Bond yields have risen sharply. That should, in theory, make stocks less attractive based on relative valuation conditions.

Still, the stock market rally has hardly gone off track, as the return on the 10-year treasury TMUBMUSD10Y,

reached 1.20% on Monday, an extension of this year’s lead of nearly a quarter point. US Equity Futures ES00,

pointed to an optimistic start on Monday and European equities rallied. The S&P 500 SPX,

climbed nearly 5% last week when it hit its seventh new year’s high.

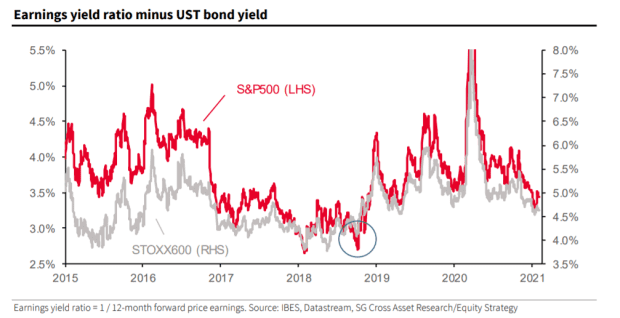

Société Générale strategists led by Roland Kaloyan scrutinized stocks in light of the 10-year Treasury at an 11-month high. They looked at earnings yields – basically price-earnings expectations turned upside down – and compared them to bond yields.

As the chart shows, the gap between earnings and bond yields is not as narrow as it was at the end of 2018, when stocks swayed. The current spread suggests that equities could absorb government bond yields above 1.5%, the strategists said. And assuming earnings continue to move in line with analyst expectations, the US and European stock markets could absorb an additional 135 basis points of tightening by the end of the year, the strategists said.

Analysts expect earnings from the S&P 500 to grow 24% this year and 16% next year, and for Stoxx Europe 600 SXXP,

business revenues will grow by 41% this year and by 16% next year. “We remain constructive in the equity markets, but American and / or European companies are not making that earnings per share [earnings per share] growth expectations are likely to pose greater risk to the (respective) stock indices today than rising bond yields, ”the strategists said.