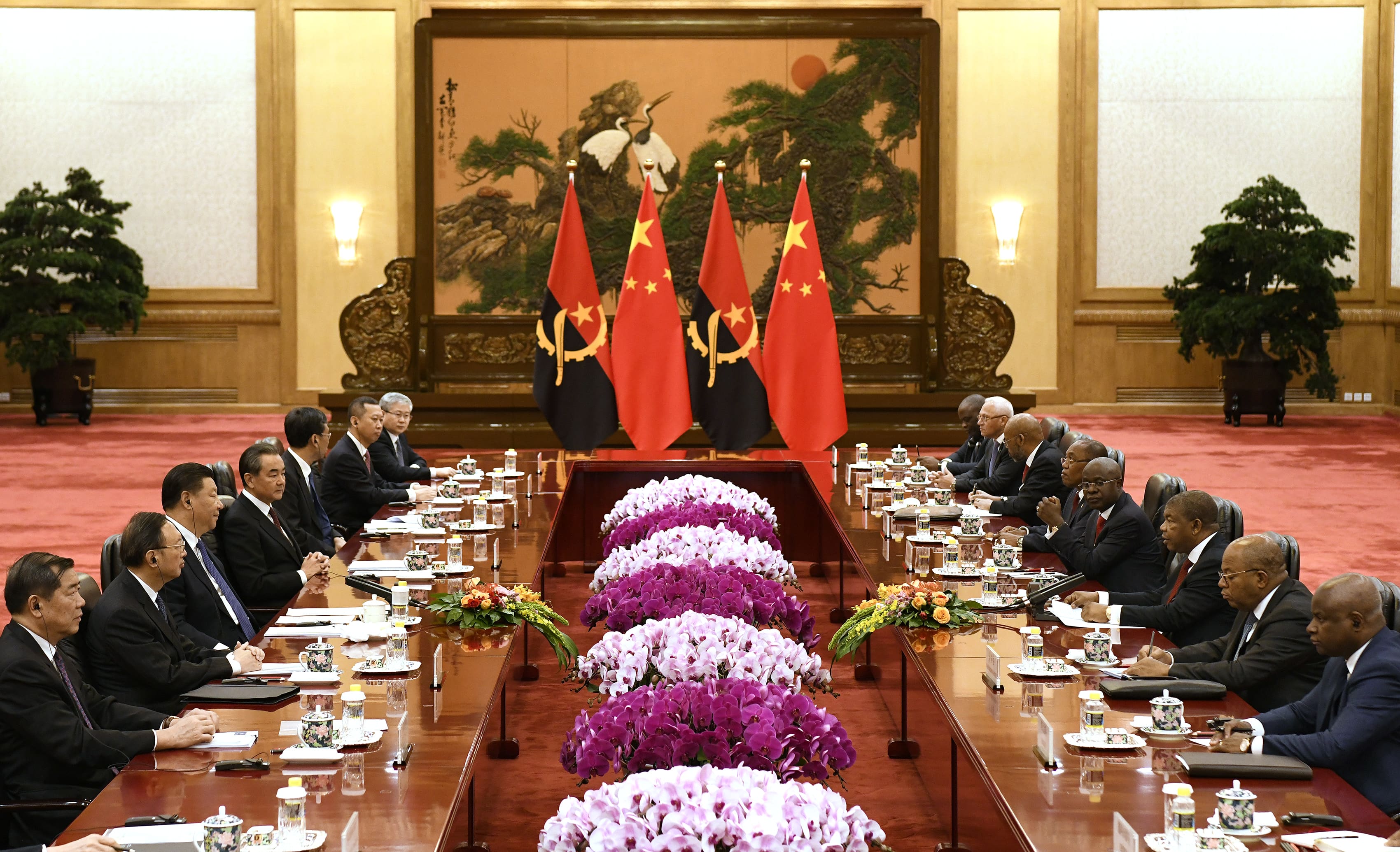

Chinese President Xi Jinping, third from left, will meet Angolan President Joao Lourenco, third from right, in the Great Hall of the People in Beijing, China on Tuesday, October 9, 2018.

Daisuke Suzuki / Getty Images

After Zambia became the first coronavirus-era indebtedness on the African continent, analysts are wondering if countries that rely heavily on Chinese loan financing would be prone to debt problems.

The Covid-19 pandemic has created problems for many sub-Saharan African countries that have borrowed substantial money from China in recent years to finance major infrastructure projects, putting pressure on a slowdown in the continent’s economic growth and declining commodity prices exacerbated.

Zambia became the first country on the continent to formally default on its debt in November 2020 by forgoing a $ 42.5 million repayment.

