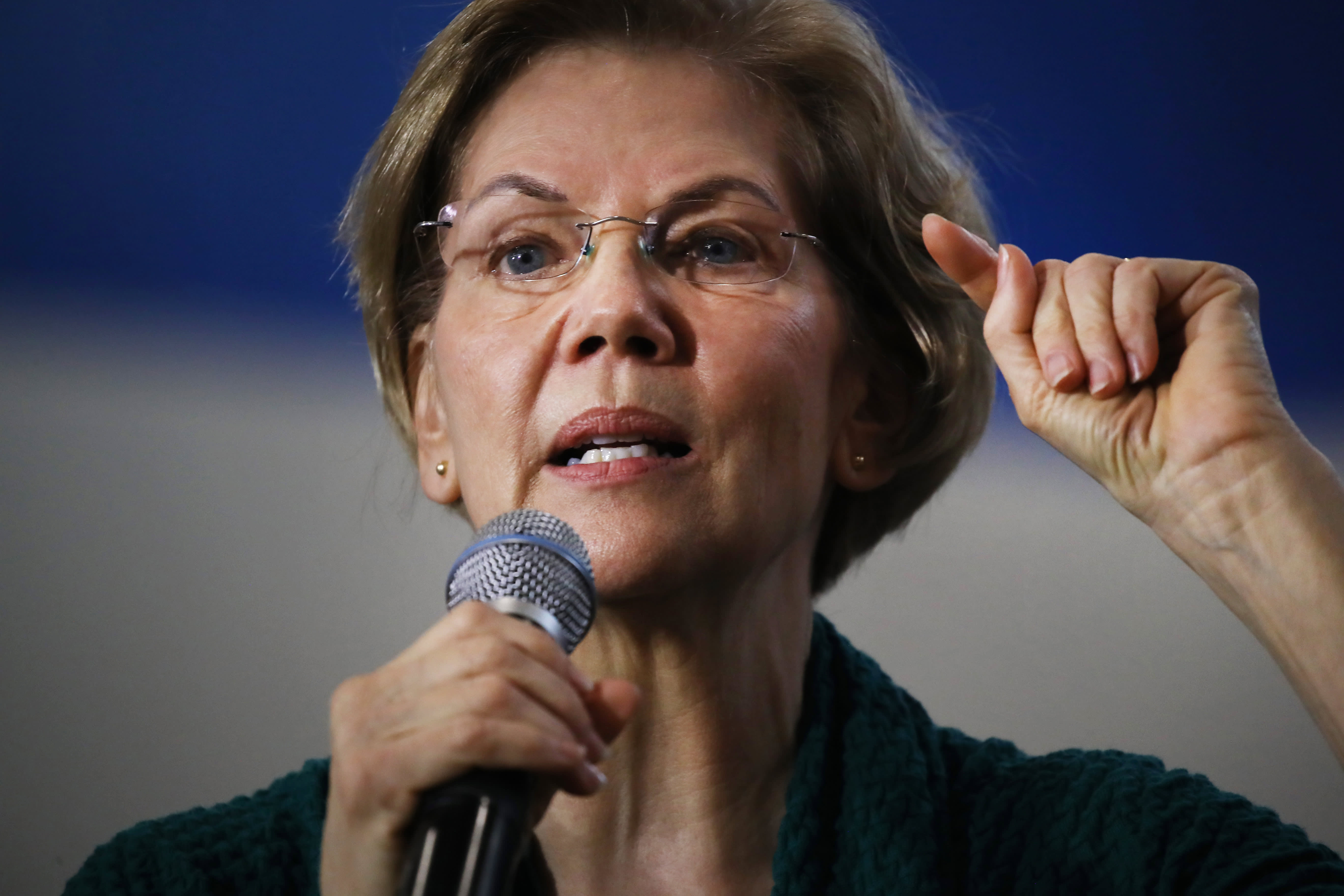

Senator Elizabeth Warren asked Robinhood in a letter Tuesday to explain why it restricted trading of GameStop’s red-hot stocks after hedge funds took massive losses in a short rush.

