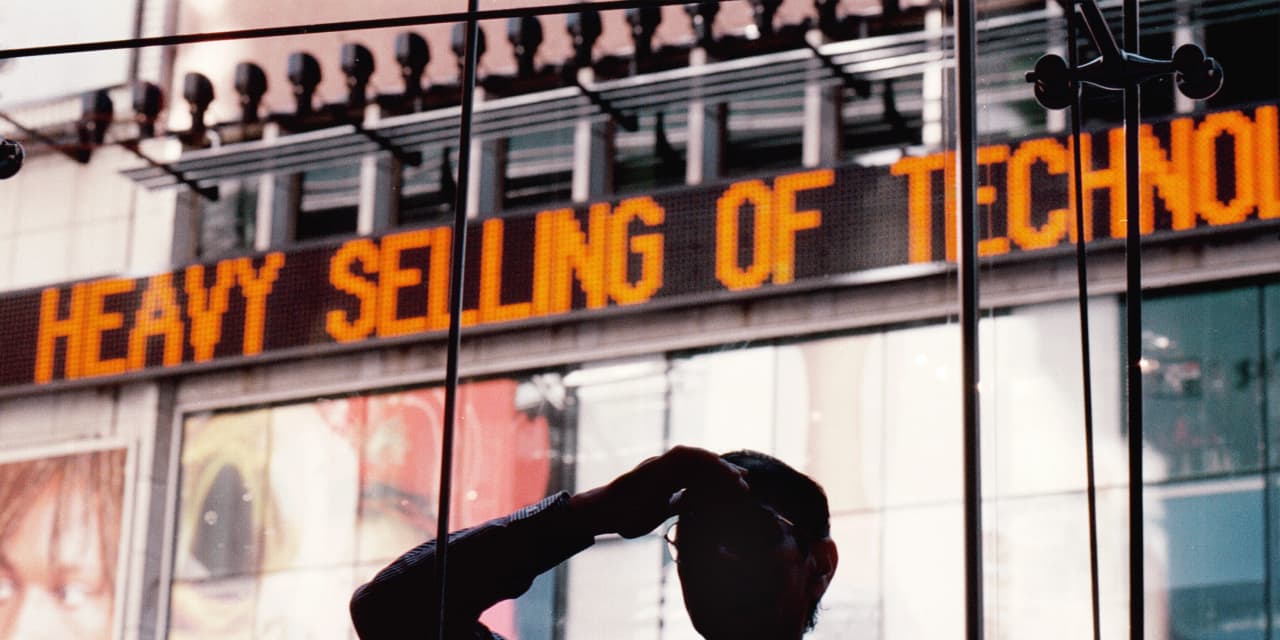

The Nasdaq Composite Index fell nearly 10% from its recent peak on Thursday, a move commonly defined as a market correction, reflecting a pullback from record highs for technology stocks as bond yields rise.

The technology-laden Nasdaq Composite COMP,

fell 8.5% Thursday morning after seeing a peak on Feb. 12 at 14,095.47.

The last time the Nasdaq Composite fell into a correction, defined as a decline from a recent peak of at least 10% but no more than 20%, was in early September last year.

On Wednesday, the index saw its sharpest two-day slip since September 8.

The Nasdaq slump reflects an increase in benchmark government debt returns, making the tech-heavy look less attractive compared to fixed income and other sectors of the stock market that have not fared as well as the economy begins to recover from the COVID pandemic. Tech stocks are particularly sensitive to rising bond yields because their value depends heavily on the growth of future earnings, which are discounted more deeply when bond yields rise.

Investors are betting that additional fiscal stimulus from Congress will spur the US economic recovery, but also drive up inflation and force the Federal Reserve to raise interest rates sooner than they would like – a general environment not favorable for technology stocks.