Cryptocurrency Exchange Coinbase Global Inc. (NYSE: COIN) got off to a strong start on Wall Street after a direct listing of its shares last week.

The Coinbase Analyst: Rosenblatt Securities analyst Sean Horgan started Coinbase’s coverage with a Buy rating and a price target of $ 450.

Coinbase’s thesis: Rosenblatt is optimistic about the long term for Coinbase as it will benefit from the growing adoption and adoption of cryptocurrency, Horgan said. The company’s short-term view is cautious as its stocks face downside risk from a fall in crypto’s price, he added.

Long-term sustainable growth is less uncertain, given the upside risk of institutional adoption and subscription growth, the analyst said.

Related link: Why Square, PayPal are the best choices in the fintech space over profit

Horgan cited the following as reasons for owning Coinbase stock:

• Coinbase’s current 11% share of the cryptocurrency market puts the exchange in pole position to capitalize on long-term growth, the analyst said. The key to long-term success is to maintain market share, invest in infrastructure to accelerate institutional adoption, and expand the range of subscriptions and services to acquire new customers and increase average revenue per user, he added. to.

• The differentiator of the exchange is its security infrastructure and it is the deepest economic canal the company owns, Horgan said.

• There is scope for a gradual reduction in compensation from the current 55-60 basis points to 35-40 basis points by 2025, the analyst said.

• The analyst sees Coinbase in a unique position to monetize its private user base through ancillary financial services such as credit / debit cards, stock trading and consumer lending, similar to what Square Inc.’s (NYSE: SQ) Cash app and PayPal Holdings Inc. (NASDAQ: PYPL) Venmo has done.

Cryptocurrency has reached a turning point on its path to legitimacy, according to Rosenblatt, and this is only a long-term disruptive trend in the early innings.

“Net / Net, we are buyers of COIN as a leader in the long-term and pureplay cryptocurrency equity category,” the company said.

COIN Price promotion: At the last check, Coinbase shares fell 2.77% to $ 311.92 on Wednesday evening.

Related Link: Coinbase’s IPO Heralds Next Stage of the Crypto Bubble: Investing Like It’s 1929

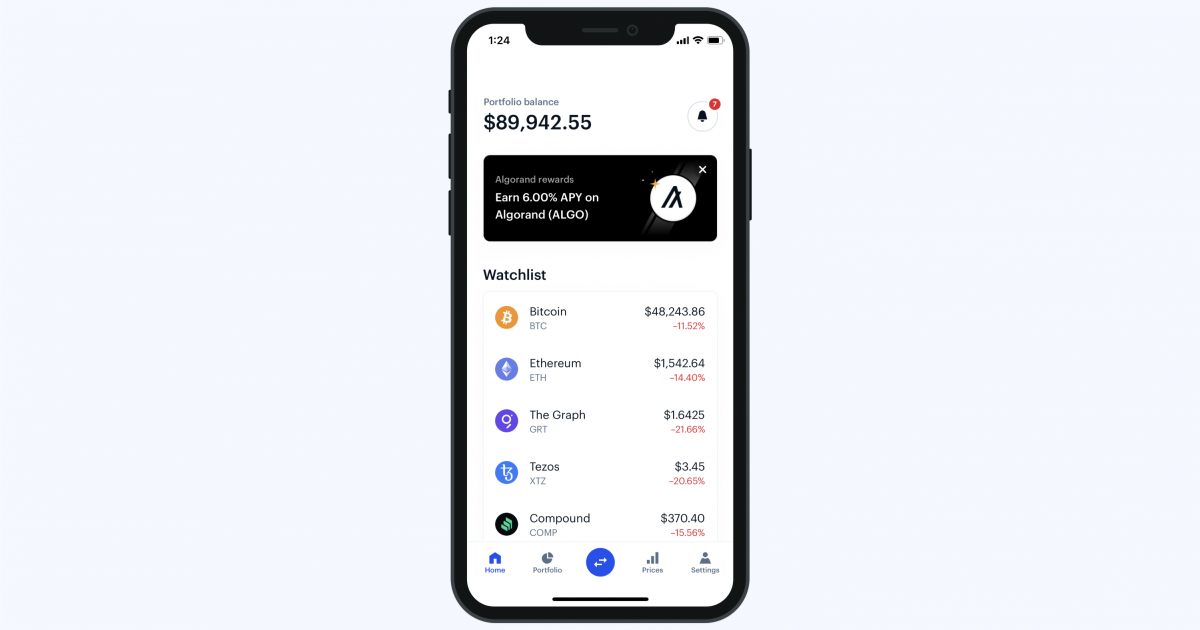

(Photo: Coinbase)

Latest reviews for COIN

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| April 2021 | Rosenblatt | Initiates coverage | To buy | |

| April 2021 | Loop Capital | Initiates coverage to | To buy | |

| April 2021 | DA Davidson | Maintains | To buy |

See more analyst ratings for COIN

Check out the latest analyst reviews

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.