Turkey’s currencies and stocks collapsed following the abrupt termination of the central bank head, a move that prompted investors to take a cautious stance on risky assets on Monday.

The dollar USDTRY,

increased by as much as 15% against the Turkish lira and the BIST-100 stock market index XU100,

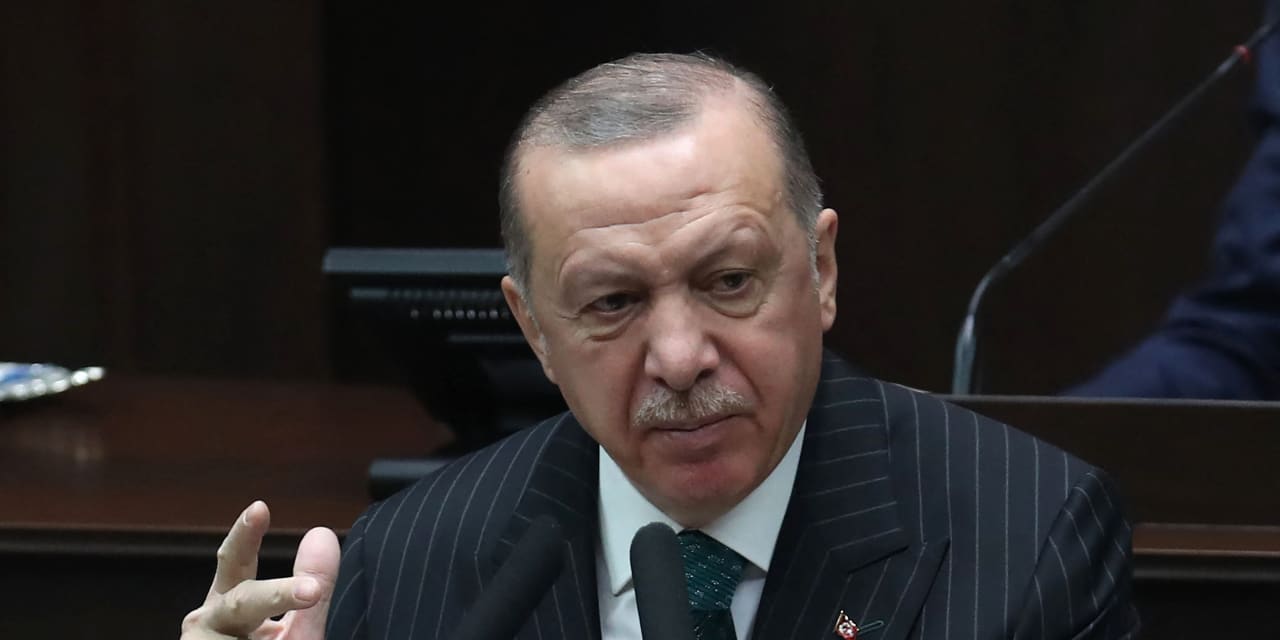

Traded 8% lower following President Recep Tayyip Erdogan’s decision to replace Governor Naci Agbal with Sahap Kavcioglu – the third change at the Central Bank of the Republic of Turkey (CBRT) in two years. Turkey’s central bank last week hiked interest rates by 2 percentage points to 19%, a full percentage point more than expected.

“With the removal of Naci Agbal from the CBRT, Turkey is losing one of its last remaining anchors of institutional credibility,” said Phoenix Kalen, a strategist at French bank Societe Generale. “During his short tenure, Agbal had succeeded where several predecessors had not – by building confidence in the central bank’s inflation-focused framework, by restoring the independence of monetary policy, by encouraging international investors to reintroduce To address the crisis-prone Turkish story, to stimulate an 18.0% rise in the lira against the dollar, and most crucially – by stopping and even reversing the damaging trend of dollarization in the economy. “

The movements in Turkey sent traders to safe-haven currencies such as the dollar DXY,

and the Japanese yen USD / JPY,

and away from emerging market currencies, including the Mexican peso USDMXN,

the South African rand USDZAR,

and the Russian ruble USDRUB,

BBVA BBVA,

which owns just under half of Turkey’s Garanti BBVA, fell 7% in Madrid.

That caution spread to stocks, where the Stoxx Europe 600 SXXP,

and US equity futures ES00,

were fractionally higher.

Airlines including International Airlines Group IAG,

easyJet EZJ,

and Ryanair RYA,

slipped after scientific advisers reportedly urged British Prime Minister Boris Johnson not to lift the ban on foreign holidays. That’s because the European Union is struggling with its vaccination campaign and is now considering blocking exports of AstraZeneca-made vaccines to the UK.

Shares of AstraZeneca AZN,

who separately reported that his vaccine, made with the University of Oxford, was 79% effective in preventing COVID-19 and 100% effective in preventing serious illness in a US study, increased by 1.1%.

Volkswagen VOW3,

and its majority shareholder Porsche Automobil Holding PAH3,

both had progressed and continued their tremendous run since VW created the plans for electric vehicles and batteries. Analysts at Deutsche Bank raised their target price for VW by 46% and for Porsche by 38%. “With the global rollout of the ID.4, we see a good chance that VW could surpass Tesla’s TSLA,

[battery electric vehicle] sales as early as next year, which should increase the creditworthiness of the EV strategy, ”the analysts said.