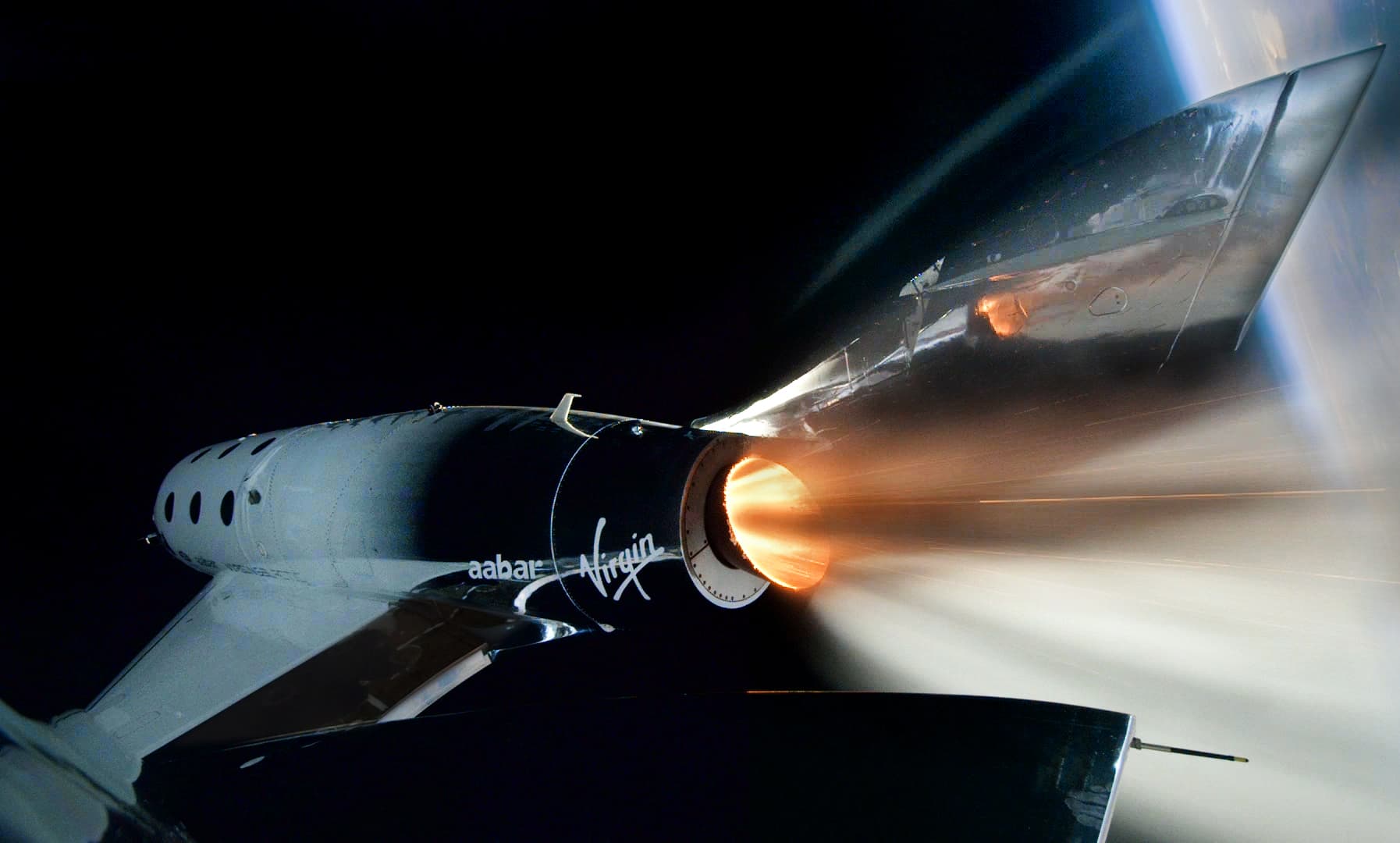

Virgin Galactic’s Unity spacecraft reaches space for the first time.

Source: Virgin Galactic

Ark Invest, which operates the largest actively managed exchange-traded fund, plans to add a “Space Exploration ETF” under the ticker ARKX, according to a securities filing on Wednesday.

While the members of the ETF have yet to be announced, shares of space companies Virgin Galactic and Maxar Technologies are each up more than 8% in out-of-hours trading.

Ark Invest comes off a hugely successful 2020, with its flagship ARK Innovation Fund returning over 170% last year and growing assets under management to $ 17 billion. The main stake of the fund is electric car manufacturer Tesla, which accounts for more than 10% of its weight.

Ark founder and CEO Cathie Wood told CNBC last month that investors should “be on the right side of change and stay on the right side of change as it has hit the escape speed in the wake of the coronavirus.” Wood, an old Tesla bull, has a $ 7,000 price target that the company must hit by the end of 2024.

The Space Exploration ETF would target companies that “lead, enable or benefit from technology-assisted products and / or services occurring beyond the Earth’s surface,” the filing said.

The space industry grew steadily in 2020, despite delays due to the COVID-19 pandemic, with investment rebounding after a short pause. Investor interest in aerospace companies has remained at a higher level, despite only a few listed companies.

But more space companies plan to enter public markets in the coming year, with both traditional IPOs and SPAC deals expected in 2021.

Ark divided the industry into four categories: orbital aerospace, sub-orbital aerospace, enabling technologies, and favored aerospace.

“Space exploration is possible due to the convergence of a number of themes, and a Space Exploration Company may not generate revenue at the moment, and there is no guarantee that such a company will generate revenue from innovative technologies in the future,” Ark said. .

Ark further explained the four categories of companies that will be in the Space Exploration ETF:

“Orbital Aerospace Companies are companies that launch, create, maintain, or operate platforms in orbital space, including satellites and launch vehicles. Suborbital Aerospace Companies are companies that launch, create, maintain, or operate platforms in suborbital space, including drones, air taxis, and electric Aircraft Enabling Technologies Companies are companies that create the technologies necessary for successful value-added aerospace operations, including artificial intelligence, robotics, 3D printing, materials and energy storage. Beneficiary aerospace companies are companies that benefit from air and space activities, including agriculture, internet access, Global Positioning System (GPS), construction and imaging. “

– CNBC’s Maggie Fitzgerald contributed to this report.

Subscribe to CNBC PRO for exclusive insights and analysis, and live programming of working days from around the world.