Bitcoin’s rise to unprecedented levels above $ 23,000 on Thursday is met with a lot of ballyhoo on Wall Street, but at least one tech expert is warning that the popular digital currency could be poised for a downturn.

Tom DeMark says based on his timing models, the world’s most prominent cryptocurrency is likely to withdraw soon.

Read: The ‘confident’ S&P 500, expert on stock timing, is up 5% in the next 2 weeks

“While it may seem insidious to take such a stance, this is what our combined timing models are currently suggesting about Bitcoin,” he said, pointing to what he described as “pending uptrend depletion,” he said Thursday or. Friday could take place. , initiating a downward movement for the budding asset.

“The previous instances where this long-term model has spoken include the precise high of December 18, 2017, the precise low day of December 14, 2018, and then the precise high day of June 26, 2019,” DeMark wrote.

He said that any warning about bitcoin’s BTCUSD,

cuts was the precise high or low day.

DeMark is a technical analyst who applies market timing measures to determine when to buy and sell assets.

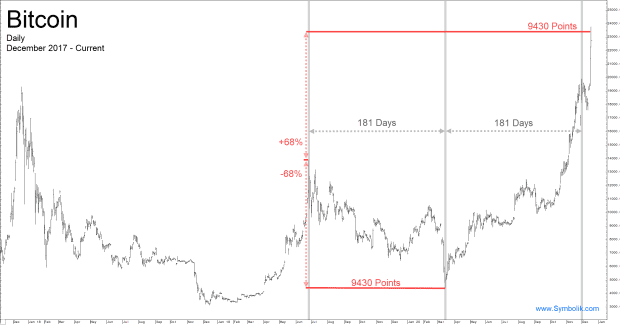

The prominent analysts say bitcoin’s drop from June 26, 2019 to a low of March 16 was 9,430 points, adding that “if someone were to add 9,430 points to the high of June 26, 2019, it projects up to 23,288. what the zone is in which the current market is traded. “

Symbolik.com

“Clearly, there is no certainty in the forecasting industry and it is often wise to wait for confirmation of a trend’s completion rather than making a bold prediction,” he said. “Nevertheless, waiting for a closure less than the closure 4 or 5 days earlier and the next day would follow disadvantage, sacrificing the chance.”

DeMark used a mapping service called Symbolik, founded by his son TJ DeMark, which promises to provide institutional-grade cloud-based analytic tools to make its bitcoin call.

DeMark said bitcoin could decline anywhere from about 5.5% to 11%, but the decline could also be steeper. He also acknowledges that the asset could perpetuate its gains and ignore the signal of exhaustion if investors continue to pile on the asset.

Also see: As bitcoin breaks new records, these market viewers see $ 250,000 and even $ 400,000 on the horizon