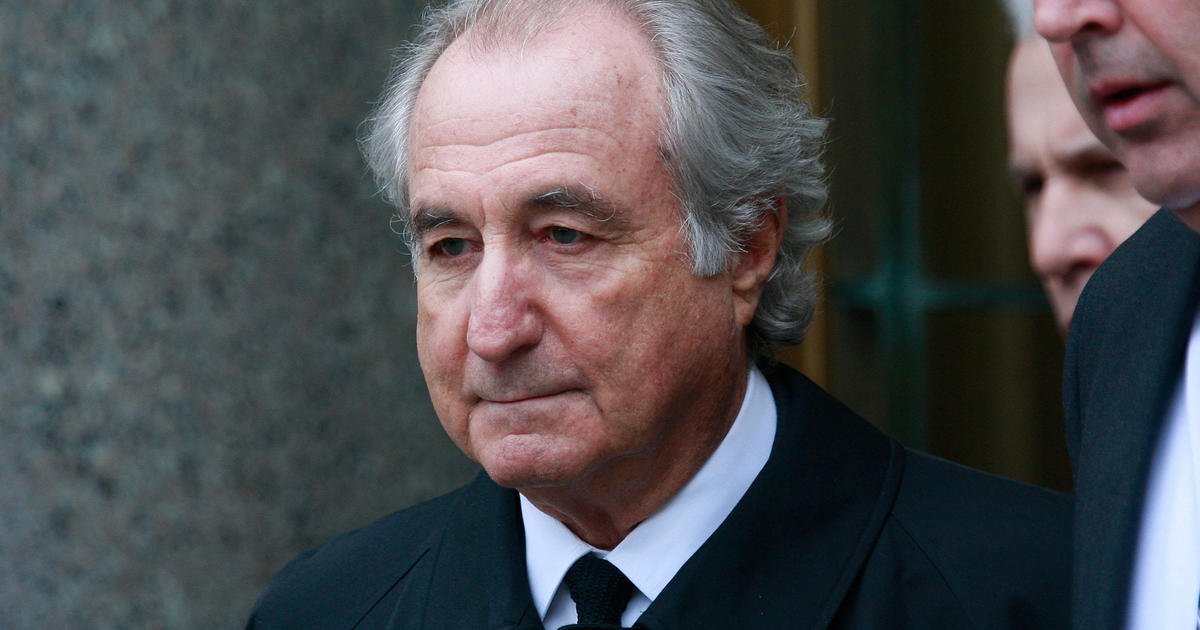

Bernie Madoff, the financier who pleaded guilty to orchestrating the largest Ponzi scheme in history, died in a federal prison on Wednesday, the federal Bureau of Prisons confirmed to CBS News. Madoff, 82, died at the Federal Medical Center in Butner, North Carolina, the agency said in a statement.

The agency said Madoff’s cause of death would be determined by a medical examiner.

Last year, Madoff’s lawyers filed court papers to try to get him out of prison in the COVID-19 pandemic, saying he was suffering from end-stage kidney disease and other chronic medical conditions. The request has been denied.

Madoff admitted that he has defrauded thousands of customers in billions of dollars in investment over the decades.

A court-appointed trustee has recovered more than $ 13 billion of an estimated $ 17.5 billion invested in Madoff’s business. At the time of Madoff’s arrest, customers with false bank statements reported that they had assets worth $ 60 billion.

For decades, Madoff enjoyed an image as a self-made financial guru whose Midas touch braved market swings. As a former chairman of the Nasdaq stock market, he attracted a dedicated legion of investment clients – from Florida retirees to celebrities such as famed film director Steven Spielberg, actor Kevin Bacon and Hall of Fame pitcher Sandy Koufax.

But his investment advisory firm was exposed in 2008 as a multi-billion dollar Ponzi scheme that wiped out people’s fortunes and destroyed charities and foundations. He was so hated that he had to wear a bulletproof vest in court.

Madoff pleaded guilty to securities fraud and other charges in March 2009, saying he was “deeply sorry and ashamed”.

Mario Tama / Getty Images

After living under house arrest for several months in his $ 7 million penthouse apartment in Manhattan, he was handcuffed to jail to scattered applause from angry investors in court.

‘He stole from the rich. He stole from the poor. He stole from the in between. He had no values, ”former investor Tom Fitzmaurice told the judge at the sentencing. “He cheated his victims with their money so that he and his wife … could live an incredibly luxurious life.”

US District Judge Denny Chin showed no mercy and sentenced Madoff to up to 150 years in prison.

“This is where the message should be sent that Mr. Madoff’s crimes were extremely bad and that this kind of irresponsible manipulation of the system is not just a bloodless financial crime that takes place only on paper, but instead … a dizzying human toll, said Chin.

The Madoffs also took a severe financial blow: a judge issued a $ 171 billion forfeiture order in June 2009, stripping Madoff of all of his personal belongings, including real estate, investments and $ 80 million in assets owned by his wife, Ruth. , had claimed they were hers. The order earned her $ 2.5 million.

The scandal also took a personal toll on the family: one of his sons, Mark, committed suicide on the second anniversary of his father’s arrest in 2010. And Madoff’s brother, Peter, who helped run the company, was sentenced to 10 years in prison in 2012, despite claims he was groping in the dark about his brother’s misdeeds.

Madoff’s other son, Andrew, died of cancer at the age of 48. Ruth is still alive.

