There is an old saying among commodity traders that the cure for high prices is high prices. The same will likely be true for options on GameStop Corp. and other high-flying targets that have become popular on Reddit message boards, one veteran options analyst argued.

The idea is just Econ 101: if the prices for wheat or oil or gold get too high, users will naturally use less of the product. As demand is rationed, prices eventually fall (the same idea works in reverse, seeing low prices as the cure for, you guessed it, low prices).

And so it could be after the crazy buying of call options last week, which give the holder the right but not the obligation to buy the underlying asset at a certain price at a certain time, on GameStop GME,

and shares of other high-short companies, Julian Emanuel, chief equity and derivatives strategist at BTIG, said in a note on Sunday.

The heavy call buy was part of an effort by an army of individual investors organized through Reddit’s WallStreetBets forum to inflate the prices of the companies with high short positions, forcing short sellers to buy back their shares and the rally. speed up. Call buying generated a feedback loop of its own when market makers, who had sold the call options, bought the underlying stock to hedge or neutralize their market exposure.

More details: How an options trading frenzy is driving stocks up and fueling fears of a market bubble

The strategy, as anyone who paid the least attention to markets or the news last week, seems to have worked pretty well. GameStop shares were up 400% last week, finishing at $ 325 on Friday after hitting a high near $ 500 on Thursday. GameStop ended 2020 close to $ 18 per share.

Read: GameStop short squeeze is fueling new exchange services that track Reddit posts

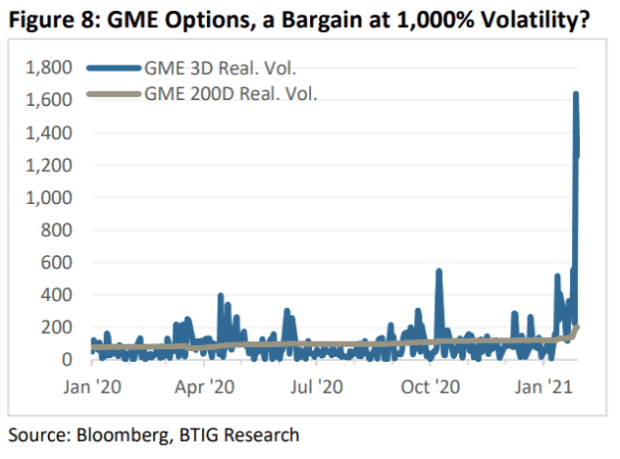

Given those swings, implied volatility – a measure of the cost of an option – turned out to be 1,000% cheap at an off-the-chart 1,000% for options that expired last week, Emanuel said, as he noted in the chart below the sharp rise in the price. realized three-day volatility.

BTIG

But it will likely be a different story in the future, he said, arguing that options “have probably become too expensive to remain a source that will further fuel some of the meteoric gainers”.

To illustrate, he noted that an at-the-money call option (one with a strike price equal to the stock price) on GameStop expiring on February 19 costs about half the actual GameStop stock price, or 580% volatility. In comparison, rely on the S&P 500 SPX,

which also expires on Feb. 19, will cost 2.5% of the index’s true price, or 26.5% volatility, he said.

Since both options were at the money, they had no “intrinsic value,” a measure of the option’s profitability based on its strike price versus the share price. Instead, the premiums consisted entirely of “time value”, based on the expected volatility of the underlying and the time until the option expires.

The GameStop stock was down 27% on Monday, while the Dow Jones Industrial Average DJIA,

rose 300 points, or 1%, and the S&P 500 was up about 1.8%. Major benchmarks took back some of the ground lost in their worst weekly decline since October, a drop attributed in part to hedge funds and other investors cutting both long and short positions.

The bottom line, Emanuel said, options on GameStop and much of GameStop’s cohort of social media-driven speculative stocks “now have options that are very expensive, maybe even prohibitively expensive.”