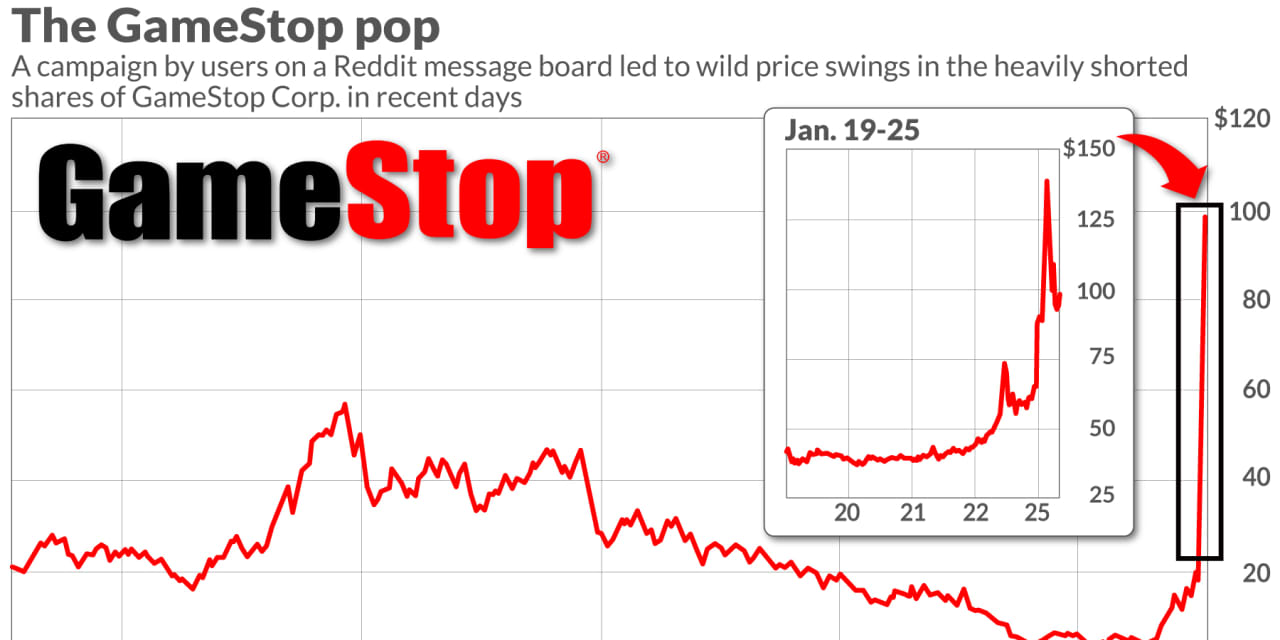

The shares of GameStop Corp. peaked past $ 150 on Monday, but then dropped to a loss on the day in another volatile session when loyalists and short sellers clashed over the value of the video game store.

GameStop GME,

Shares flew a whopping 144% higher to an intraday record of $ 159.18 earlier Monday, while being shut down several times, then falling briefly in the red the day before returning to a gain of less than 20%. More than 126 million shares exchanged hands by noon for a stock with an average daily volume of less than 9 million shares over the past 52 weeks.

In January alone, stocks skyrocketed by a whopping 400% during a fight involving a retailer slammed by the COVID-19 pandemic and online video game purchases. GameStop has been a darling of Reddit message board WallStreetBets, where hundreds of posters have pushed for stock purchases after investors betting against the chain pushed short-term interest rates to over 100%.

Also see: “The mechanics of the market are breaking,” Jim Cramer says of GameStop’s madness

Short sellers have turned to GameStop stock as the pandemic contributed to online selling problems. Citron Research’s well-known short-seller Andrew Left released a video late Thursday outlining points about why GameStop should be a $ 20 share, then backed out, claiming he and his family had been threatened. Shares started to rally in mid-month, up 57% on Jan. 13, with five of the next seven trading days posting daily gains of 10% or more despite a disappointing preliminary earnings report from the retailer. The stock ended Friday at 51% after Citron canceled a scheduled live stream for harassment and hacking attempts.

Ihor Dusaniwsky – the head of predictive analytics at financial technology and analytics firm S3 Partners, specializing in analyzing short selling data – told MarketWatch that GameStop is in a unique situation on the short side.

“We are seeing a short squeeze on older shorts that have suffered huge mark-to-market losses on their positions, but we are seeing new shorts coming in and using any available equity loans to initiate new short positions in the hope of a possible withdrawal from these stratospheric stock price movement, ”said Dusaniwsky.

“This keeps the overall short position in GME relatively flat, although there is a significant short squeeze in a significant number of existing short sellers,” Dusaniwsky continued. “As in the revolutionary war, the first line of troops goes down in a shower of musket fire, but is replaced by the next troops in line.”

Dusaniwsky said short seller’s net mark-to-market losses are at $ 6.12 billion this year, including a $ 2.79 billion loss on Monday, when the stock rose more than 60%.

For more: Reddit moderator on GameStop surge – ‘They hate that you play by the rules and still win’

GameStop did not release any news coinciding with the spike, and did not respond to a request from MarketWatch for comment. The Securities and Exchange Commission declined to comment on possible investigations on Monday.

Earlier this month, GameStop admitted that sales during the holiday season were down more than 25% and were lower than expected. Over the past two quarters, losses for the company have spiked significantly, following a quarter ending April 2020 in which GameStop reported an adjusted loss of $ 1.61 per share from the 7 cents per share in earnings it reported in the quarter of the previous year.

Analysts expect adjusted earnings to rise 12% to $ 1.42 a share for the holiday-boosted January end period with sales up 5% to $ 2.29 billion, compared to the same period a year ago.