In more recent trading, silver futures were up 6.5%.

“SLV will destroy the biggest banks, not just a few small hedge funds,” wrote a WallStreetBets user.

Another claimed that JPMorgan Chase has “suppressed metals for a long time. This should be epic. LOAD UP.”

The Winklevoss twins, who sued Facebook’s famous Mark Zuckerberg and were early bitcoin backers, both tweeted support for WallStreetBets’ push to silver.

“If the silver market is proven to be fraudulent, you better believe the gold market is next,” tweeted Cameron Winklevoss.

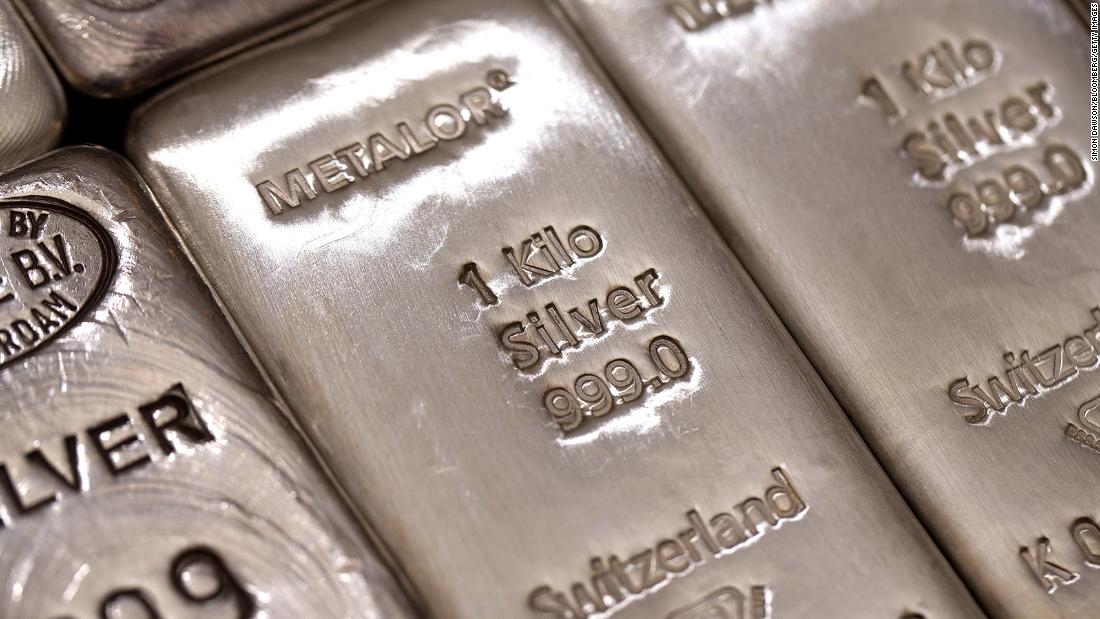

Leading retail sites posted warnings over the weekend that they were dealing with high demand.

“Due to unprecedented demand for physical silver products, we will not be able to accept additional orders for a large number of products until global markets open on Sunday evening,” APMEX, which calls itself the world’s largest online retailer of precious metals, wrote in a message at the top of its website.

SD Bullion warned that “due to unprecedented demand for silver” it would also be unable to accept orders until Sunday evening. Similar notices were posted by Money Metals and other websites.

“Unsurprisingly, the sharp and abrupt rise in consumer demand is overwhelming the physical supply of silver coins from dealers in the short term,” Ryan Fitzmaurice, a commodities strategist at Rabobank, told CNN Business in an email.

Unlike GameStop and other unloved stocks targeted by WallStreetBets, silver futures have been strong lately. Hedge funds and other institutional investors were bullish on silver futures and the precious metal traded near multi-year highs.

“It’s a dramatically different market configuration,” said Fitzmaurice. “I’m not sure how well this new trading strategy from Reddit will fare in futures markets and especially in the notoriously volatile commodity markets.”