Day traders are credited with sparking a revolution on Wall Street, pushing GameStop Corp. stock. GME,

and AMC Entertainment Holdings AMC,

disrupting the foundations of segments of the hedge fund industry.

Now a group of data providers is betting that financial markets will never be the same again and that investors with large pockets will spend a lot of money to follow discussions on message boards like Reddit’s r / wallstreetbets and social media platforms like Discord for listed companies.

“We believe this is some sort of turning point and perhaps irreversible,” Boris Spiwak, marketing director at alternative data company Thinknum, told MarketWatch in an interview Monday. Thinknum’s plans were mentioned in an article by Barrron this weekend.

Spiwak said he envisions clients using the services of companies like Thinknum as a way to take advantage of not only chit-chat on social media platforms, but also as a form of crisis management, as sounding individual investors gather on platforms to congregate around investment ideas. .

“This is very new and we see it as a crisis management purchase, an insurance policy and a way to increase returns and minimize losses,” he told clients.

Thinknum’s service, which launched last week, is one of the most expensive it offers to customers, costing just under $ 25,000 per year to track the frequency of New York Stock Exchange listed companies and companies on the Nasdaq be called. on sites like r / wallstreetbets or other Reddit subreddits.

“Demand has been enormous – we have received more than 100 incoming requests from hedge funds in the past few days,” wrote Thinknum’s marketing director.

So far, interest in these expensive products has come from fund managers, but the company also says it is asking questions from institutional investors looking for “an insurance policy to protect themselves from Reddit.”

The moves of the alternative data company come as video game retailer GameStop and other companies such as film chain AMC Entertainment and headphone maker Koss Corp. KOSS,

have experienced a parabolic surge in stock values in a short period of time as investors congregating on sites like Reddit’s r / wallstreetbets put millions into high-short companies to start a rally in those stocks.

The recent emergence of highly shorted stocks targeted by the army of individual investors seemed to be hurting hedge funds.

Melvin Capital Management, one of the hedge funds at the heart of the GameStop battle, lost 53% on its investments in January, The Wall Street Journal wrote, citing famous people. WSJ also said another hedge fund, Maplelane Capital, ended January with a loss of about 45%.

Meanwhile, Andrew Left, founder of Citron Research, a famous short seller, changed his strategy last Friday and said his company would no longer publish short selling reports. Left was seen as the ire of individual investors for his negative outlook on GameStop – a brick-and-mortar store he said was only worth about $ 20 amid a growing shift in digital video game sales.

“Young people want to buy shares. That’s the spirit of the times, ”Left said of his decision to discontinue the activities of identifying companies he believes are overvalued and publicly announcing that he is betting his stock will sink.

“They don’t want to be short in stocks, so I’m going to help them buy stocks,” Left said of his focus on long investing.

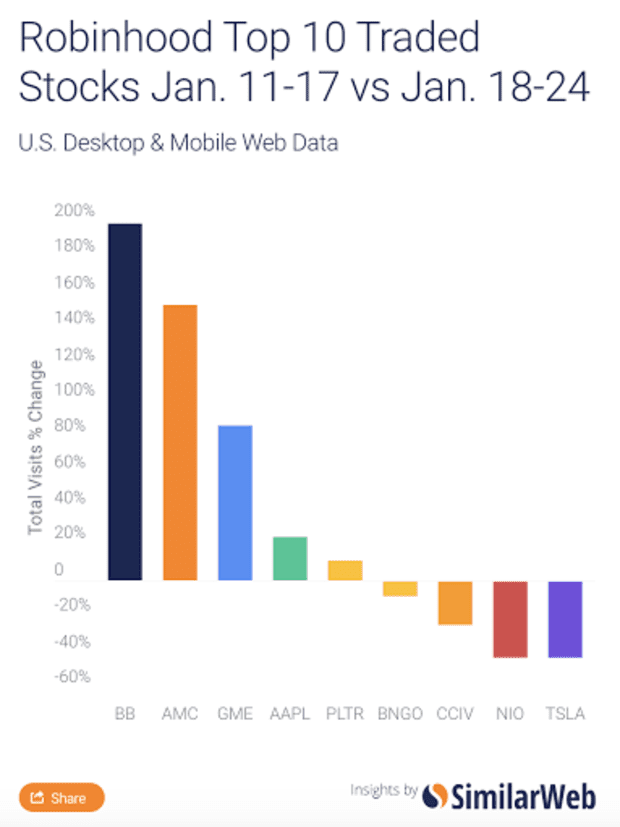

Other companies, including SimilarWeb, are also trying to promote tools for investors to track investments and discussions on popular social media sites as well as on some popular trading platforms.

SimilarWeb says it can track stock symbol searches among mobile app users and desktop users on the Robinhood Markets platform, for example. SimilarWeb says search activity can be an indication of actual trading and help customers identify trends early on, said Ed Lavery, director of Investor Solutions at SimilarWeb.

SimilarWeb

SESAMm, which considers itself one of the leading providers of analytics and artificial intelligence for investment professionals, had also developed or worked on services that could help identify social media trends, Spiwak said.

SESAMm, which recently received some $ 7.5 million in venture capital funding from NewAlpha Asset Management and global investment firm The Carlyle Group, did not immediately email for comment.

Meanwhile, the liquidation of profitable long positions by hedge funds and other investors who needed cash to cover losses on short positions losses was blamed on the Dow Jones Industrial Average DJIA,

the S&P 500 index SPX,

and the Nasdaq Composite Index COMP,

with their worst weekly losses since October last Friday.

Markets tried to get back from those losses early Monday, kicking off what is likely to be a turbulent February.