The shares of General Electric Co. collapsed on Wednesday after the industrial conglomerate confirmed a $ 30 billion deal with AerCap Holdings NV, while surprisingly also proposing a 1-for-8 reverse stock split.

GE, which hosted an analyst meeting early Wednesday, also gave financial outlook for 2021, in which the adjusted earnings bandwidth was a bit dismal, but the revenue and free cash flow bandwidths were in line with expectations.

The stock GE,

swung fell 6.0% in morning trading, putting it on track for its biggest one-day drop since September 21, 2020, when it fell 7.7%. The drop comes after the stock rallied 11.6% in March through Tuesday, including a 3-year high close of $ 14.17 on Monday, as the S&P 500 index SPX,

is up 1.7% in the same time.

The reverse split could surprise investors, as they are usually reserved for companies who fear their stock price could or have fallen below thresholds that could cause mutual fund investors to avoid the stock or prompt stock exchanges to issue notifications. to enact. Read more about reverse stock splits.

In the case of GE, the company said the board of directors is recommending the split of reserves, which shareholders will vote on at the May annual meeting, given the company’s “significant transformation” in recent years.

“The reverse stock split would reduce the number of shares outstanding to a number more typical of companies of similar market capitalization,” GE said in a statement.

FactSet, MarketWatch

GE had a market capitalization of $ 122.75 billion at Tuesday’s closing price, and 8.77 billion shares outstanding as of January 31. In comparison, Lowes Companies Inc. LOW,

with a market capitalization of $ 121.34 billion, has approximately 734 million shares outstanding, while Starbucks Corp. SBUX,

with a market capitalization of $ 125.44 billion, it has 1.18 billion shares outstanding.

In effect, GE’s proposed reverse split would multiply the stock price by eight, while reducing the number of shares outstanding to about 1.1 billion. If shareholders approve the demerger, the demerger will be effective at any time prior to the first anniversary of its annual meeting on May 4, 2021, at the discretion of GE Board of Directors.

GE confirms deal with AerCap

GE confirmed a deal on Wednesday to combine its GE Capital Aviation Services (GECAS) aircraft leasing business with AerCap, in a deal that will create more than $ 30 billion in value for GE shareholders.

The Wall Street Journal had reported earlier this week that a deal was near.

Under the agreement, GE will receive $ 24 billion in cash and 111.5 million shares of common stock, with a market value of approximately $ 6 billion and a 46% ownership interest in the combined company.

GE said it plans to use the proceeds from the deal to further reduce debt, bringing the total debt reduction to more than $ 70 billion since the end of 2018.

The deal is part of a multi-year effort by GE to reduce risk at GE Capital, which is estimated to have $ 21 billion in assets after the deal closes, up from $ 68 billion by the end of 2020. twelve months. And once the deal is done, those remaining assets will become part of the consolidated industrial balance sheet.

“Today marks GE’s transformation into a more focused, simpler and stronger industrial company,” said Chief Executive Larry Culp.

“AerCap is the right partner for our exceptional GECAS team,” said Culp. “We are creating a leading airline rental company with expertise, scale and reach to better serve customers around the world, while GE acquires both cash and a meaningful stake in the stronger combined business, with flexibility to make money as the aviation industry evolves. recovers. “

GE financial guidance

As part of its analyst day, GE provided details of its 2021 financial guidance.

The company expects adjusted earnings per share of 15 cents to 25 cents for the full year, compared to the FactSet consensus of 25 cents.

In terms of sales, GE expects growth in the low-single-digit percentage range, while the current FactSet sales consensus of $ 80.4 billion implies an increase of 1.0%.

Free cash flow is expected to reach $ 2.5 billion to $ 4.5 billion this year, encircling the FactSet consensus of $ 3.6 billion.

GE said its guidance is based on the assumption that the aviation market will recover in the second half of the year. GE expects growth in the renewable energy market, an accelerating turnaround in the electricity sector, and sees an “attractive” health care market, with scans back to pre-COVID levels.

“We are on a positive trajectory in 2021 as momentum in our businesses grows and we are transforming into a more focused, simpler and stronger industrial company,” said CEO Culp. “We are excited to move more to offense and invest in breakthrough technologies to meet the needs of our customers and the world – for more sustainable, reliable and affordable energy; more integrated and personalized healthcare; and smarter and more efficient flights. “

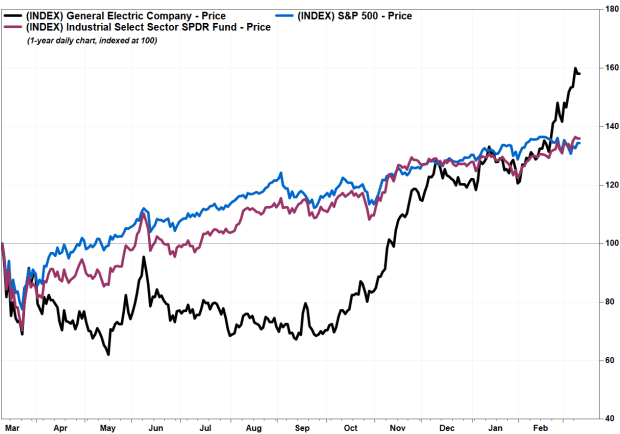

GE’s share is up 16.2% in the last three months and is up 48.6% in the last 12 months. For comparison: the exchange-traded fund SPDR Industrial Select Sector XLI,

is up 36.6% over the past year and the S&P 500 is up 34.9%.