ARK Investment, one of the fastest growing fund managers in 2020, just saw its flagship company enter a bear market, with a strong sell-off of growth stocks, technology-related stocks amid a sustained rise in interest rates.

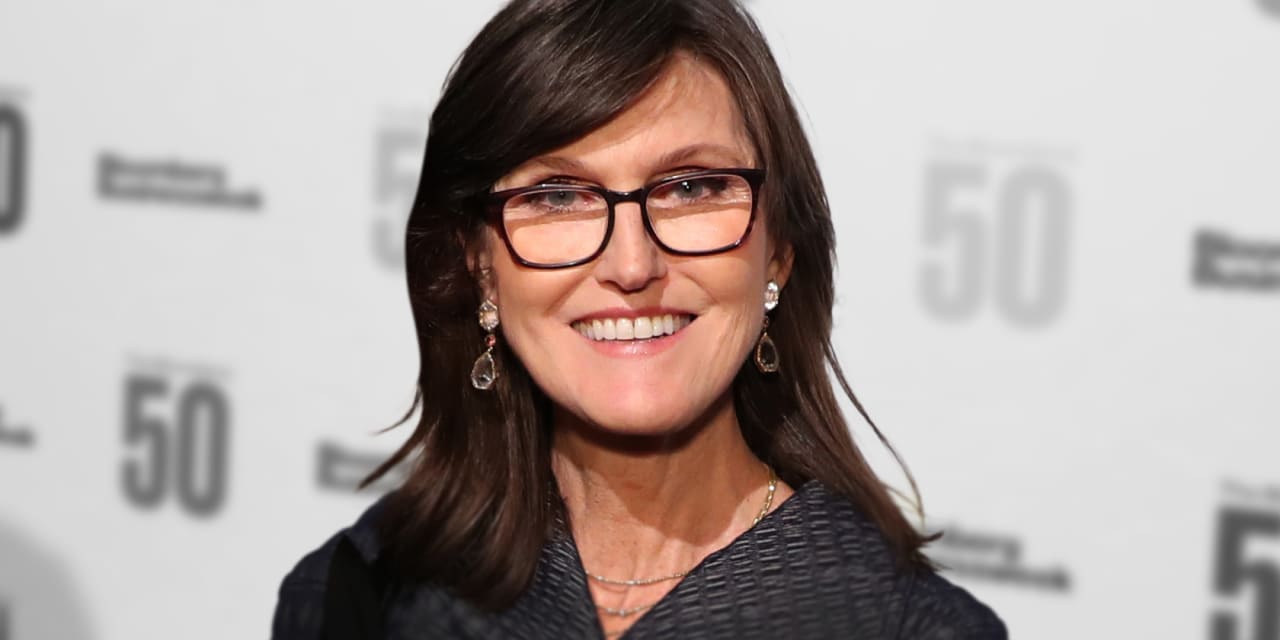

Led by the company’s CEO and founder, Cathie Wood, the exchange-traded fund ARK Innovation ARKK,

Wednesday fell 6.3%, bringing it down 20% from its peak of $ 156.58 on Feb. 12, meeting the definition of a bear market commonly used by market technicians.

The ARK Innovation ETF has assets of $ 24.6 billion, but its focus is on vibrant companies, including Tesla Inc. TSLA,

Square Inc. SQ,

TDOC from Teladoc Health Inc.,

Zillow Group Z,

and Roku Inc. YEAR,

have proved to be a blessing – and a curse lately – for the fund.

The decline for the fund comes as the Nasdaq Composite COMP,

tumbled 2.7% to record the worst two-day slip for the technology-laden index since Sept. 8, according to Dow Jones Market Data.

Investors shun technology in favor of so-called value stocks, which are considered undervalued, over growth stocks, which have records of or prospects for outgrowing peers.

An increase in the 10-year Treasury yield TMUBMUSD10Y,

up to about 1.47% on Wednesday has supported the rotation of tech and technology-related businesses into energy and financial services, which are expected to outperform as the economy recovers from the COVID-19 pandemic.

Tech names are more vulnerable to a downturn in a higher interest rate regime because those stocks usually offer no returns and operate in areas considered overvalued by some measures.

Wood is known for focusing on big name investments and disruptive innovations. In the past year, ARK has seen the assets of its seven exchange-traded funds explode more than tenfold.

But now investors are wondering how the high-flying fund manager will respond to higher yields and a shift to undervalued companies, as the rollout of vaccines and the expectation for COVID aid packages help drive bets to less favored sectors of the market.

Wood recently told CNBC that she is unaffected by the yields and anticipates a downturn, and promised to double some bets even if rates remain high, providing a “reality check” for her strategies. She has reportedly increased her stake in Zoom Video Communications ZM,

which has recently benefited from the trend of working from home.

See: Analysts say Zoom Video can continue to thrive in a vaccinated world

Reports also showed she had bought more Tesla when the electric vehicle manufacturer’s stock fell.

Shares of Ark Innovation are down 8.6% so far this week, with a gain of less than 1% since the start of the year. In comparison, the Dow Jones Industrial Average DJIA,

is up 2.2% so far in 2021, the S&P 500 index SPX,

is up 1.7% and the Nasdaq Composite Index COMP,

is up 0.8% after being hammered over the past few sessions.