Congress is expected to pass a $ 900 billion coronavirus control bill, including $ 600 incentive checks and $ 300 in improved unemployment benefits. Notably, the package lacks the break from mandatory student loan payments and student loan interest, which have become a cornerstone of coronavirus policy.

Previous reports indicated that the stimulus package would extend the hiatus, suggesting that the policy was eliminated during the negotiations.

The forthcoming coronavirus support bill includes “no forgiveness of loans and no extension of payment pause and interest waiver,” said Mark Kantrowitz, student loan expert. “The previous proposal to extend the payment hiatus and the interest waiver until April 2021 was apparently dropped from the legislation. So Joe Biden may have to take executive action shortly after taking office to extend the payment hiatus and interest waiver.”

“They may have dropped the extension of the payment break and interest waiver, along with other requests, to try and get the compromise legislation done. It’s 5,593 pages long,” he adds.

If the break is not extended, student loan borrowers will have to resume payments in February 2021, although it seems unlikely that the country’s economy will have fully recovered by then.

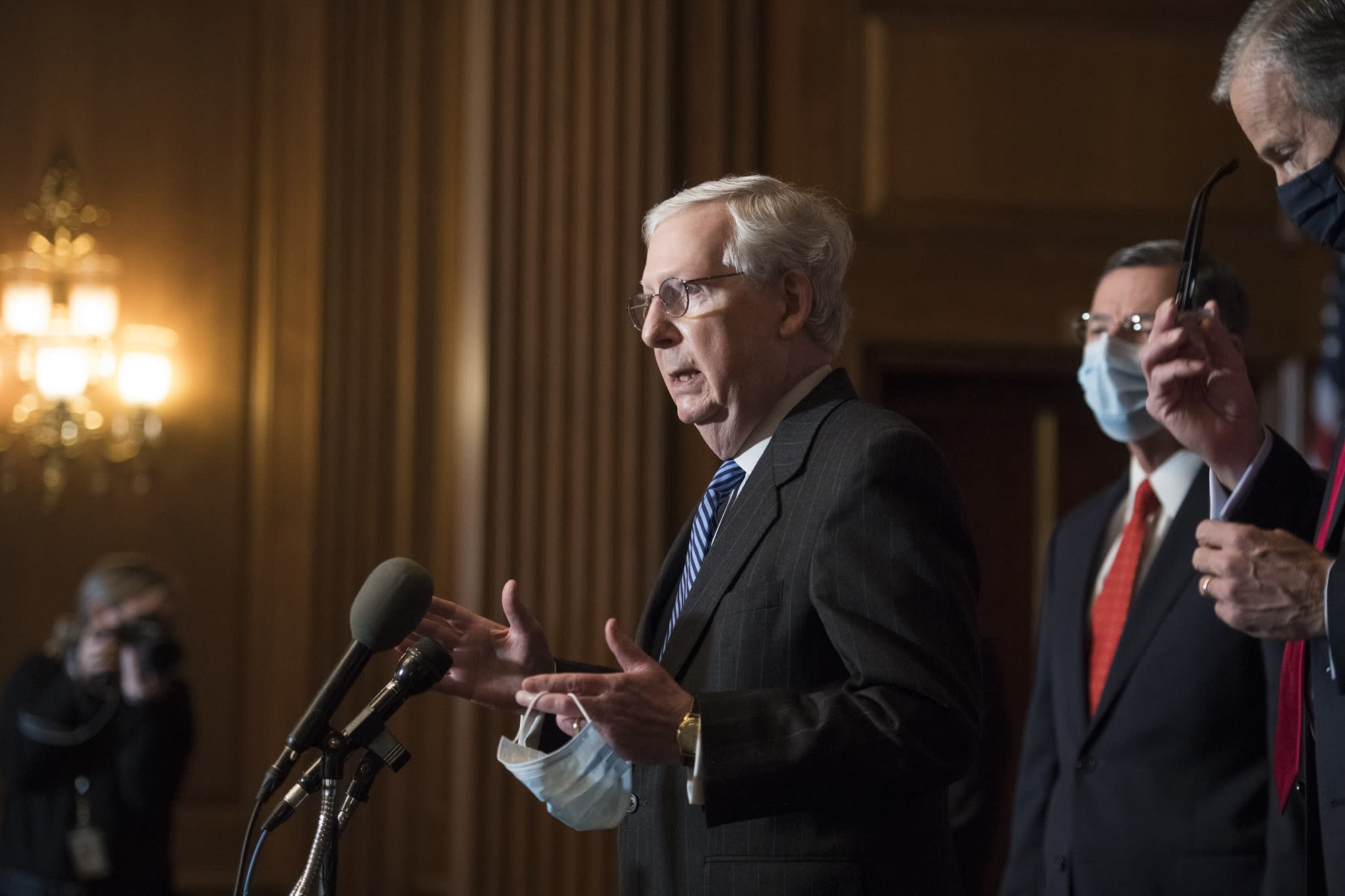

US President Donald Trump signs HR 748, the CARES Act, in the White House Oval Office on March 27, 2020 in Washington, DC.

Erin Schaff | Getty Images

In March, lawmakers passed the Coronavirus Aid, Relief and Economic Security Act, also known as the CARES Act, which paused federal student loan payments.

In August, President Donald Trump signed an executive order to continue the interest-free tolerance through the end of December.

Later, education secretary Betsy DeVos announced that borrowers should not resume payments until February.

“The coronavirus pandemic has presented challenges for many students and borrowers, and this temporary disruption in payments will help those affected,” DeVos said on December 4. “The additional time also allows Congress to do its job and determine what action it deems necessary and appropriate.”

Experts say student loan borrowers still need support.

“The CARES Act has helped student loan borrowers for much of this year by enabling them to pay off their federal student loans,” said Jill Gonzalez, analyst and communications director for Personal Finance site WalletHub. “The current deadline for this is the end of January. However, the pandemic is far from over and its effects on the economy will be felt for many years to come.”

“In light of this, it is extremely important that these federal student loan policies get an extension, and even that other types of loans are drawn,” Gonzalez said. “Millions of people are still struggling financially, and less than half think 2021 will be better for their wallets. This will continue as long as unemployment remains high.”

However, there are steps student loan borrowers can take to prepare for 2021, said Sandy Baum, senior fellow at the Urban Institute.

“The good news is that about 1/3 of borrowers have an income repayment plan,” she says. “If they can verify their income, they don’t need to make any payments unless their income is above 150% of the poverty line. Other borrowers who feel they can’t make their payments should make every effort to sign up for one of these plans. “

Still, “many of the biggest problems will be bureaucratic,” says Baum. “Borrowers will not know what to do, how to make their payments, how to claim the protection that is available to them.”

Do not miss: