Massive disruption races down the highway to a $ 1.5 trillion global freight market as legacy manufacturers and newcomers alike struggle for pole position in a race for dominance in zero-emission trucks.

Electric vehicles have come to the attention of investors in the past year as stocks such as Tesla TSLA,

Nikola NKLA,

NIO NIO,

XPeng XPEV,

Li Auto LI,

and WORLD 1211,

roared higher. And for good reason: electric vehicles will have penetrated 100% of the global automotive market by 2040, according to UBS UBS,

By 2025, the Swiss bank expects two players – Tesla and Volkswagen VOW,

– to have already emerged as the world’s best sellers of electric cars, delivering approximately 1.2 million cars every next year.

But vehicle emissions are more than just cars. There are bigger things that move.

Amid evolving regulations and technological innovation, both battery electric and hydrogen fuel cell alternatives to internal combustion engines are emerging to disrupt the global freight transportation market, estimated by UBS at $ 1.5 trillion.

Essential Reading: Buy These 3 Battery Stocks To Play The Electric Vehicle Party, But Stay Away From This Company, Says UBS

The Swiss bank expects zero-emission vehicles, or ZEVs, to eventually replace trucks powered by internal combustion engines, with the pace of change accelerating compared to three years ago when newcomers join the fray.

In a report published Wednesday with the contribution of 21 analysts, UBS said it expects most of the truck market to be shared by battery-electric vehicles and fuel-cell electric vehicles, which are powered by hydrogen. Renewable natural gas could also play a smaller role in the market, the analysts said.

The main driving force is global emissions regulations, but the economics of both battery and fuel cell ZEVs are also highly competitive. UBS expects heavy duty trucks powered by batteries or fuel cells to be more cost-effective than diesel by 2030, including the cost of infrastructure. However, input delivery remains a challenge, with global battery cell shortages expected by 2025, according to UBS, and the green hydrogen industry is still young.

UBS predicts that 30% of heavy truck sales in North America, Europe and China will come from ZEVs by 2030, with ZEV trucks accounting for 40% to 60% of medium duty truck sales in these regions.

Read this: Forget about Nio and XPeng. This company and Tesla will be the top two electric vehicles by 2025, UBS says.

If Tesla’s targets are taken at face value, its heavy-duty, battery-electric semi-truck will be a “superior alternative” to combustion engines by 2025, UBS said.

To the extent that Tesla can maintain an edge in battery innovation, analysts from the Swiss bank believe the US company “may have a built-in advantage” over older heavy-truck manufacturers that rely on third parties to provide batteries. .

Conventional truck and engine manufacturers are expected to fight hard to maintain control, including through new offerings and partnerships, but UBS expects to “lose at least some of the market.” The incumbent manufacturers are facing the “biggest headwind” in this changing space, the bank said.

In medium trucks, newcomers such as Rivian, Lion and Chanje will establish their presence and will be the main challengers. These companies are currently privately owned, but can be made public through an initial public offering or merger with a blank check for a special takeover company.

Plus: Tesla faces a race with Volkswagen as the German car giant focuses on battery costs and new giga factories

As for heavy trucks and motorcycles, Tesla, Nikola and Hyliion HYLN expects to

to dominate if they are able to implement their respective visions, UBS said, although incumbent operators such as Toyota 7203,

and Hyundai 005380,

are also expanding worldwide. The analysts noted that both the battery-electric and fuel-cell offerings of new entrants are still under development and may not meet the targets for both weight and range.

In UBS’s model, all of the following conventional truck and engine manufacturers are expected to lose market share by 2030: Cummins CMI,

Daimler DAI,

Volvo VOLV.B,

– who owns Mack Trucks – and Traton 8TRA,

which is majority-owned by Volkswagen and is expected to complete the acquisition of Navistar NAV,

mid-2021.

In this battle between truck manufacturers, UBS expects infrastructure, battery and fuel companies to rise above the fray and enjoy the most tailwind. These groups of stocks are their preferred choice. The Swiss bank keeps an eye on energy infrastructure company Quanta Services PWR,

and chemicals and battery groups such as Albemarle ALB,

LG Chem 051910,

and Contemporary Amperex Technology Co. Limited (CATL) 300 750,

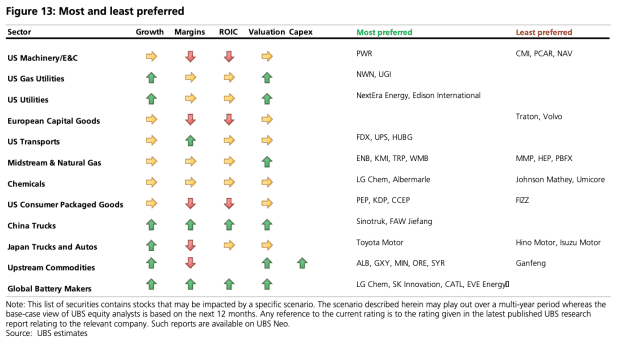

More of UBS’s most and least preferred stock picks from the report are shown in the chart below: