Markets are waiting for a stimulus bill that could rally through the holiday season, and all eyes are on 2021. It’s also a big day for Tesla – the stock price at the end of Friday will determine the weighting of its shares when next week adds he joined the S&P 500.

As for the coming year, our call of the day Wedbush analyst Daniel Ives has a slew of predictions with the biggest names in technology.

“Moving into 2021, there is clear momentum for the tech space / equities as a number of transformational trends such as cybersecurity, cloud, 5G, e-commerce and autonomous will take center stage,” said Ives.

On Tesla TSLA,

Ives believes the forward-thinking carmaker will have continued success with its Giga 3 plant in China, which is expected to begin delivery of the Tesla Model Y next month, exceeding the target of 250,000 annual deliveries.

Global demand for electric vehicles should hit “a major tipping point”, namely 6% of all car sales from 3% today, while Ives also expects China’s Baidu BIDU,

to enter the market through a partnership or acquisition.

But read this opinion: Nio, not Tesla, is the better EV stock choice for 2021

Apple AAPL,

will emerge as “the clear winner” in next year’s race to dominate in 5G, breaking the record of annually sold iPhones, Ives said.

Regulatory headwinds, such as the antitrust cases facing tech giant Google owned by Alphabet GOOGL,

and social media platform Facebook FB,

According to Wedbush, fines and pressure can come from Washington, but no major changes in technical business models or business breakdowns.

Essential Reading: Big Tech turns each other on during antitrust investigations and lawsuits

On cybersecurity, Ives said that the recent Solarwinds SWI,

software hack will drive spending in the long run and lead to budget growth of at least 20%. He also expects consolidation in the industry with aggressive acquisitions from strategic buyers.

Read more: Microsoft was breached in the SolarWinds cyber attack, in what one executive calls “ a moment of reckoning. ”

Ives sees Microsoft MSFT,

ahead of Amazon AMZN,

in the battle for cloud services and Uber UBER,

Exceeding profitability beyond expectations of a strong recovery in commuting and travel sharing.

In bricks and mortar, Ives believes that e-commerce will remain above 20% of the total retail trade, despite the retail sector returning after the corona virus. Real estate technology will take a leap forward, with online markets Redfin RDFN,

and Zillow Z,

taking “material share” from traditional brokerages.

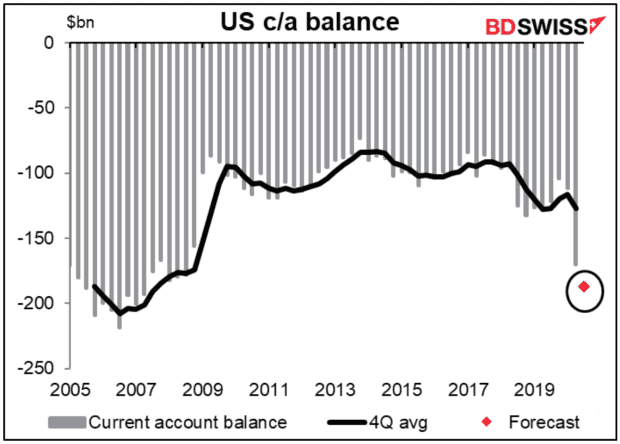

The graph

BDSwiss Market Insights

Our chart of the day, courtesy of Marshall Gittler at BDSwiss, shows how much the US current account deficit has widened and what is expected from today’s report for the third quarter. FactSet’s consensus is that the current account deficit will be $ 188.6 billion – an increase of $ 18.1 billion from its $ 170.5 billion deficit in the second quarter.

The markets

Stock market futures YM00,

ES00,

NQ00,

point slightly down, ready for a soft opening as the US awaits a stimulus package from Congress. Asian markets fell while European equities surged with SXXP,

as Brexit trade talks remain in the spotlight, with officials on both sides saying major disparities stand in the way of a deal with just two weeks to go. GBPUSD, pound

declines slightly against the dollar, bringing yesterday’s gains back to near two-year highs.

The buzz

Congressional lawmakers are facing a Friday deadline to pass an economic stimulus package for the coronavirus. As the talks drag on, they may miss that target, as well as the deadline for a bill to continue funding the government – which would trigger a shutdown.

A major Food and Drug Administration committee has voted that the benefits of Moderna’s COVID-19 vaccine candidate outweigh the risks. The recommendation paves the way for full approval of Biotech Moderna’s MRNA,

vaccine by the FDA.

According to a report from Reuters, the US will add dozens of Chinese companies, including chip maker SMIC, to a blacklist.

The latest title from CD Projekt CDR,

was expected to be one of the best-selling games of all time. But initial reviews of “Cyberpunk 2077” on consoles were dire, and now Sony has pulled the game – with Tesla Chief Executive Elon Musk and actor Keanu Reeves – off PlayStation Store. Shares are down more than 40% from two weeks ago.

Random reads

Florida’s newly minted team of python-sniffing dogs found their first snake – an eight-foot Burmese python.

A surreal painting worth more than $ 250,000, lost at Düsseldorf Airport, has been recovered in a nearby dumpster.

Need to Know starts early and updates to the opening bell, however Register here to get it in your email box once. The e-mailed version will ship at approximately 7:30 a.m. East.

Do you want more for the coming day: Sign up for The Barron’s Daily, a morning investor briefing, including exclusive commentary from Barron’s and MarketWatch writers.