Wall Street and Silicon Valley put billions of dollars into electric vehicles and related businesses by 2020, betting on their future dominance and, in many cases, fueling valuations that have little relation to the companies’ current or anticipated production and sales.

There is little doubt that the auto industry is leaning towards electric vehicles amid the rise of Tesla Inc. TSLA,

Falling prices and increasing availability of electric vehicles or EVs; the potential for technological breakthroughs that offer a cheaper, more durable and faster rechargeable battery; advances in EV infrastructure and “green-friendly” government initiatives taking root in the US and elsewhere show the likely way.

And what was once an investment universe made up solely of Tesla and a few fuel cell companies has grown into a subsector combining industry, technology and transportation, with China as a major driving force both as a base market for EV manufacturers and EV demand. . According to data from CB Insights and Dow Jones Market Data Group, a total of at least $ 28 billion in total was invested in public and private electric vehicle companies.

Don’t Miss: The Explosion of Electric Vehicle Financing, Valuation, and Trading in One Graph

“The writing is on the wall regarding the long-term EV versus internal combustion debate,” said John Mitchell, a partner at Blue Horizon Capital.

In several countries around the world, people will no longer be able to buy combustion engine vehicles within a few decades, and global automakers have realized that “the transition to electric vehicles is the only way to compete,” he said. .

Not to be outdone, General Motors Co. GM,

Ford Motor Co. F,

and other longtime automakers increased their investments in electric vehicles and autonomous vehicles, with GM even pledging to phase out combustion engine vehicles in less than 15 years. Tesla of course joined the S&P 500 index SPX,

in 2020 after finally showing a consistent profit. SPX,

New companies such as Nio Inc. NIO,

Nikola Corp. NKLA,

and Fisker Inc. FSR,

caught the attention of major investors and the involvement of specialty acquisition companies became almost commonplace.

“The EV party has just begun, buckle your seat belts,” Wedbush analyst Dan Ives said recently. Recent weaknesses are short-term “growing pains”, he said.

This does not mean that the switch from combustion engines to electric cars will take place quickly. Electric cars currently make up about 2% of global car sales, and estimates for future market share range from a low forecast of 10% to 20% of cars sold by 2030 to as much as two-thirds of the market by then. time.

Much more money will be needed to finance the switch, despite the billions that have already gone into EV-related investments. A recent note from B. of A. Securities placed a price tag on a future EV “revolution”, stating that funding that change is still a “huge hurdle”.

Considering the relationship between Tesla’s capital increase and its vehicle-making capacity, the B. of A. analysts calculated that a shift to a 100% EV world would require more than $ 2.5 trillion in investment coming from the companies, investors and governments around the world. the world.

Recent capital increases by EV and related companies through the SPACs, or “blank checks” companies, “may be just the beginning,” they said.

‘Hypergrowth’ in EV and renewables

The increased interest in electric vehicles and related stocks has raised concerns about a bubble.

At a recent JPMorgan virtual investor conference, Global Research chief Joyce Chang and others told the audience that they did not see a “broad bubble in the stock market,” but that “certain areas” of the market were “experiencing hyper-growth, such as electric vehicles and renewables.”

Bubbles are, of course, easy to spot – in retrospect. It remains to be seen whether the current influx of money and attention to EV companies, as well as to autonomous vehicles and AV adjacent companies, will resemble the momentary notice given to cloud computing companies half a decade ago, or the early Aughts’ spotlight on fuel cell companies, some of which – twenty years later – have still not returned to record highs.

The Tesla bubble: Betting on electric cars and the rise of SPACs have led to a new version of the dot-com boom, writes columnist Therese Poletti

JPMorgan’s analysts reminded the public that EV, renewables and “innovation stocks” make up a small percentage of the broader stock market, with EVs only about 2% of the S&P 500.

But good for the future, Mitchell of Blue Horizon pointed out the increasing quality and technical improvements for EVs.

“Battery life will only be extended and with the trillions invested worldwide by anyone supporting the electrification of the transportation system, the infrastructure for widespread adoption and use of EV technology will only grow,” he said.

