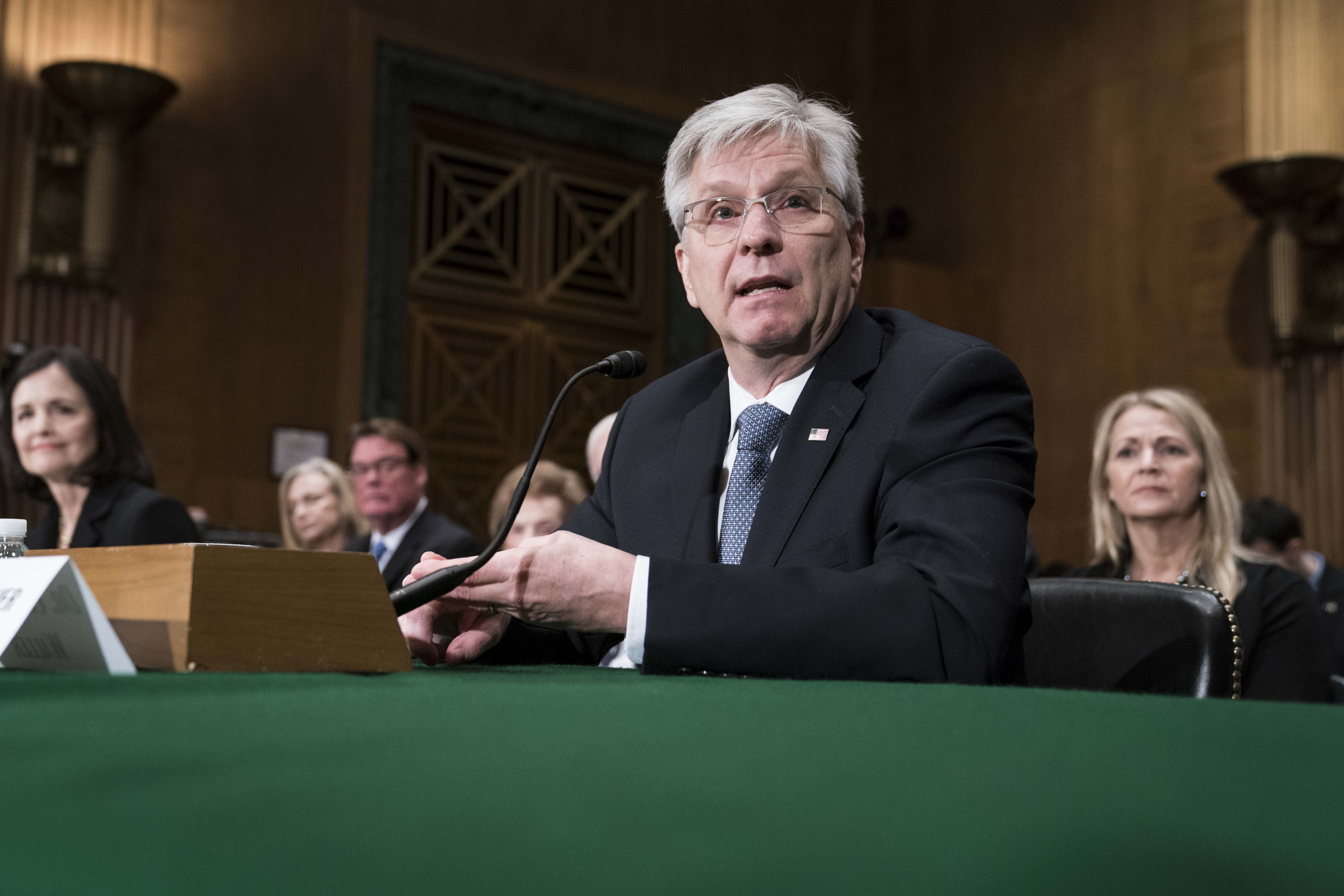

Federal Reserve Governor Christopher Waller said on Friday that he sees the US economy boom, but not fast enough for central bank to tighten policy.

“I think the economy is ready to crack,” Waller told CNBC’s Steve Liesman during a “Squawk on the Street” interview. “There is more to do, but I think everyone is getting a lot more comfortable getting the virus under control and we are starting to see it in the form of economic activity.”

Those comments came amid a marked upward movement in the economic data.

In March alone, non-farm payrolls were up 916,000, retail sales were up 9.8% on incentives, and multiple production meters hit their highest levels in years.

There is further evidence that job growth continued into April, with unemployment claims dropping to 576,000 last week, by far the lowest level since the early days of the pandemic.

All of that coupled with a vaccination rate of more than 3 million a day, and it adds up to a strong outlook, Waller said.

“We can pretty much get the virus under control. We get 70% of the population vaccinated, then all the foundations are in place for the good, strong growth that we left in January, February 2020,” he said. ‘We still have room to catch up where we were. We are reclaiming lost territory. ‘

‘No reason to pull the plug’

The economy officially entered a recession in February 2020, according to the National Bureau of Economic Research, which is officially calling for contractions and expansions. While the US is poised for another quarter of strong growth, its gross domestic product is still a little below pre-Covid-19 levels.

That’s part of the reason Waller agrees with his fellow central bankers that he sees the need to keep policy loose. The Fed currently keeps short-term interest rates close to zero and buys at least $ 120 billion in bonds every month.

During a major policy change last year, the Fed pledged not to raise rates until it sees full and inclusive employment, and is willing to tolerate inflation slightly above its traditional 2% target until then. Fed officials have expressed concern about the uneven nature of the recovery, particularly with regard to those at the lower end of the income spectrum.

“We’ve got to make that up first,” said Waller. “Other parts of the economy really seem to have come back. We still have relatively high unemployment rates, especially among minorities, and so we still have a long way to go. really through it. “

Waller added that he thinks the inflationary pressures that are starting to emerge are likely to be temporary, an opinion widely held by the Fed. The consumer price index rose 2.6% in March compared to a year ago.

Waller said he expects the Fed’s preferred inflation indicator based on personal consumption spending could be around 2.5% by 2021.

Become a smarter investor with CNBC Pro.

Get stock selection, analyst calls, exclusive interviews and access to CNBC TV.

Sign up today to start a free trial.