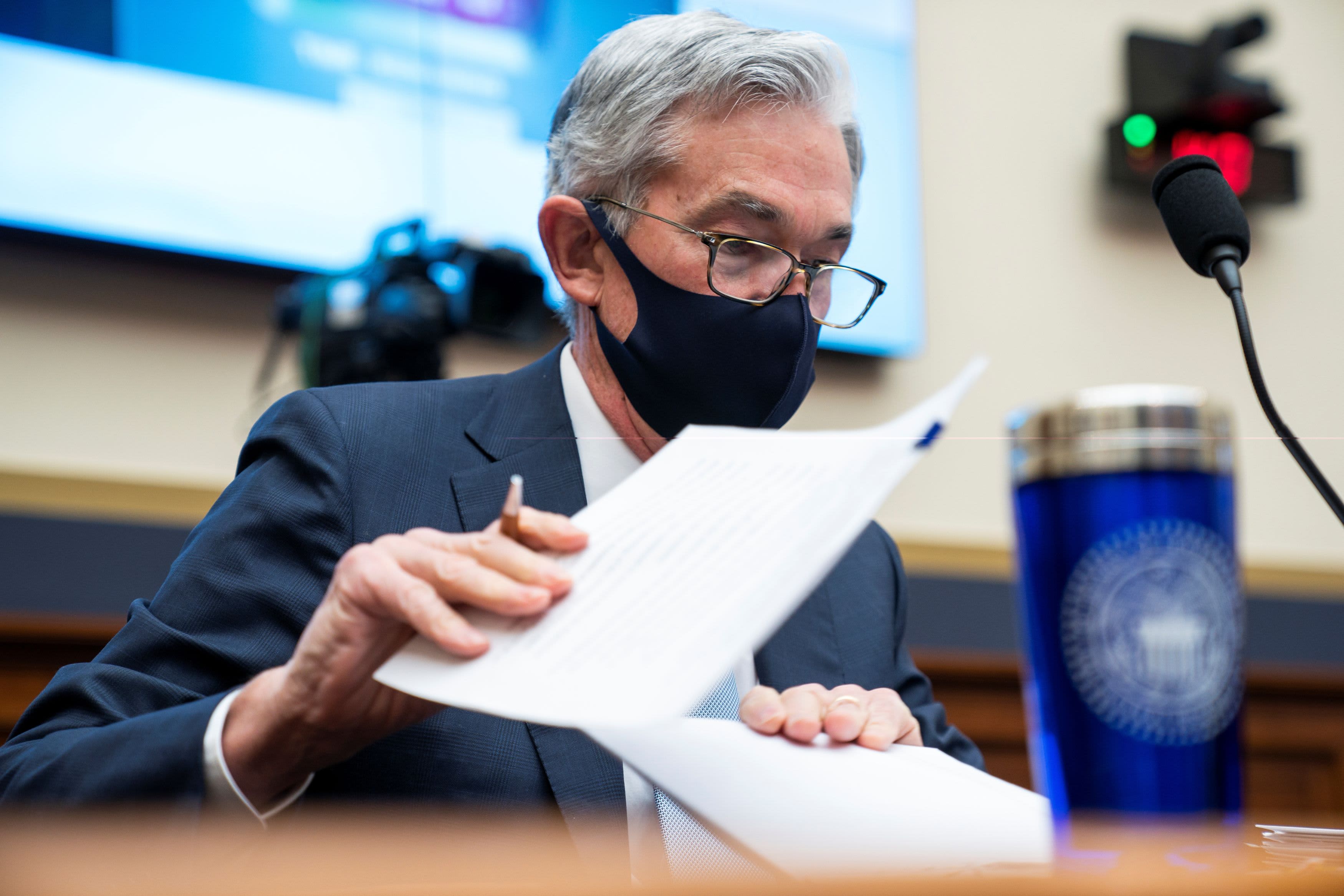

Federal Reserve Chairman Jerome Powell prepares for a House Financial Services Committee hearing on “Oversight of the Treasury Department’s and Federal Reserve’s Pandemic Response” at the Rayburn House Office Building in Washington, DC on December 2, 2020.

Jim Lo Scalzo | Reuters

Strong fiscal help from Congress coupled with accelerated vaccine distribution has seen the US economy recover faster than expected, Jerome Powell, chairman of the Federal Reserve, said Thursday.

At some point, that will allow the central bank to call back the aid offered, although he said now is not the time.

“As we make significant further progress toward our goals, we will gradually roll back the number of Treasury and mortgage-backed securities we buy,” Powell told NPR’s “Morning Edition” in a live interview. “We will very gradually and with great transparency over time, when the economy has almost fully recovered, withdraw the aid we have provided during emergencies.”

US stock market futures fell slightly after Powell spoke.

In the wake of the Covid-19 lockdown just over a year ago, the Fed cut short-term interest rates to nearly zero and buys at least $ 120 billion worth of bonds every month.

Powell and other Fed officials have pledged to keep that accommodation until the economy reaches full employment and inflation averages about 2%. He said the US has made progress towards those goals.

“In a nutshell, it’s a combination of better developments in the field of Covid, especially the vaccines, and also economic support from Congress. That’s really what drives it,” he said. “That will allow us to reopen the economy sooner than expected.”

The US vaccinates nearly 2.5 million people a day, and hospital admissions and death rates have generally declined, although the number of cases has declined or is rising gradually in some states.

Congress has approved more than $ 4 trillion in stimulus measures in the past year and is looking at potentially another $ 3 trillion in future spending.

Powell called current tax practices “unsustainable,” although necessary in the face of the crisis. The low interest rates allow the US to take on the debt burden without causing too much hardship, although Congress will eventually have to address the debt issue, he said.

“We’ll have to, but it’s not time now,” Powell said.

Looking back over the past year, he said he does not regret the extraordinary measures taken by the Fed, even though some critics are concerned that the amount of fiscal and monetary stimulus measures could prove troublesome later if the economy overheats.

“Ultimately, I think what we’ve done in a crisis served its purpose by averting what could have been much worse results,” Powell said.