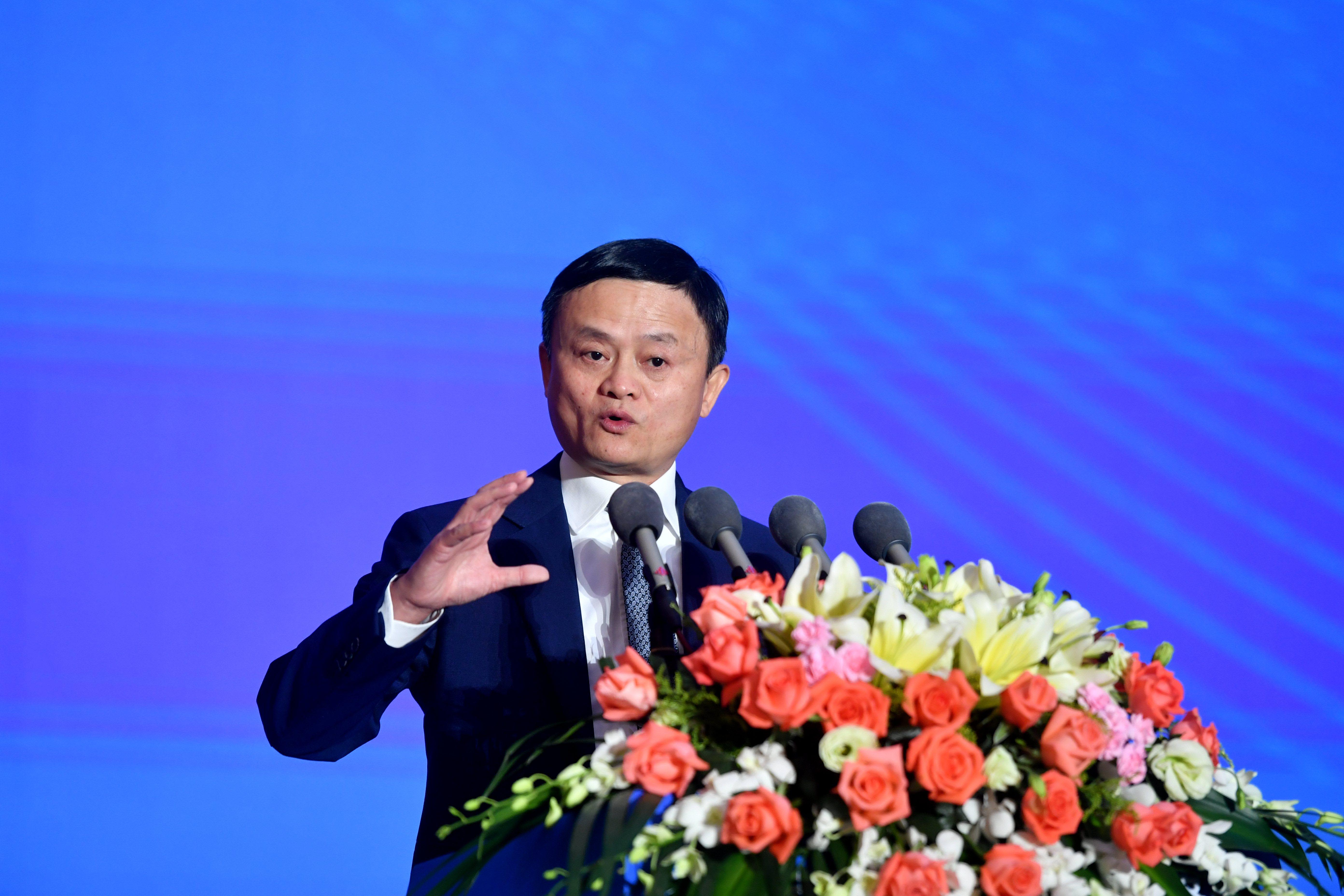

Jack Ma, founder of Alibaba Group, at the opening ceremony of the 3rd All-China Young Entrepreneurs Summit on September 25, 2020 in Fuzhou, Fujian Province, China.

Lyu Ming | China News Service | Getty Images

China announced new anti-monopoly rules this weekend – but that won’t have much of an impact on the market for now, a market observer said.

“The new regulations are, you know, still somewhat vague in details,” Hao Hong, director and chief of research at Bank of Communications International, told CNBC’s “Street Signs Asia” Monday.

China’s state administration for market regulation (SAMR) has tightened restrictions on Chinese internet giants like Alibaba and Meituan, and on Sunday introduced new guidelines to curb monopolistic behavior. The new rules formalize a concept released months earlier.

Still, the development seemed to have little impact on shares of Chinese internet giants, with most of them still positive Monday afternoon in Hong Kong: Tencent rose 0.82%, Meituan jumped 1.54% and JD.com rose 1.14%. Alibaba alone went against the trend and declined by about 0.16%.

Monday’s market movements contrasted sharply with the volatility of November, when Hong Kong-listed stocks of China’s tech giants plummeted after the regulator’s initial announcement. Billions of dollars in market value were wiped out after the antitrust guidelines were first proposed.

Hong said the market needs time to digest the details of the latest anti-monopoly guidelines, adding that China’s internet giants have been in business for years and already have “very solid” market positions.

“The ordinance starts, you know, with a very good intention,” Hong said. “The fact is that … the market position … of these major internet platforms is currently difficult to achieve.”

While Hong acknowledged that the new rules will “make it easier for the smaller guys to grow,” he added that many major internet players, such as Alibaba and Tencent, have also “put their own money into many of the internet startups. “

Some well-known examples of such investments include Alibaba’s stake in financial technology giant Ant Group and Tencent’s backing of short video company Kuaishou, which saw widespread investor interest Friday during its $ 5 billion public listing in Hong Kong.

Beijing’s increased scrutiny comes at a time when the tech industry is coming under the global regulatory spotlight, with similar moves in both the US and the European Union.

– CNBC’s Evelyn Cheng contributed to this report.