Warren, D-Mass., Noted that the online brokerage abruptly changed trading rules last week for individual investors in certain stocks on its free platform, while Wall Street hedge funds and institutional investors were allowed to continue trading GameStop, Koss, AMC Entertainment, Express , Naked Brand Group and other companies.

“Robinhood has a responsibility to treat its investors fairly and fairly and to provide them with access to the market under a transparent and consistent set of rules,” Warren wrote in her letter to Robinhood CEO Vladimir Tenev.

“It is very worrying that the company may not be doing this,” wrote Warren, who is a member of the Senate Banking Committee.

The letter asks Robinhood to disclose why the company imposed strict trade restrictions on the video game retailer Gamestop and its other stocks, and whether its hedge fund investors or other financial services companies that had significant interests in such trading influenced the app company’s decision. .

Robinhood had severely restricted buying a handful of shares, allowing customers to buy only one share in some cases. It also increased margin requirements for certain stocks and options.

“The public deserves a clear account of Robinhood’s relationships with major financial firms and the extent to which those relationships may undermine its obligations to its customers,” Warren wrote.

The senator also wrote that she was “troubled by Robinhood’s inclusion of enforced arbitration clauses in its client agreement, suggesting investors will not have ample opportunity to pursue their claims and seek help.”

In the past week, at least 18 lawsuits have been filed against Robinhood for its trade restrictions.

Warren wrote that enforcing these claims in “secret arbitration proceedings deprive customers of fair hearing, undermine public accountability, and hinder efforts to gather a thorough and complete understanding of events.”

Investors who have been harmed by Robinhood’s trade restrictions should be able to plead their case in court, rather than in closed proceedings too often rigged against plaintiffs, she wrote.

A Robinhood spokeswoman did not immediately respond to a request for comment on Warren’s letter.

Warren’s letter came on the same day Robinhood said it would allow customers to buy up to 100 shares of GameStop, while also increasing the limits for AMC and Koss, and lifting the restrictions on BlackBerry and Genius Brand.

The GameStop stock price exploded by 400% last week, ending January at more than 1,600% as a group of investors in Reddit’s WallStreetBets discussion group hypnotized the stock.

In turn, the massive rise in the share price put a brief strain on hedge funds that had bet that GameStop’s stock price would fall, forcing those funds to buy shares to cover the losses on their positions. Those purchases, in turn, increased upward pressure on the price of the shares and exacerbated the hedge funds’ losses.

Short sellers lost nearly $ 20 billion on GameStop positions last month due to the pressure.

Short sellers bet on a stock by borrowing shares that they then sell. A short seller hopes that the price of the stock will then fall so that when they later buy stock to replace the borrowed stock, the short seller can cash in on the difference in price.

But when prices go up, a short seller has to buy stock to replace the borrowed stock at a higher price than what they first sold for. That situation results in a loss for the short seller.

Many individual traders and politicians on both sides of the aisle have criticized Robinhood’s decision to restrict the buying of certain stocks, such as GameStop, that have been at the center of the controversy.

Tenev, Robinhood’s CEO, told CNBC last week that his company had limited 13 shares on Wednesday as a risk management decision to protect the company and its investors.

Tenev said the decision was based in part on the Securities and Exchange Commission’s net capital rules and the conditions for clearinghouse deposits that brokers must comply with.

Last week’s large trading volumes put pressure on online brokerages such as Robinhood, which require clients to pay in cash when they close a position.

The brokers also needed additional cash to provide their clearing facility with additional capital to protect trading partners from excessive losses.

GameStop’s stock prices fell Tuesday, falling 51% to around $ 110 a share from noon.

That sharp drop follows a drop of more than 30% during the regular market session on Monday.

GameStop’s stock price closed at $ 325 per share on Friday.

If GameStop closes at current levels, it would bring its two-day loss to around 66%.