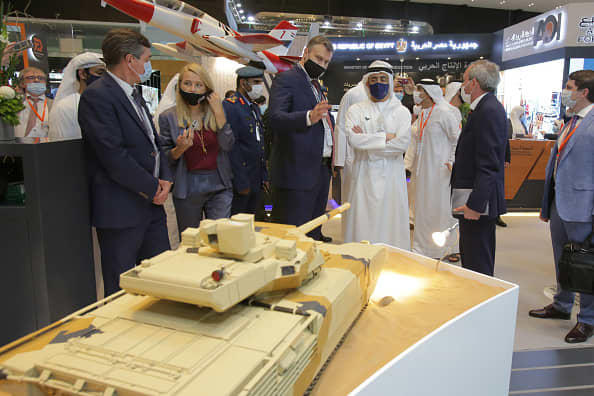

Crown Prince Mohammed bin Zayed bin Sultan Al Nahyan (C) of the Emirate of Abu Dhabi, Deputy Supreme Commander of the UAE Armed Forces, views a scale model of a T-14 Armata tank by UralVagonZavod Research and Development Corporation at the IDEX 2021 International Defense Exhibition & Conference.

Photo by TASS | TASS via Getty Images

DUBAI, United Arab Emirates – Defense spending in the oil-rich Gulf states – one of the largest buyers of US weapons worldwide – is expected to decline nearly 10% in 2021, after a significant increase in the previous year.

That’s thanks to tighter budgets due to the drop in oil prices during the coronavirus pandemic, defense intelligence firm Jane’s said in a new report.

Defense spending in the Gulf Co-operation Council (GCC) countries will decline 9.4% in 2021 as countries in the region are under pressure from the impact of Covid-19 and the low oil prices, ”Jane’s wrote in a report published Friday. , adding that it “expects a rapid recovery in the coming years” – but no return to pre-pandemic levels until 2024. That’s a significant change for a region whose arms imports have increased 61% between 2015 and 2019, according to the Stockholm International Peace Research Institute.

“The significant drop in oil prices in 2020, coupled with a corresponding drop in demand from the manufacturing and transportation sectors, has resulted in increased pressure on government budgets,” Charles Forrester, chief analyst at Jane’s, said in the report. He noted the decline in oil and gas revenues, as well as the decline in revenues from non-oil sectors such as tourism, finance and travel as a result of nationwide lockdowns.

In 2018, the company expected defense spending in the Gulf to increase consistently over the next few years, reaching more than $ 110 billion by 2023. Defense spending is up 5.4% from the previous year to $ 100 billion in 2020, but is expected to drop to $ 90.6 billion this year and $ 89.4 billion in 2022.

Gulf Cooperation Council States: Defense Spending and GDP Growth, 2010-2025. Source: IHS Markit / Janes Defense Budgets

IHS Markits / Janes

Procurement expenditures, that is, the purchase of defense equipment, but excluding things like salaries, operating and maintenance costs and R&D, will also decline slightly to $ 13.25 billion from $ 13.38 billion in 2021, Jane’s predicts, after an increase of 4. 5% in 2020.

The report came ahead of IDEX, the Middle East’s largest defense expo, taking place in Abu Dhabi this week. Despite the pandemic, IDEX was still busy with participants. Ahead of the event, organizers expected more than 70,000 attendees and 900 exhibitors to gather in the Emirates capital throughout the week to showcase their latest technologies and brokerage deals in a region that accounted for 35% of total global arms imports in the past five years. according to SIPRI.

Israel absent from arms fair

Israel was absent from the arms fair, despite its historic normalization and rapid warming of ties with the UAE after the signing of the Abraham Accords in September. Since then, there has been plenty of talk of defense and technology cooperation, but an increase in the number of Covid-19 cases in Israel has prompted the country’s leaders to close the main airport and halt international travel.

The advent of diplomatic relations with Israel means new technologies and more competition for the Gulf market, opening up more options for equipment that is still compatible with what has already been purchased in the West.

Lockheed Martin F-35 Joint Strike Fighter Lightning II

Robert Sullivan | FlickrCC

A big question mark remains the Lockheed Martin F-35 Joint Strike Fighter jet, for which the UAE inked a $ 23 billion purchase in the closing days of Trump’s presidency.

It would become the first Arab country to receive the highly sophisticated and secretive system that was given the green light in the aftermath of the deal with Israel. The Israeli army controls all the jets; The UAE acquisition “will help connect the defense industries of the US, Israel and the Emirates,” said Jane’s report.

Development of local defense industries

But the sale is currently on hold pending review by the Joe Biden administration, which has so far shown much more restraint in its relationship with the Gulf states compared to its predecessor, which bypassed Congress over major arms deals with the UAE. and Saudi Arabia. and others.

This is seen as one of the many reasons why the UAE and other Gulf states, namely Saudi Arabia, are investing money in developing their own indigenous defense industries – with the aim of increasing their self-sufficiency, creating local jobs and self-sufficiency. compete as arms exporters. .

Both Saudi Arabia and UAE, with the help of state-owned companies such as Saudi Arabian Military Industries and the Emiratis ‘EDGE’, are also working to leverage new technologies in the defense sector – to build their own conventional deterrent capabilities and reduce dependence on foreign countries. suppliers, ”said Forrester.

Those technologies include armored vehicles, naval ships, smart missiles, electronic warfare and unmanned aerial systems, including aerial drones, EDGE CEO Faisal Al Bannai told CNBC at the show on Monday. EDGE is an advanced technology group made up of 25 Emirati companies and is one of the top 25 arms suppliers in the world.

“As these solutions begin to evolve and mature, the local customer will certainly prefer to buy local sovereign products as they have more flexibility and can meet their needs in a much shorter time frame,” he told CNBC’s Hadley Gamble .

The CEO aims to see the UAE companies compete at both the international and regional levels.

“I can certainly see that as you grow your capabilities and needs continue to grow, I think it is only good for the local industry and local talent to grow such capabilities,” he said.