The chatter of a receding tantrum has subsided, following the big move at the beginning of the year in the 10-year treasury.

But the factors that led to that short sell-off in Treasurys are still there. Chief among these are the introduction of COVID-19 vaccines, as well as the massive fiscal stimulus already implemented with more in the pipeline, pent-up purchasing power in household savings, and easy monetary policy.

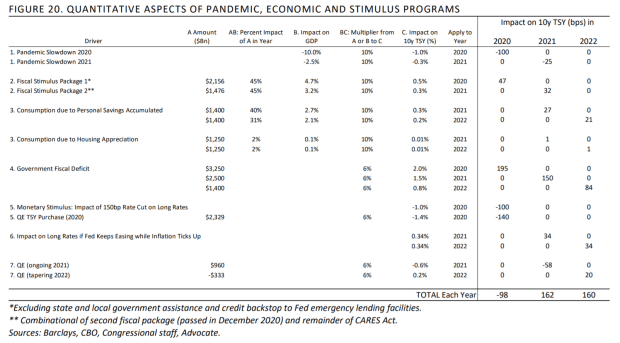

Scott Peng, founder and chief investment officer of New York investment manager Advocate Capital Management, says a perfect storm is breaking. His model estimates the yield on 10-year treasury bills TMUBMUSD10Y,

this year by 162 basis points and next year by another 160 basis points – well ahead of market estimates of about 17 basis points of gains in each of the next two years. The 10-year-old yielded 1.12% in the early Wednesday action.

Peng, formerly Citi’s chief interest rate strategist and one of the first to notice price anomalies in Libor, says his model doesn’t even include an additional tax incentive from the Biden government, which has proposed a $ 1.9 trillion coronavirus plan. as well as additional expenditure on infrastructure.

Central to his view of an interest rate rise is the historical correlation between nominal gross domestic product growth and both short and long-term interest rates in the US, UK, Germany and Japan. Long-term regression has reflected a 50% ratio between GDP growth and Treasury yield since 1960, although more recent history suggests the ratio may have fallen to 27%.

Even that lower level of correlation would suggest that the introduction of the vaccine, pent-up purchasing power, the rise in government debt and the monetary stimulus would increase yields.

Wouldn’t such a rise in rates ring alarm bells at the Federal Reserve? Peng calculates that the Fed would need to quadruple the size of its quantitative easing to offset the expected rate hike in 2021. “A QE rate of $ 300 billion per month would surpass 2020 QE and is unlikely to be sustainable for a longer period of time, especially if the economy is recovering well,” he says.

Peng didn’t extend his analysis to stocks, but the implications would be clear. A spike in interest rates would make relative valuations much more unattractive – although it could create conditions for value stocks to thrive after a decade of underperformance.

The buzz

GameStop GME,

Shares were up 2% in premarket trading, after dropping 60% to $ 90 on Tuesday. The brief push caused by users of the Reddit WallStreetBets forum had pushed the stock to $ 483 last week. Cinema operator AMC Entertainment AMC,

which plummeted 41% on Tuesday, also rose 2%.

Online retail giant Amazon AMZN,

reported earnings and revenue forecasts for the fourth quarter, in addition to news that Jeff Bezos will step down as CEO later this year to become executive chairman, with an emphasis on new products and early initiatives. Andy Jassy, the head of its fast-growing cloud division, will take over as CEO of the entire company.

Alphabet GOOGL,

GOOG,

jumped 7% in premarket trading as Google’s parent company easily exceeded fourth-quarter earnings expectations and boosted both search revenue and high-growth cloud business.

There is a whole range of income on deck, including PayPal PYPL payment service,

and online auction service eBay EBAY,

after the close of trade.

In the field of coronavirus, pharmaceutical GlaxoSmithKline GSK,

will pay up to € 150 million to CureVac CVAC,

to develop next-generation vaccines targeting multiple variants. Glaxo will also help produce up to 100 million doses of CureVac’s first-generation vaccine, a boost for Europe, which has been slow with the introduction of vaccines. Separately, preliminary investigation finds the AstraZeneca AZN,

– Oxford University vaccine provides protection for up to three months before the second dose is administered. According to the COVID-19 tracking project, new cases of coronavirus in the US have fallen to 115,619 on Tuesday, from a peak of 243,996 in mid-January.

The economic calendar includes the ADP estimate of private sector payroll and the Institute for Supply Management’s services index. A measure of the Chinese services sector came out below the estimates.

The markets

The Nasdaq-100 NQ00,

contract led to an advance in equity futures ES00,

after the results of Amazon and Alphabet. The dollar DXY,

was stable.

Italian Stocks I945,

Expectations had risen when Mario Draghi, the former president of the European Central Bank, becomes the country’s next prime minister.

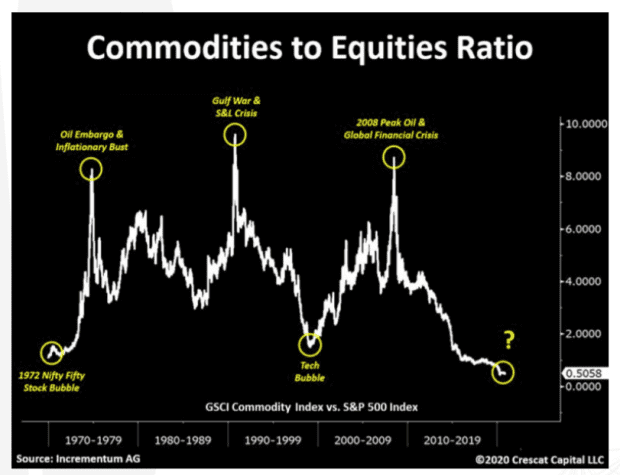

The graph

In a letter to investors, hedge fund company Crescat Capital said the way is set for a massive shift of investors from overvalued megacap growth funds and fixed income to undervalued materials, energy and other commodities. It said if it could focus on just one chart for the next three to five years, it would be the commodity to stock ratio. “The ability to buy gold stocks and sell overvalued large-cap growth stocks resembles 1972. In just two years in 1973-74, the S&P 500 SPX,

fell 50%, while the gold supply increased fivefold, ”he said.

Random reads

Speaking of Reddit posts – a study shows that language use on the platform can predict future breakups.

Sounds like the start of a script for a new Indiana Jones movie – mummies with golden tongues found in Egypt.

Need to Know starts early and will update until the opening bell, but sign up here to get it in your email box once. The emailed version will ship at approximately 7:30 a.m. East.

Do you want more for the day ahead? Sign up for The Barron’s Daily, a morning investor briefing that includes exclusive commentary from Barron’s and MarketWatch writers.