US stocks will open higher after the Dow Jones Industrial Average DJIA,

and S&P 500 SPX,

closed at record high last week.

It comes as the yield on the US 10-year Treasury TMUBMUSD10Y,

stable at 1,619%. However, attention will quickly turn to Wednesday’s Federal Reserve meeting, which has become crucial in the context of rising bond yields in recent weeks. The central bank is under pressure to prevent a further destabilizing interest rate rise.

In our call of the dayAccording to JPMorgan strategists, the rise in bond yields was not over and it was premature to sell cyclical stocks and buy back defensive stocks such as healthcare and technology stocks.

The investment bank strategists, led by Mislav Matejka, said cyclical stock valuations – the ones that will gain as economic activity picks up – started looking “toppy” after their strong run over the past year.

For example, European cyclical stocks have outperformed defensive stocks by 57% in the past 11 months, nearing the top when it comes to past recovery. As a result, they said that most of the cyclical / defensive moves “may be behind us” given the magnitude of the cyclical price and their high valuations.

But the strategists warned that it was still “premature” to face a turnaround. “To do that, you need to see a spike in PMIs, a weakening of relative earnings and an end to rising bond yields,” they noted.

These three critical things are unlikely to happen, they said, with earnings momentum for cyclicals that “will continue to accelerate in the coming quarters.” As for purchasing manager indices, the desynchronized nature of the global cycle – with China potentially peaking, the US approaching the highs and Europe looking to pick up this summer – means a spike is not imminent, they said.

The key driver for cyclical stocks remains the direction of bond yields and, more importantly, JPMorgan strategists said the rise in interest rates was not over. “Yes, in the short term policymakers will continue to push back, but [they] are likely to accept higher returns as the economy strengthens. ”

“As long as interest rates are rising, cyclical stocks should not be sold,” she added.

Value stocks, on the other hand, continue to look very attractive, JPMorgan said, as it focused its long positions on banks and the reopening trade.

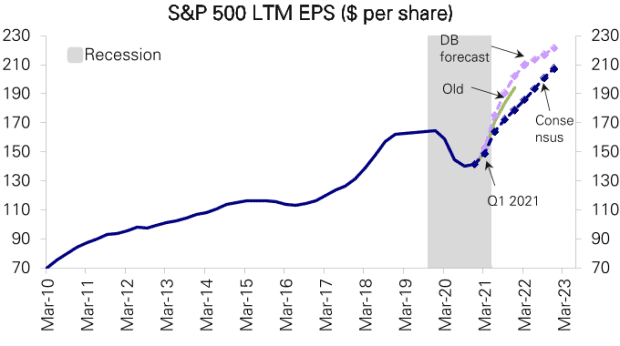

The graph

Deutsche Bank DB,

strategists raised their S&P 500 earnings per share (EPS) forecast to $ 202 for 2021 and to $ 222 for 2022, following the expiration of the $ 1.9 trillion stimulus package and economic forecasts.

The Tweet

According to S3 Partners data published by the Wall Street Journal, the value of short bets against shares of Special Purpose Acquisition Companies (SPACs) has tripled since the beginning of the year.

The markets

US Equity Futures YM00,

ES00,

NQ00,

be slightly higher for the open. European equities posted more significant gains with the pan-European Stoxx 600 index 0.6% higher in early trading. Asian markets were mixed overnight as investors looked ahead to the Fed meeting.

The buzz

Bitcoin BTCUSD,

prices hit an all-time high on Saturday, rising above the $ 60,000 milestone. The cryptocurrency has since relapsed and was last traded at $ 56,272, according to CoinDesk.

Elon Musk has officially changed his title to “Technoking”, according to a Tesla TSLA,

submission announced on Monday.

Mexican President Andrés Manuel López Obrador on Sunday criticized the US government, saying the US has not helped Mexico with COVID-19 vaccines.

Danone BN,

Chairman and general manager Emmanuel Faber is stepping down, the board of the French food group confirmed on Monday. It has come under pressure from activist investors in recent months.

Swiss pharmaceutical company Roche Holding ROG,

said Monday it has agreed to acquire GenMark Diagnostics GNMK,

in a deal worth about $ 1.8 billion.

Digital payments company Stripe said on Sunday that it has closed a $ 600 million round of funding that values it at $ 95 billion – more than double the valuation a year ago.

Beyoncé and Taylor Swift made history at the Grammys, where the best awards were won by female musicians.

Read randomly

Father and son discover the tunnel of death from World War I that has been hidden in France for a century.

Need to Know starts early and will update until the opening bell, but sign up here to have it delivered to your email box once. The emailed version will ship at approximately 7:30 a.m. East.

Do you want more for the day ahead? Sign up for The Barron’s Daily, a morning investor briefing that includes exclusive commentary from Barron’s and MarketWatch writers.