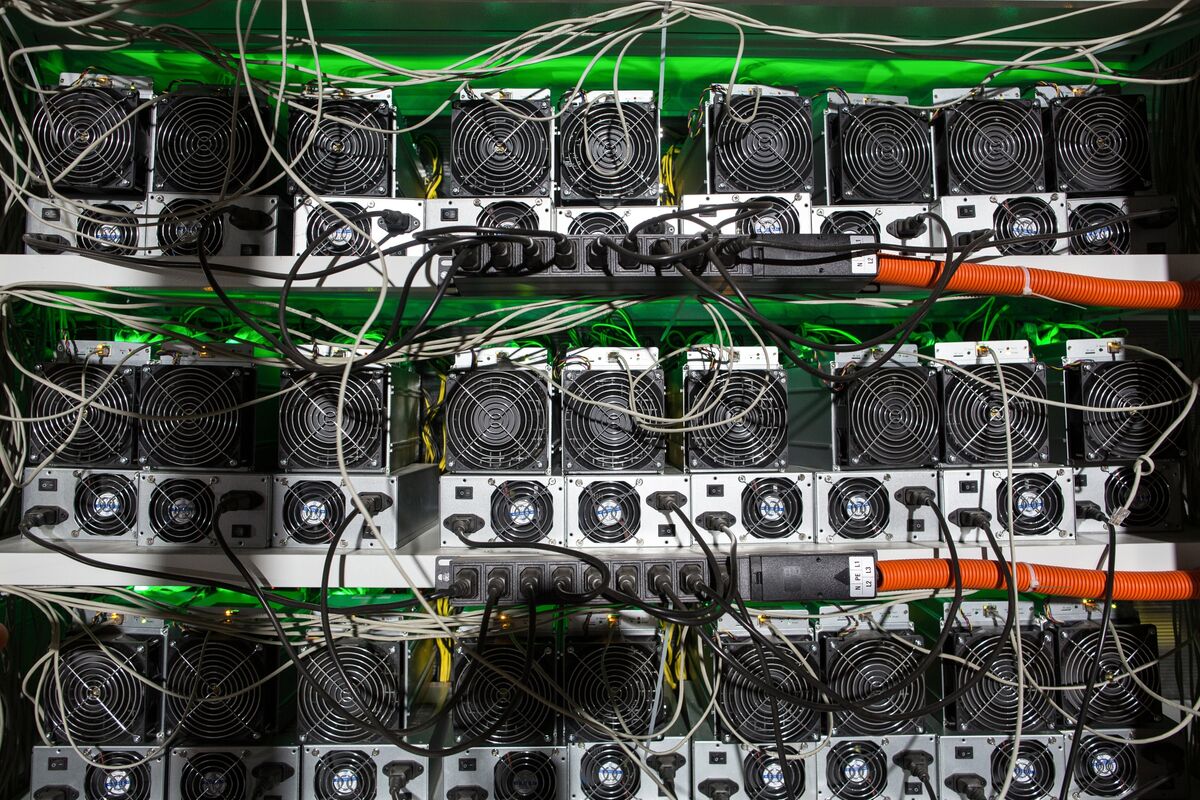

Hardware for cryptocurrency mining.

Photographer: Andrey Rudakov / Bloomberg

Photographer: Andrey Rudakov / Bloomberg

Bitcoin, the world’s largest cryptocurrency, first hit $ 30,000 just weeks after passing another major milestone.

The currency gained nearly 9% on Saturday to pass $ 31,800, before falling slightly below that price. It was up nearly 50% in December, when it first crossed $ 20,000.

The latest acquisitions top one dazzling rally for the controversial digital asset in 2020, which rebounded strongly after a severe crash in March that lost 25% in the coronavirus pandemic.

The currency “is likely to be on the way to $ 50,000 in the first quarter of 2021,” said Antoni Trenchev, managing partner and co-founder of Nexo in London, which bills itself as the world’s largest crypto provider. Institutional investors returning to their desks this week are likely to push prices up further after retail purchases over the holiday season, he said.

Bitcoin is increasingly being “embraced in more global investment portfolios as holders go beyond techies and speculators,” Bloomberg Intelligence commodity strategist Mike McGlone wrote in a note last month. Proponents of the currency have also seized the story that the currency could serve as a storehouse for wealth amid allegedly rampant central bank money, even if inflation remains largely low.

Bitcoin should eventually rise to about $ 400,000, Scott Minerd, Guggenheim Investments chief investment officer, told Bloomberg Television on Dec. 16. interview.

Still, there are reasons to be cautious, in part because Bitcoin remains a sparsely traded market. The currency fell a whopping 14% on Nov. 26 amid warnings that the asset class was overdue with a correction. The big price hike in 2017 was followed by an 83% route that took a year.

Read more: Does Bitcoin Boom Mean ‘Better Gold’ or a Bigger Bubble? QuickTake

(Updates prices in second paragraph, comments in fourth and fifth paragraphs, and context in eighth paragraph)