The age-old battle between growth or value investment style advocates has intensified. But RiverPark Funds’ Mitch Rubin says any move towards value will be short lived.

Rubin said in an interview that successful portfolio allocation has little to do with economic factors, such as government spending, “and has everything to do with the forces of creative destruction unleashed” by the COVID-19 pandemic.

“There are companies that are either new or have played a pivotal role and are well positioned to dominate a digital world,” he said. “And there are those who have not adapted and will face severe secular headwinds.”

Rubin added that some companies that have done particularly well during the pandemic lockdown will not continue to grow quickly after life returns to normal.

Rubin is the Chief Investment Officer of RiverPark, which is based in New York and has $ 3.8 billion in assets under management. He manages the RiverPark Long / Short Opportunity Fund, which has been rated five stars (the highest) by Morningstar. The fund was profiled in this article in April 2020. The goal is long-term growth, with downward movement and volatility tempered by what Rubin calls “tactical” short positions. Below you will find more about the performance.

To short a stock is to borrow its shares and sell them immediately, with the expectation of buying them back after they have declined, returning them to the lender, and putting away the difference.

Rubin said he avoids betting on stocks that have already been heavily shorted by other investors. This protected the fund from losses suffered by some institutional investors earlier this year, when there was extraordinary interest in buying shares of GameStop Corp. GME to provide,

and other stocks that had been out of favor.

Long positions

Two examples of long investments Rubin mentioned were Snap Inc. SNAP,

and Pinterest Inc. PINS,

“For us, they are both profitable, they both have large cash balances and both are growing at an extraordinary rate with margins increasing,” he said.

Rubin pointed to “dramatically” growing user bases at both companies. He said there are long-term opportunities because of the potential to increase ad revenue.

“Both Snapchat and Pinterest make money [through advertising prices] with a discount on Facebook, with a discount on Google, which has a discount on all other forms of media, such as television and newspapers, ”he said.

Other long positions include Exact Sciences Corp. EXAS,

Illumina Inc. ILMN,

and DexCom Inc. DXCM,

“They are all innovative healthcare companies that detect and manage diseases that are widespread in society,” said Rubin.

Some Rubin’s long positions were taken due to depressed prices. These include Charles Schwab Corp. SCHW,

UnitedHealth Group Inc. UNH,

and Walt Disney Co. DIS,

“The opportunity, if you were patient, was to buy great companies on sale,” he said. In particular, he was ‘very excited about the launch of Disney +’, a Netflix NFLX rival,

Short positions

Rubin has short positions in Peloton Interactive Inc. PTON,

and Zoom Video Communications Inc. ZM,

two companies whose shares soared during the pandemic. Platoon’s combination of fitness equipment and training class streaming plans is a perfect fit for a stay-at-home population, while Zoom has become the standard for corporate video conferencing.

But Rubin has shorted both due to a combination of high stock valuations and “business models that we believe will not be cumulative.”

“They were just extremely profitable at one point,” he said.

Another acronym is Boston Properties Inc. BXP,

a real estate investment fund that operates office buildings not only in Boston, but also in the metropolitan areas of Los Angeles, New York, San Francisco and Washington DC. Rubin said the company is a good example of a business that will be disrupted by “creative destruction” as there will be less demand for office space in the long run.

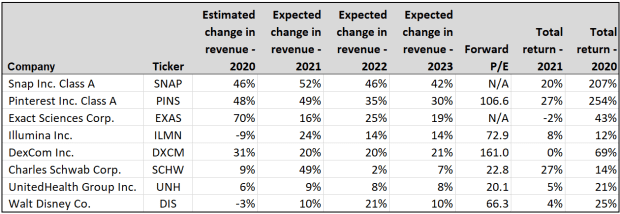

Sales growth estimates

Here are sales growth forecasts for three calendar years for the eight companies listed above in which Rubin has long positions, along with projected price-earnings ratios based on consensus earnings expectations for the next 12 months among analysts polled by FactSet:

(FactSet)

The revenue growth rates for calendar 2020 are marked as “estimated” because not every fiscal year or quarter of a company matches the calendar.

There are no forward P / E ratios for Snap and Exact Sciences as the companies are expected to post negative earnings per share for calendar 2021.

For Schwab and UnitedHealth, you can see that the forward P / E ratios are not high compared to a forward P / E of 22.3 for the SPDR S&P 500 ETF Trust SPY,

The forward P / E for Disney is quite high. However, the company’s earnings are expected to increase by $ 2.74 in 2021 to $ 5.38 in 2023, which would result in a P / E of 34.8, based on the closing price of $ 187.56 on April 7 .

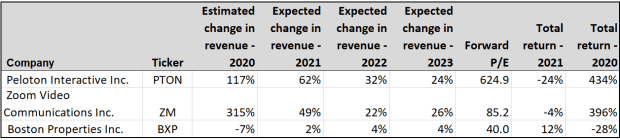

Here are the same numbers for the three short films Rubin discussed:

(FactSet)

For Peloton and Zoom Video Communications, sales growth is expected to cool from 2020’s triple digits, but remain in double digits at least until 2023. But both stocks have pulled out this year.

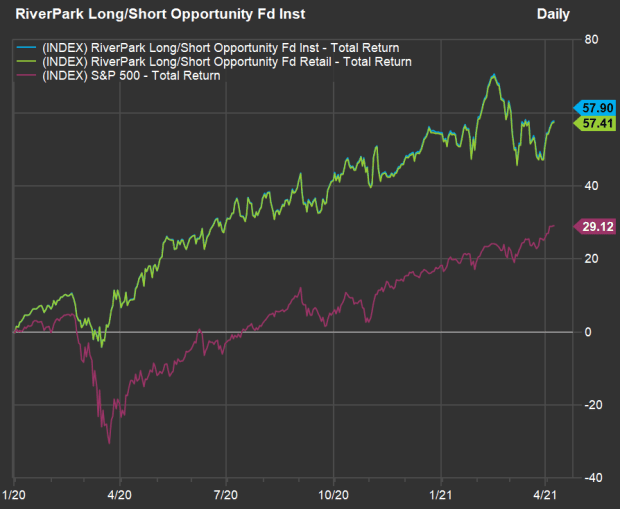

Performance

A comparison of the performance of the RLSIX institutional stocks of the RiverPark Long / Short Opportunity Fund,

and retail shares of RLSFX,

with the S&P 500 Index SPX,

as of the end of 2019, shows that the fund was able to meet its target of limiting volatility when the stock market fell in the first quarter of 2020:

(FactSet)

The institutional class of the fund has a minimum initial investment of $ 50,000 and annual expenses of 1.75% of its assets, while the retail class has a minimum of $ 1,000 and an expense ratio of 2.00%. Neither class has a sales charge (or tax). Those costs are high, but not uncommon for a long / short active management style.

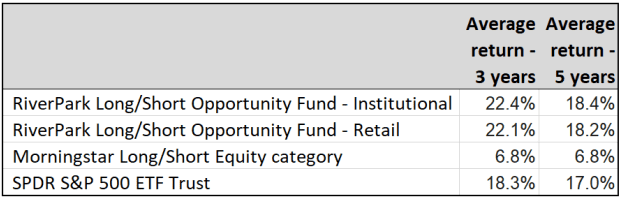

The above returns are net of costs, as are the following average returns for longer periods:

(FactSet)

Do not miss: These stocks seem expensive now, but in two years time, you wish you had bought them at these prices