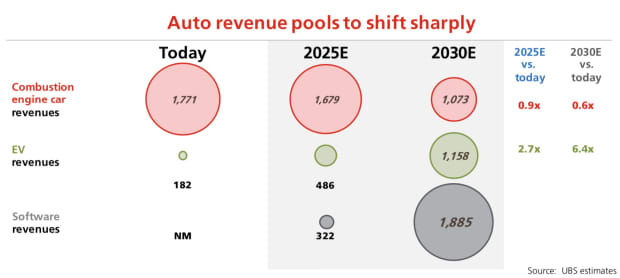

UBS analysts predict that global automakers’ revenues from electric vehicles will shift to $ 1.16 trillion by the year 2030 from $ 182 billion today.

Conversely, revenue from ICE vehicles, which today stands at $ 1.77 trillion, will decrease to $ 1.07 trillion. Revenue for software will make up an even bigger part of that revenue circle by 2030, at nearly $ 2 trillion.

Here’s the UBS chart, in billions:

A company or a business plan?

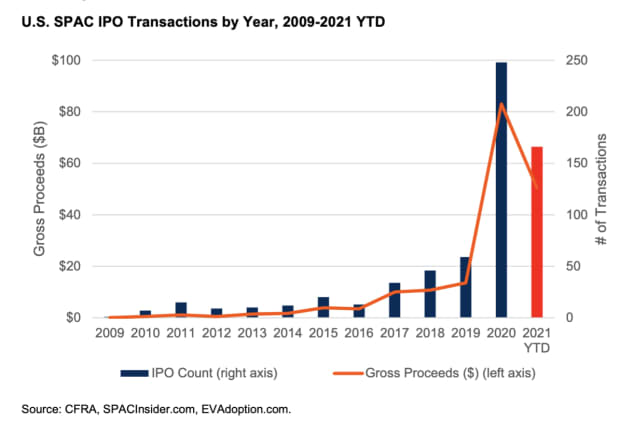

Blank check companies have been around for a long time, but played a bigger role in U.S. investments last year, when there were more IPOs through special purpose acquisition companies than all other years combined, CFRA’s Garrett Nelson said in a recent note.

Activity in 2021 is on track to exceed last year’s “by a wide margin”, and some of the biggest SPAC deals are likely to happen again in the “fast-growing electric and autonomous vehicle (EV / AV) space”, he said.

Some of the companies that come in “look more like business plans than revenue or profit-generating companies,” but there is reason for optimism, Nelson said.

The CFRA analyst named Fisker, Lucid Motors, which plans to go public through an SPAC merger with Churchill Capital Corp. IV CCIV,

and the private electric truck manufacturer Rivian as companies better positioned than others.

Tesla has of course achieved a first-mover advantage that is widely considered substantial.

The UBS analysts calculate that Tesla has a cost advantage of about $ 1,000 to $ 2,000 per electric car over other automakers, although competition is increasing. The vow of Volkswagen AG,

The CBG platform, the carmaker’s building block for its electric vehicles, is already “fully cost competitive” with Tesla.

VW, the No. 2 automaker in the world, is still lagging behind in battery costs, with Tesla likely to maintain its price advantage in the battery space due to its vertical integration and technological advancements, they said. Still, they see that major car manufacturers like VW could achieve parity for the manufacturing cost and margin of electric cars in four years.

EVs, not AVs, could be the real game changer

Related to the influx of investors from electric vehicle manufacturers is the interest generated by lidar, batteries, sensors and other components hailed as the key to autonomous vehicles.

Full autonomy has been proven to be a persistent and costly problem to solve, with sufficient regulatory and technological hurdles.

Despite lofty goals, most cars on the road today offer advanced driver assistance systems that are not dramatically different from the systems of previous years and are far from being the game-changer they are expected to be for lives and economies in a not-so-so-so far future.

For now, carmakers are focusing mainly on partial autonomy and ADAS offerings that can be commercialized in the short term, with EVs moving forward in terms of consumer interests and regulatory pressure.

“EVs are just a better product,” said Blue Horizon’s Mitchell.