Sign up for our Middle East newsletter and follow us @Middle East for news about the region.

Turkish President Recep Tayyip Erdogan said the authorities have used $ 165 billion in central bank foreign exchange reserves to withstand 2019 and 2020 developments, and can use them “again if necessary.”

“The central bank currently has about $ 90 billion in reserves,” he told lawmakers in Ankara on Wednesday. “These reserves can be reused if necessary or they could exceed $ 100 billion in the future,” Erdogan said, referring to the monetary authority’s total gross reserves.

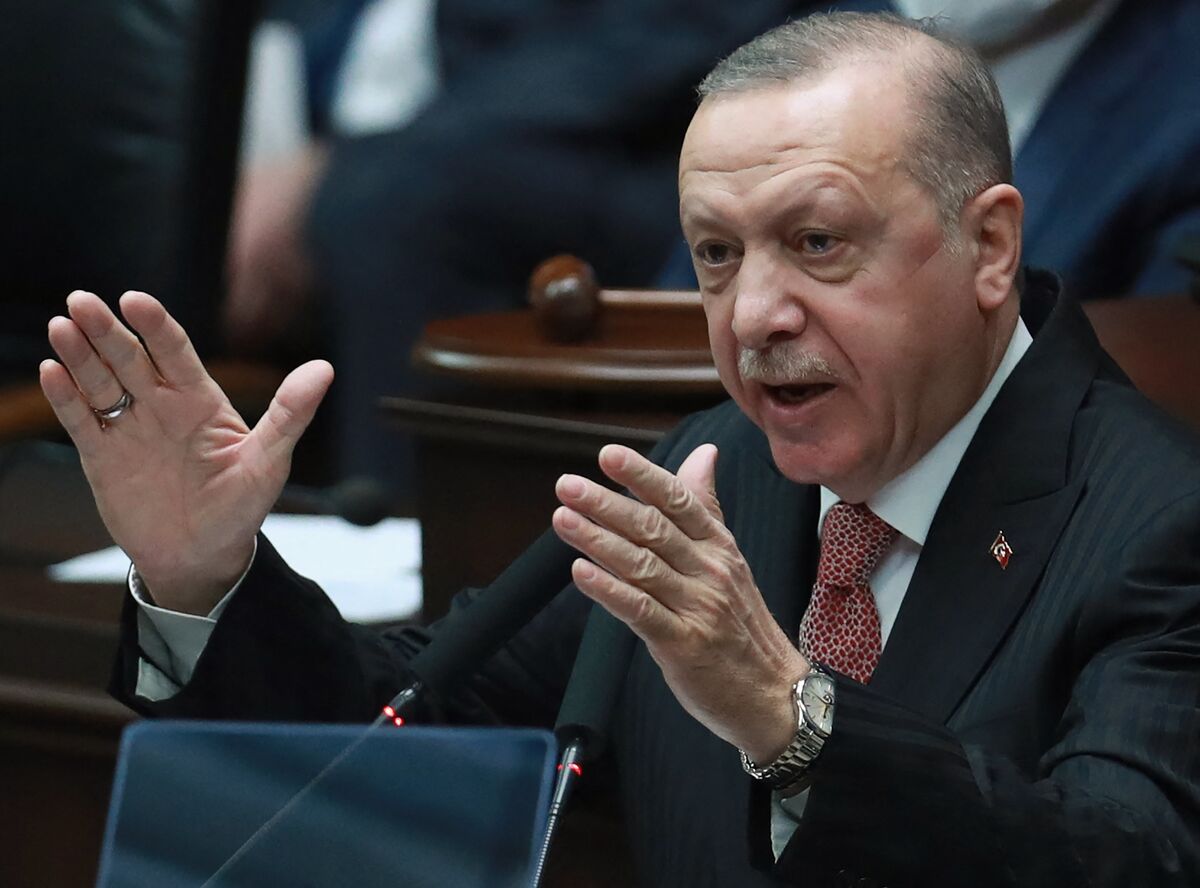

Recep Tayyip Erdogan on April 21.

Photographer: Breathe Altan / AFP / Getty Images

The lira extended its decline against the dollar during his speech, trailing 0.8% lower at 8.1771 at 4:10 pm in Istanbul.

Turkey’s main opposition, the Republican People’s Party, is Demanding officials explain a decline in foreign reserves during the period when Berat Albayrak, Erdogan’s son-in-law, was Minister of Finance and Finance. He held the position from July 2018 to November last year.

On Wednesday, Erdogan accused the party of spreading a “huge lie” by suggesting that $ 128 billion is “missing or stolen.”

Global banks, including Goldman Sachs, predict that more than $ 100 billion in central bank reserves was spent last year alone to avoid a disorderly depreciation of the lira as the currency came under pressure after a string of major interest rate cuts to support the pandemic-hit economy.

In 2019, Turkey initially increased foreign currency sales as the lira weakened in the run-up to municipal elections, through a rerun of the vote in Istanbul that lost Erdogan’s AK party. Geopolitical tensions with the US later that year battered the currency.

Erdogan said on Wednesday that $ 165 billion in central bank reserves was used to fund the current account deficit and capital outflows, as well as to meet the foreign exchange and gold demands of local investors. The president said much of the money remained in the country when the central bank conducted the exchange transactions through market maker banks.

Turkey’s total gross reserves, including gold and money held by the central bank on behalf of commercial lenders, are down more than 15% from early 2020 to $ 89.3 billion in April. Net foreign exchange reserves fell more than 75% to $ 9.9 billion, while money borrowed from banks through short-term swaps reached tens of billions of dollars.

When those swaps are removed from net reserves, they fall below zero, according to Bloomberg’s calculations.

In a written interview after his appointment last month, new governor Sahap Kavcioglu said the central bank would maintain its goal of increasing foreign exchange reserves and “use reserve-strengthening tools under the right circumstances.”

(Updates with more details.)