(This is the third in a three-part series of top-rated stocks that sell-side analysts expect to see the most in the next 12 months. Part 1 deals with large-cap stocks and Part 2 deals with small-caps.)

Mid-cap stocks tend to fall through the cracks in the media spotlight. The idea of a midsize company seems less exciting than a small newcomer or tech giant.

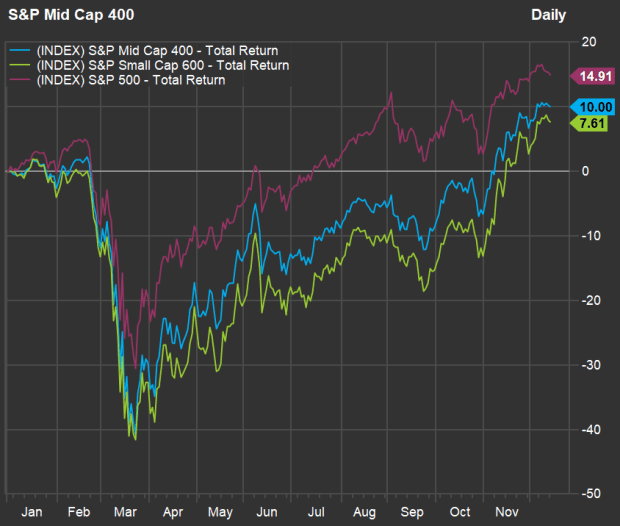

On the other hand, midcaps have performed well this year. Below is a list of 20 stocks from the S&P 400 Mid Cap Index that analysts expect to rise the most in the next 12 months.

Michael Brush interviewed Jim Paulsen, market strategist and economist at the Leuthold Group, and they identified several reasons why small and mid cap stocks are expected to outperform large caps.

This is how the S&P 400 Mid Cap Index MID,

has performed this year, compared to the S&P Small Cap 600 Index SML,

and the large-cap S&P 500 SPX,

:

(FactSet)

The mid-cap and small-cap groups were hit much harder than the S&P 500 during the first COVID-19 lockdowns in March. All three indexes recovered, with the midcaps in the middle of the pack.

In a bull market where many big tech-oriented companies continue to grow double-digit sales, it is no surprise that the large cap index is the best performer. A major reason for this is that the S&P indices are weighted by market capitalization. The five largest companies in the S&P 500 make up 22.7% of the index. In comparison, the five largest companies in the S&P 400 Mid Cap Index have a weighting of 9.4%.

Of course, when you look at individual stocks, it doesn’t matter what the trends of the capitalization-weighted indices are. MarketWatch’s Jeff Reeves recently argued that some mid-cap companies are in a good position – large enough to have established businesses, but small enough to take advantage of changing market conditions. He selected five mid-cap stocks.

Analysts’ favorite mid-cap stocks

Here are the 20 stocks included in the S&P 400 Mid Cap Index with at least 75% ‘buy’ ratings with the most upside potential for the next 12 months, implied by analysts’ consensus price targets:

Analysts expect shares of Ligand Pharmaceuticals LGND,

to nearly double in the coming year. The company’s stock is down 11% in 2020, although analysts polled by FactSet expect full-year sales to rise 43% to $ 170 million in 2020 based on Captisol, a drug it uses in combination with remdesivir (developed by Gilead Sciences Inc. GILD,

) to treat patients with COVID-19. The analysts expect Ligand’s revenue to rise an additional 69% to $ 289 million in 2021, followed by a decline to $ 218 million in 2022.

The best performer on this year’s list was Emergent BioSolutions EBS,

with a total return of 55% up to and including December 11. During the third quarter, the company initiated Phase 3 trials of hyperimmune globulin drugs that could potentially be used for great COVID-19 patients. Analysts expect Emergent’s revenue to grow 38% for 2020, followed by a 23% increase in 2021 and a 20% decline in 2022.

Here are revenue growth estimates for the entire group for calendar years through 2022:

Taylor Morrison Home Corp. TMHC,

is expected to increase sales by 24% in 2020, followed by a 22% increase in 2021 and 7% in 2022. Another home builder is expected to benefit from increased home sales due to relocation away from major cities and low interest rates. including TRI Pointe Group TPH,

Analysts expect sales to rise 16% in 2021, followed by a 3% sales decline in 2022.

Shares of Tree TREE lending,

loan products and other financial services are down 10% this year and revenues for 2020 are expected to decline 19% due to a decline in demand for consumer loans, including student loans. Revenue is expected to increase by 20% in 2021 and increase by 17% in 2022.

Do not miss: 25 bank stocks with a dividend yield of at least 3.5% that pass two major tests