After Advanced Micro Devices Inc. benefited from Intel Corp.’s missteps in 2020, billions of dollars depend on the company continuing down that path as its bigger rival tries to repair itself.

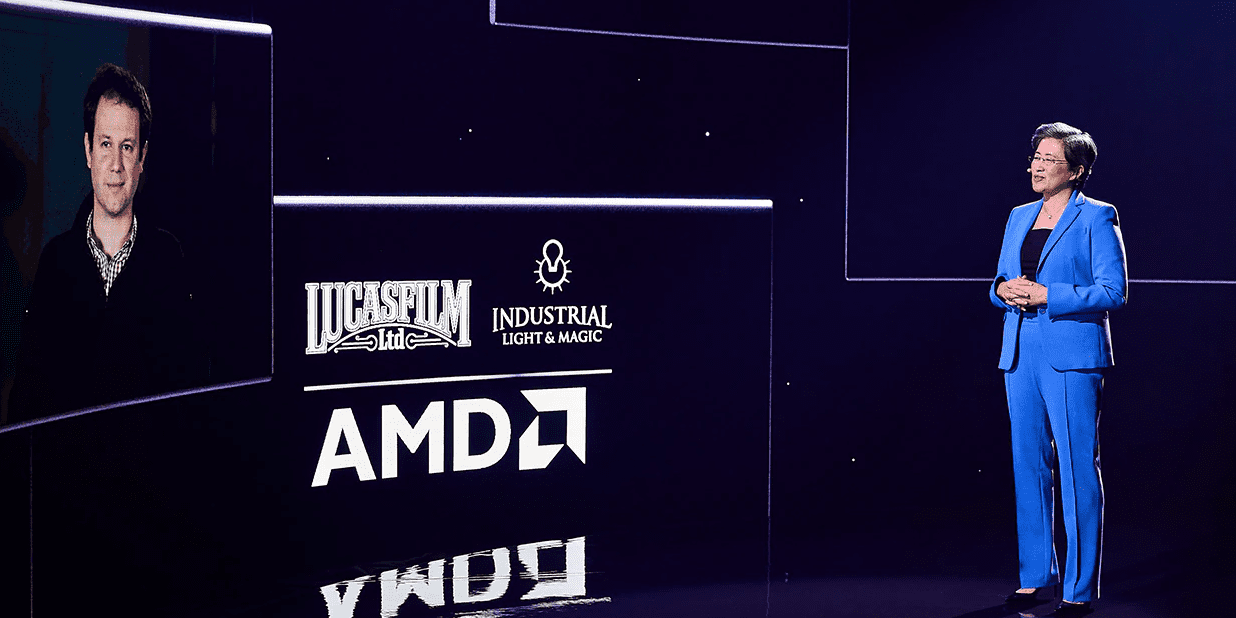

Gelsinger’s arrival is seen as a much-needed infusion of talent to better counter the likes of AMD CEO Lisa Su, who over the past six years has turned the Santa Clara, California-based chipmaker into a formidable rival to Intel after years. to be a sad stepsister from Silicon Valley. AMD drove over Intel in July, when Intel said it should delay its next-generation 7-nanometer chips until 2023 due to manufacturing issues, the same chip architecture that AMD first launched in late 2019.

In the past 12 months alone, AMD stocks are up nearly 80%, while Intel stocks are down nearly 10%, compared to a 60% rise in the PHLX Semiconductor Index SOX,

AMD stock doubled in 2020, after being the largest gain on the S&P 500 index in both 2018 and 2019, pushing AMD’s market cap above $ 100 billion.

Also: AMD buys Xilinx in stock for $ 35 billion

BMO Capital Markets analyst Ambrish Srivastava, who recently downgraded AMD to underperform and lowered its price target to $ 75, said he expects the changing of the guard at Intel to weigh on AMD’s stock price.

“We think a lot of the rich appreciation is also due to how poorly Intel has performed,” said Srivastava. “Which in turn has opened a ‘blue sky’ scenario for how much share AMD could gain versus Intel, driving the valuation even higher.”

What to Expect

Merits: Of the 34 analysts polled by FactSet, AMD is expected to post adjusted earnings of 47 cents a share, up from 39 cents a share expected at the start of the quarter and 32 cents a share reported in the same period a year ago . Estimize, a software platform that crowdsource estimates from hedge fund managers, brokers, buy-side analysts and others, asks for a profit of 50 cents a share.

Revenue: In November, AMD predicted fourth-quarter sales of $ 2.9 billion to $ 3.1 billion, while analysts at the time had forecast average sales of $ 2.6 billion. Now, 30 analysts expect revenues of $ 3.02 billion on average, up from the $ 2.13 billion reported in the same quarter a year ago. Estimize expects sales of $ 3.08 billion.

Stock movement: In the fourth quarter, AMD shares were up 12%. In comparison, the SOX index rose 25%, the S&P 500 index SPX,

12% won, and the technically tough Nasdaq Composite Index COMP,

rose 15%.

What analysts say

Cowen analyst Matthew Ramsay, who has an outperform rating, said he expects AMD’s earnings and product roadmaps to be less volatile compared to Intel’s in the coming year.

“Over the next 2+ years, we see little change in competitiveness or fundamentals from an AMD perspective,” said Ramsay. “Road maps are ready.”

“While the renewed focus and clarity around Intel’s internal priorities and roadmaps may generate some customer loyalty and slow its share loss somewhat in the meantime, the earliest products would likely be large-scale by 2023 if Intel succeeded in restoring its 7nm roadmap,” Cowen’s analyst.

B of A Securities analyst Vivek Arya, who has a buy review on AMD, said that while the company announced new lines of gaming laptops and ‘Milan’ data center chips at CES earlier this month, there were omissions. Arya said investors were concerned about the “lack of detail on Milan without revealing new server customers” and “focus on gaming, not commercial notebooks where AMD is most challenged.” Also at CES, rival Nvidia Corp. NVDA,

announced a new line of gaming laptops.

Benchmark analyst Ruben Roy, who has a hold rating, said he expects the wind to improve both of AMD’s business segments.

“We are updating our revenue and earnings per share estimates for 2021 to reflect modestly higher sales in the Computing and Graphics Segment, given the continued strength in the PC market and higher semi-adjusted revenues given the sustained strength from recent game console launches, ”said Roy.

Analysts expect an average of $ 1.77 billion in computing and graphics revenue from AMD, and $ 1.23 billion in enterprise, embedded and semi-custom sales, the segment that includes data center and game console chips.

Of the 35 analysts covering AMD, 20 have a buy or overweight rating, 12 a hold rating and three a sell rating, with an average price target of $ 95.30.