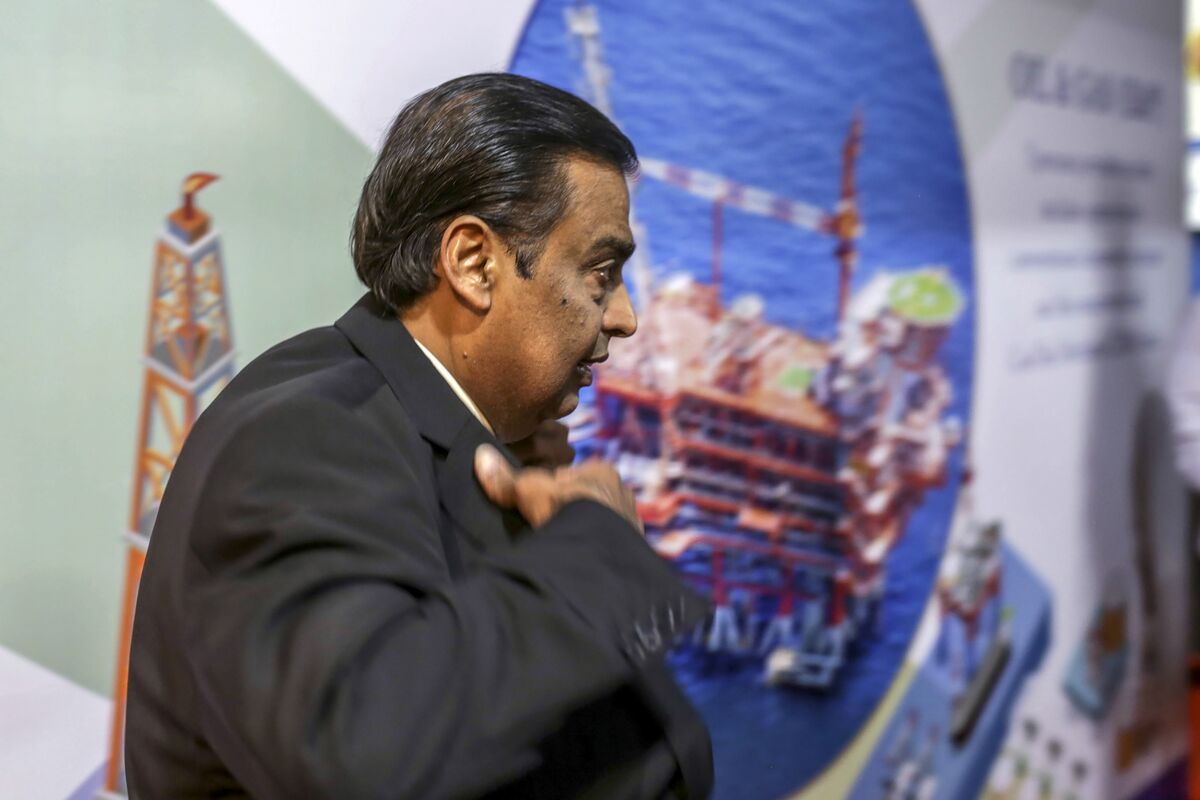

Mukesh Ambani

Photographer: Dhiraj Singh / Bloomberg

Photographer: Dhiraj Singh / Bloomberg

The Indian market regulator ordered billionaire Mukesh Ambani and his conglomerate Reliance Industries Ltd. must pay a combined fine of 400 million rupees ($ 5.5 million) for alleged violation of stock trading rules about 13 years ago.

In his order dated January 1, de Securities and Exchange Board of India said Reliance and its agents reportedly made inordinate profits from the sale of shares in Reliance Petroleum Ltd., a former entity, both in the cash and futures markets. Reliance Industries has to pay 250 million rupees and Ambani, the chairman, is liable for the alleged manipulative trade, Sebi said.

A Reliance spokesperson said he could not immediately comment on the order.

After years of investigation, Sebi noted in 2017 that Reliance, along with 12 unlisted trading houses, was conducting illegal transactions in the shares of Reliance Petroleum. They bought stocks between March and November 2007, and then the company took short positions – betting the stock price would fall – in November futures before starting to sell the stock to bring the price down, Sebi said.

Reliance Industries falls after manipulation costs, trade ban

In the same year, the regulator also told companies to return a profit of Rs 4.47 billion plus interest and banned Reliance from trading futures and options in Indian stock markets for a year. Reliance had appealed the injunction, saying it was “unjustified sanctions” on genuine transactions conducted in the interest of shareholders.

Reliance Petroleum merged with Reliance Industries in 2009. The Petroleum History was a publicly traded subsidiary of the company owned by Ambani and owned a refinery of 580,000 barrels per day in a special economic zone at Jamnagar in the western Indian state of Gujarat, where the group has the world’s largest refining and petrochemical complex .