President Donald Trump has rejected the $ 900 billion omnibus law and issued a thinly veiled threat not to sign it. It could turn into the Christmas nightmare for struggling Americans, as well as Trump’s fellow Republicans, as described as being thrown under the bus by his Tuesday night video message. But so far, the markets seem poised to shake off this Wednesday.

Investors may be hardened by a week that’s sparked new jitters on the COVID-19 front as the long holiday weekend beckons. But they really need to take stock of rising risks, ours says call of the day from a team at Jefferies led by their global equity strategist Sean Darby.

See: Is the stock market open on Christmas Eve? Here are the trading hours for holidays and New Year’s days

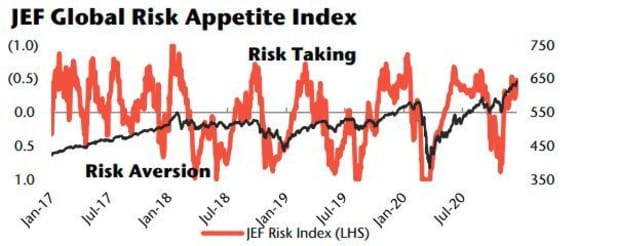

“In an almost exact repeat of late last year, our risk indicators started flashing euphoria with a slightly too optimistic sentiment,” Darby told clients in a note on Wednesday. “Aside from an overflowing dollar short, there are a few other catalysts for a stock market correction.”

Like corporate earnings revisited higher and higher, negative real interest rates and “jaunty” inflation expectations. Another big one is the January elections in Georgia, which will decide which party controls the senate, he said.

As for those “euphoria” signals, the Darby-led team points to Investors Intelligence studies that have shown a persistently high prevalence of bulls – more than 60% over four weeks. Above that level, it could indicate excessive bullishness.

There are also the largest number of S&P 500 SPX,

stocks trading above their 200-day moving average since 2013, a sharp rise in Jefferies’ own sentiment index, and year-to-day highs for its global risk appetite index.

Jefferies, FactSet

Bloomberg, Jefferies

“In addition, the spread between inflows in risky and safe assets has been on positive ground during one of the longest periods since 2017,” said the Darby team.

But, maybe it’s nothing.

The markets

Equity Futures YM00,

ES00,

NQ00,

rise, while European equities SXXP,

have also pushed north. The Asian markets were mostly positive across the board. The pressure on oil, which is under pressure due to reports of rising crude oil supplies.

Read: When are the markets open during Christmas and New Year?

The buzz

A holiday data dump is arriving, with weekly and ongoing unemployment claims, durable goods orders, and reports on personal income and consumer spending. There are also new home sales and consumer sentiment indices on the roll.

Trump tweeted his video demand for significant changes to the difficult-to-negotiate $ 900 billion stimulus bill, hinting that he might not sign it. He wants “ridiculously low” payments to Americans to go from $ 600 to $ 2,000, and what he described as wasteful spending, cut from the law. That with numerous Republicans objecting to direct checks on taxpayers out of concern over the fate of the Georgian GOP-incumbents on Jan 5. Runoffs that apparently moved the needle.

The US government is approaching a deal for tens of millions of additional COVID-19 vaccine doses from Pfizer PFE,

and German partner BioNTech BNTX,

Tesla CEO Elon Musk claims he sought a buyout from Apple CEO Tim Cook in the company’s “darkest days”, but couldn’t even get a meeting. That’s amid Apple AAPL reports,

plans a competitive electric car yourself.

France will allow thousands of British trucks stranded for fear of a more contagious strain of coronavirus to enter the country, allay fears of food shortages during the holiday season. Drivers need proof of a negative virus test, with the same rules for other UK travelers. Truckers and police clashed amid delays over the massive backlog:

The graph

That was the pandemic year. Michael O’Rourke, chief market strategist at JonesTrading rounded up the big data points and asset changes we’ve seen in a year.

JonesTrading

Random reads

Seven minutes of terror for NASA’s Mars Rover

Need to Know starts early and updates to the opening bell, however Register here to get it to your email box once. The emailed version will ship at approximately 7:30 a.m. East.

Do you want more for the day ahead? Sign up for The Barron’s Daily, a morning investor briefing, including exclusive commentary from Barron’s and MarketWatch writers.