the rally are all very well in place: vaccines, strong corporate profits and massive stimulus packages,” he added.

With just two weeks of trading left in 2020, the S&P 500 is up 14.8% this year, while the Dow is up 5.8% at 30 stocks. The Nasdaq Composite is up 42.2% this year as investors favored fast-growing technology companies.

On Friday, the Fed announced that it will allow the country’s major banks to resume share buybacks in the first quarter of 2021, subject to certain regulations.

Subscribe to CNBC PRO for exclusive insights and analysis, and live programming of working days from around the world.