Stocks got back on track on Wednesday, with both the Dow and S&P 500 index finishing at their second-highest level ever, as investors continue to smile at the strong economic growth outlook.

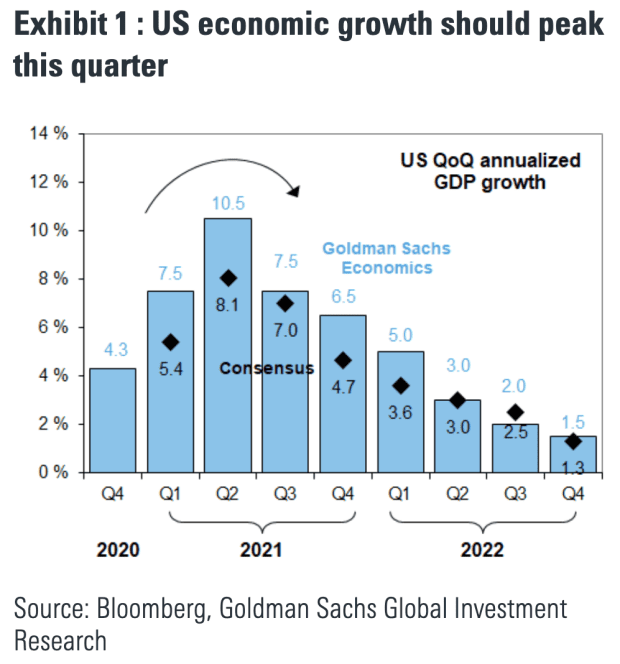

Goldman Sachs strategists are optimistic about the US economy and expect consecutive annual growth in US gross domestic product to reach 10.5% in the second quarter of 2021. That would be the strongest quarterly growth since 1978 (aside from the rise in the middle of late 2020, when the economy recovered from a sudden halt).

But it may not be good for stocks. Our call of the day belongs to the Goldman Sachs team, led by Ben Snider, who warns that as economic growth peaks, investors should expect lower stock returns and higher volatility.

Investment bank economists see US GDP growth slowing slightly in the third quarter of this year, before declining further in the coming quarters.

Chart via Goldman Sachs

“Slowing growth is usually associated with weaker but still positive stock returns and higher volatility,” say the strategists. Since 1980, the S&P 500 SPX,

has delivered an average monthly return of 1.2% with positive and accelerating economic growth, but only 0.6% with positive but slowing growth.

Equities underperform even when growth peaks. Investors who bought the S&P 500 when the Institute for Supply Management’s manufacturing index was above 60 – signaling peak growth, strategists say – achieved a median return of -1% the following month and only 3% the following. year. In March, the ISM manufacturing index ended at 65.

But it’s not all bad news. Outside of the US, the world economy is still in a tear. Economists at Goldman Sachs expect economic growth in Europe, Japan and emerging markets outside China to peak later than in the US – in the third quarter of this year. As a result, some cyclical parts of the US stock market should perform better than normal in the coming months as US growth begins to slow, the strategists say.

Goldman Sachs GS,

has two pieces of advice: Buy global cyclical stocks versus domestic cyclical stocks and buy a basket of “Europe reopen” stocks, which are lagging “US reopen” stocks.

The buzz

Cash call at Credit Suisse: The bank will raise 1.7 billion Swiss francs ($ 1.9 billion) in additional capital in the wake of the collapse of hedge fund Archegos Capital. Credit Suisse CS,

said it would lose an additional $ 654 million from the fire sale with position liquidation approaching $ 30 billion in March, after an initial hit of $ 4.7 billion.

Economically, initial jobless claims for last week were 547,000, a pandemic low, while there were 3.67 million persistent jobless claims in the week of April 10. Existing home sales for March come out at 10 a.m. in conjunction with leading economic indicators.

Europe is moving towards the world’s first major artificial intelligence laws. The European Commission – the executive arm of the European Union – proposed on Wednesday to limit the use of facial recognition by the police and to ban certain types of AI systems.

On Wednesday, representatives of technology giant Apple AAPL,

and Google parent Alphabet GOOGL,

was grilled by the Senate Judiciary Subcommittee on Competition Policy, Antitrust and Consumer Rights on the extended powers of the App Store and Google Play Store.

In India, COVID-19 returns with vengeance. The second-most populous country in the world reported a record of more than 314,000 new infections on Thursday, as the country’s healthcare system is on the verge of faltering.

The markets

US Stock Market Futures YM00,

ES00,

NQ00,

float around after Wall Street returned to its winning ways on Wednesday.

European equities UKX,

DAX,

PX1,

rose Thursday amid a wave of strong earnings reports, but it was Tokyo that led the higher position among Asian stocks HSI,

SHCOMP,

to the Nikkei 225 NIK,

rose 2.4% after two days of losses.

The graph

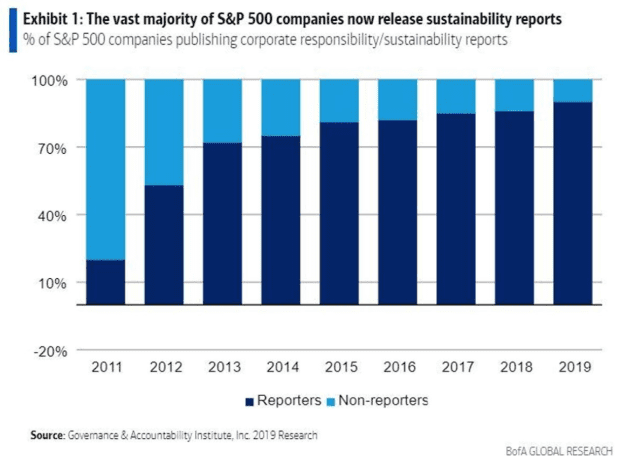

Chart via Bank of America

Our chart of the day shows the rise of sustainability reports among S&P 500 companies. In honor of Earth Day, learn more about what that means and check out six other graphs showing the “greening” of the S&P 500.

The tweet

Via Twitter

After the Financial Times first reported on Wednesday that Uber Eats UBER,

would expand to Germany, shares in rival Just Eat Takeaway TKWY,

JET,

(JET) fell by more than 4%. That led to a bizarre exchange between the chief executives of the two companies, started by JET’s leader, Dutch billionaire Jitse Groen.

Random reads

How small ‘beach huts’ became the hottest commodity in British real estate.

Tra-la-la: A $ 13,000 whistle that went missing in a cab nearly a decade ago has been returned to its owner after police found it in a Boston music store.

Need to Know starts early and updates to the opening bell, however Register here to have it delivered once to your email box. The emailed version will ship at approximately 7:30 a.m. East.

Do you want more for the day ahead? Sign up for The Barron’s Daily, a morning investor briefing, including exclusive commentary from the writers of Barron and MarketWatch.