As Africa’s second largest copper producer, the falling copper price in recent years has made the $ 11 billion debt stack increasingly difficult to manage, but Eurobond investors also raised concerns about the transparency of Chinese loan payments.

What we learned from Zambia

“The popularity of Chinese creditors has created a more diverse creditor base than the Paris Club’s historic, mainly bilateral lenders, complicating the resolution of repayment disputes,” Verisk Maplecroft Research Associate Aleix Montana said in a recent report.

Montana said the Zambia case indicates that in addition to the size of the debt, the composition of creditors also plays a role in determining debt risk. Concerns about transparency are making Western bondholders more likely to reject potential debt relief packages in countries borrowing from China, fearing that debt relief will be used to repay Chinese loans.

Resource-backed loans are often attractive to countries with rich natural resources, a need to finance infrastructure projects and limited access to capital markets. In some of China’s financing schemes, raw materials are used as repayment or collateral, Montana points out. Loans are often based on future production of resources such as cocoa, tobacco, oil or copper.

A man wearing a face mask selects clothing at a market in Lusaka, Zambia’s capital, on August 18, 2020. The confirmed COVID-19 cases in Zambia have continued to rise, with a total number close to 10,000.

Xinhua / Martin Mbangweta via Getty Images

“Repayment arrangements based on the future value rather than the quantity of a commodity are particularly risky for the borrower, as a fall in world commodity prices would require an artificial increase in production to cover the debt obligations,” said Montana. .

Zambia has now filed for debt treatment under the common framework of the G-20 (Group of Twenty), which aims to provide poorer countries with a transparent level playing field to restructure or reduce unsustainable debt obligations.

“Zambia is committed to transparency and equal treatment of all creditors in the restructuring process, and our application to benefit from the G20 common framework will hopefully reassure all creditors of our commitment to such treatment,” said Finance Minister Bwalya Ng ‘andu in a recent statement.

Oil producers and “resource-backed” loans

Montana expressed concern about the high debt levels in oil-exporting countries such as Angola and the Republic of the Congo, both of which have seen their national currencies devalue in recent years due to the broad drop in oil prices.

This makes foreign currency repayments relatively more expensive, while the use of reserve-based loans also increases the risk of debt problems, says Montana.

The UN Economic Commission for Africa (UNECA) has also stressed that both Angola and the Republic of Congo are at particular risk.

“Besides being two of the countries with the highest risk of sovereign debt and economic growth in our indices, they are two of the countries that have borrowed more heavily from China,” said Montana.

The combination of the external economic downturn, persistently high debt levels and a significant portion of backed loans make Angola particularly vulnerable, he said.

“The case of Angola is of particular concern, as it is estimated that about 75% of total Chinese debt is financed in this way, often backed by oil exports,” he said.

“Angola is the country with the highest amount of Chinese loans, spread over 100 projects to finance oil and energy companies in state-owned companies.”

Montana suggested that businesses and investors in Angola can expect credit ratings to deteriorate further, suggesting that a sufficient oil price recovery may not come soon enough for the country to meet its debt restructuring commitments in 2021.

LUANDA, Angola – After Angola’s bloody civil war ended in 2002, the country experienced a decade of rapid growth fueled by the booming oil sector. But in 2014, a global drop in the price of crude oil, which accounts for 70 percent of government revenues, and the failure of the authorities to diversify the economy, left Angola in a serious financial crisis.

RODGER BOSCH / AFP via Getty Images

Other highly indebted countries, such as Ghana and Mauritania, are less exposed to Chinese debt, Montana notes, while Ethiopia, Cameroon, Kenya and Uganda have borrowed more from China but have a lower risk of default.

However, Pangea-Risk CEO Robert Besseling told CNBC that some of the steps Angola has taken since the pandemic began should address debt concerns.

Angola has joined the G-20 DSSI (Debt Suspension Initiative), which granted a temporary suspension of repayments to bilateral creditors in the aftermath of the pandemic. It has also restructured a significant portion of China’s debt and is still “on the IMF’s good books for now,” Besseling said.

Angolan Finance Minister Vera Daves de Sousa told a Reuters conference in January that Africa’s second largest oil producer will seek to take advantage of the “three years of breathing room” provided by the debt relief program from the more than $ 20 billion in China. loan obligations. . CNBC has reached out to the government of Angola for comment.

“I would rate Angola as being exposed to a long-term threat of economic downturn due to over-reliance on its faltering oil sector, but with a reduced risk of medium-term sovereign debt due to government debt relief and loan restructuring. , “in addition to continued multilateral support. “