The author of the Cracked Market blog, Jani Ziedins, last week warned the merchants piling up at the video game store GameStop not to get greedy – or more specifically, not to be a pig.

Good.

As the graph shows, that short squeeze worked until it didn’t. Momentum hissed after Robinhood and other brokers restricted access to GameStop GME trading,

and other securities that were growing in popularity. Why will there be congressional hearings to find out the culprit – hedge funds or old-fashioned margin requirements – but the end result is the same.

GameStop may still have its moments. “As for the next step, GME will be insanely volatile for weeks and even months. That means 50% and 100% moves in both directions. But at this point, a 50% bounce will only bring us back to $ 75. Maybe we’ll get back to $ 100 or even $ 125, but waiting for anything higher is just wishful thinking, ”says Ziedins.

Here’s Ziedins’s advice. “For those who still have money on the market, there is no reason to drive this completely into the mud. Cash in what you have left, learn from this lesson, and come back to the market better prepared next time, ”says the Cracked Market blogger.

Cue, Frank Sinatra.

And those traders are inexperienced. Cardify, a consumer data company, surveyed 1,600 self-directed investors in GameStop and cinema chain AMC Entertainment AMC,

and found that most were inexperienced investors – 44% had less than 12 months of experience and another quarter had one or two years of experience. According to the poll that ended Monday, nearly half have made their biggest DIY trading investment ever in the past four weeks.

Why? Of these predominantly young and male investors, 45% said for quick financial gains. According to Cardify, nearly 20% said it was part of a long-term investment strategy and 16% said they opposed large hedge funds and institutional investors.

The buzz

The January Non-Farm Salary Report must be paid by 8:30 a.m. Eastern Time. Expectations are building after solid unemployment claims and other reports this week, with Bloomberg reporting that the economists’ consensus has risen from 50,000 to 100,000. An unusually large number could be dismissed as a whim in the seasonal change rather than a change in the underlying economy.

The U.S. Senate passed a budget resolution in the early hours of the morning that will make it possible to quickly follow the $ 1.9 trillion coronavirus emergency response plan proposed by the Biden administration without Republican backing. Vice President Kamala Harris cast the casting vote. Johnson & Johnson JNJ,

meanwhile, coronavirus vaccines have been submitted for approval by the Food and Drug Administration.

Pinterest PINS,

Shares were up 11% in premarket trading as the social media art exchange service reported forecast earnings of a 76% increase in revenues during the fourth quarter. Another social media service, Snap SNAP,

also beat expectations. In addition to using social media, people stuck at home played video games, such as Activision Blizzard ATVI,

gained 8% after it reported higher than expected earnings and bookings, increased its dividend by 15% and approved a $ 4 billion share buyback plan.

Ford Motor Co. F,

reported a surprising profit and exceeded expectations.

Exercise bike maker Peloton Interactive PTON,

fell 7% while outpacing revenues, but marked an increase in shipping and other costs. T-Mobile US TMUS,

the mobile service provider also exceeded earnings expectations, but led to a softer 2021 than expected.

Luckin Coffee, the US-listed Chinese coffee retailer, filed for bankruptcy protection less than a year after an accounting scandal.

The market

After the S&P 500 SPX,

ended Thursday on a record for the sixth time in 2021, US equity futures ES00,

NQ00,

pointed to another day of profit.

The return on the 10-year Treasury TMUBMUSD10Y,

rose to 1.16%, after finishing at its 11-month high on Thursday.

The graph

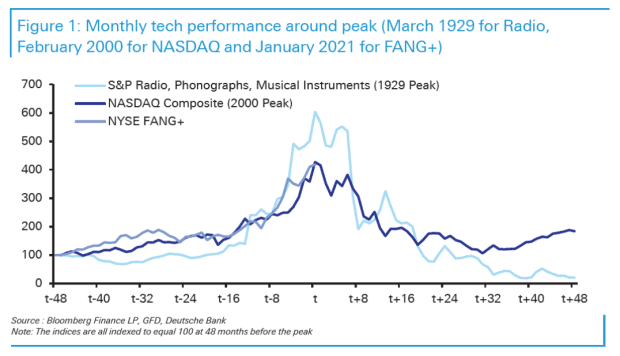

The more things change, the more they stay the same. Today’s technology giants follow a similar trajectory to the radio makers of the 1920s, as well as the dotcom era at the turn of the century. “So the point is, you can be a big believer in technology’s ability to transform our lives, but still think valuations are in a bubble,” said Jim Reid, strategist at Deutsche Bank.

Random reads

This local government meeting about Zoom ZM,

turned into a chaotic internet sensation.

According to pastry chef Hershey HSY, chocolate sales were 40% to 50% higher in areas with a higher number of COVID-19 boxes.

Need to Know starts early and will update until the opening bell, but sign up here to get it in your email box once. The e-mailed version will ship at approximately 7:30 a.m. East.

Do you want more for the day ahead? Sign up for The Barron’s Daily, a morning investor briefing including exclusive commentary from Barron’s and MarketWatch