Madoff was sent to do what amounted to a life sentence at Butner Federal Correctional Complex, about 45 miles northwest of Raleigh, North Carolina. A federal prison website listed his likely release date as November 11, 2139.

Madoff was born in 1938 in a lower-middle-class Jewish neighborhood in Queens. In the financial world, the story of his rise – how he left Wall Street with Peter in 1960 with a few thousand dollars saved by working as a lifeguard and installing sprinklers – became a legend.

“They were two struggling kids from Queens. They worked hard,” said Thomas Morling, who worked closely with the Madoff brothers in the mid-1980s, installing and running computers, making their company a trusted leader in off-the-floor commerce.

“When Peter or Bernie said something they were going to do, their word was their bond,” Morling said in a 2008 interview.

In the 1980s, Bernard L. Madoff Investment Securities occupied three floors of a high-rise in downtown Manhattan. There, with his brother and later two sons, he ran a legitimate business as an intermediary between the buyers and sellers of shares.

Madoff boosted his profile by leveraging the expertise to help launch Nasdaq, the first electronic stock exchange, and was so respected that he advised the Securities and Exchange Commission on the system. But what the agency never discovered was that behind the scenes, in a separate office under lock and key, Madoff was secretly spinning a web of ghostly wealth using cash from new investors to get the return on old investors. Pay.

Authorities say at least $ 13 billion has been invested with Madoff over the years. An old IBM computer published monthly statements with steady double-digit returns even during market declines. In late 2008, statements claimed that investors’ bills totaled $ 65 billion.

The ugly truth: no securities have ever been bought or sold. Madoff’s chief financial officer, Frank DiPascali, said in a guilty plea in 2009 that the statements about transactions were “all bogus.”

His clients, many Jews like Madoff and Jewish charities, said they didn’t know. Among them was the Nobel Peace Prize winner and Holocaust survivor Elie Wiesel, who remembered meeting Madoff years earlier at a dinner where they talked about history, education, and Jewish philosophy – not money.

Madoff “made a very good impression,” Wiesel said during a 2009 panel discussion about the scandal. Wiesel admitted that he “harbored a myth he created around him that everything was so special, so unique, it had to be secret.”

Like many of his clients, Madoff and his wife enjoyed a lavish lifestyle. They had a $ 7 million apartment in Manhattan, an $ 11 million estate in Palm Beach, Florida, and a $ 4 million house on the tip of Long Island. There was another house in the South of France, private jets and a yacht.

It all collapsed in the winter of 2008 with a dramatic confession in Madoff’s 12th-floor apartment on the Upper East Side. During a meeting with his sons, he confided that his business was “all just one big lie.”

After the meeting, a family lawyer contacted regulators, who notified federal prosecutors and the FBI. Madoff was wearing a bathrobe when two FBI agents arrived at his door unannounced one December morning. He invited them and confessed when asked “if there is an innocent statement,” according to one indictment.

Madoff replied, “There is no innocent explanation.”

As he had done from the start, Madoff insisted in his plea that he act alone – something the FBI never believed. As agents searched documents for evidence of a wider conspiracy and cultivated DiPascali as a collaborator, the scandal turned Madoff into an outcast, evaporated the fort of life, destroyed charities and apparently forced some investors to die by suicide.

A trustee was appointed to reclaim funds – sometimes by challenging hedge funds and other major investors – and distribute those proceeds among the victims. The search for Madoff’s assets “has uncovered a labyrinth of interconnected international funds, institutions and entities of almost unparalleled complexity and size,” said trustee, Irving Picard, in a 2009 report.

According to the report, the trustee has located assets and companies “of interest” in 11 places: Great Britain, Ireland, France, Luxembourg, Switzerland, Spain, Gibraltar, Bermuda, British Virgin Islands, Cayman Islands, Bahamas. More than 15,400 claims were filed against Madoff.

At Madoff’s June 2009 conviction, furious former clients were demanding the maximum sentence. Madoff himself spoke monotonously for about 10 minutes. At various times he referred to his monumental fraud as a ‘problem’, ‘an error of judgment’ and ‘a tragic mistake’.

He claimed that he and his wife were tormented and said that she “cries herself to sleep every night, knowing that I have caused all the pain and suffering.”

“That’s something I live with too,” he said.

Afterward, Ruth Madoff – often the target of victims’ contempt since her husband’s arrest – broke her silence that same day by issuing a statement claiming that she too had been misled by her high school sweetheart.

“I’m ashamed and ashamed,” she said. Like everyone else, I feel betrayed and confused. The man who committed this terrible fraud is not the man I’ve known all these years. ”

About a dozen employees and employees of Madoff were charged in the federal case. Five were tried in late 2013 and saw DiPascali take the witness stand as the government’s crown witness.

DiPascali told jurors how Madoff called him into his office just before the plan was revealed.

“He’d been staring out the window all day,” DiPascali testified. He turned to me and said, crying, ‘I’m at the end of my rope … Don’t you get it? The whole damn thing is cheating. ”

Ultimately, that fraud gave new meaning to the “ Ponzi Plan, ” named after Charles Ponzi, who was convicted of postal fraud after ridiculing thousands of people worth just $ 10 million between 1919 and 1920.

“Charles Ponzi is now a footnote,” said Anthony Sabino, a lawyer specializing in white collar criminal defense. “It’s Madoff plans now.”