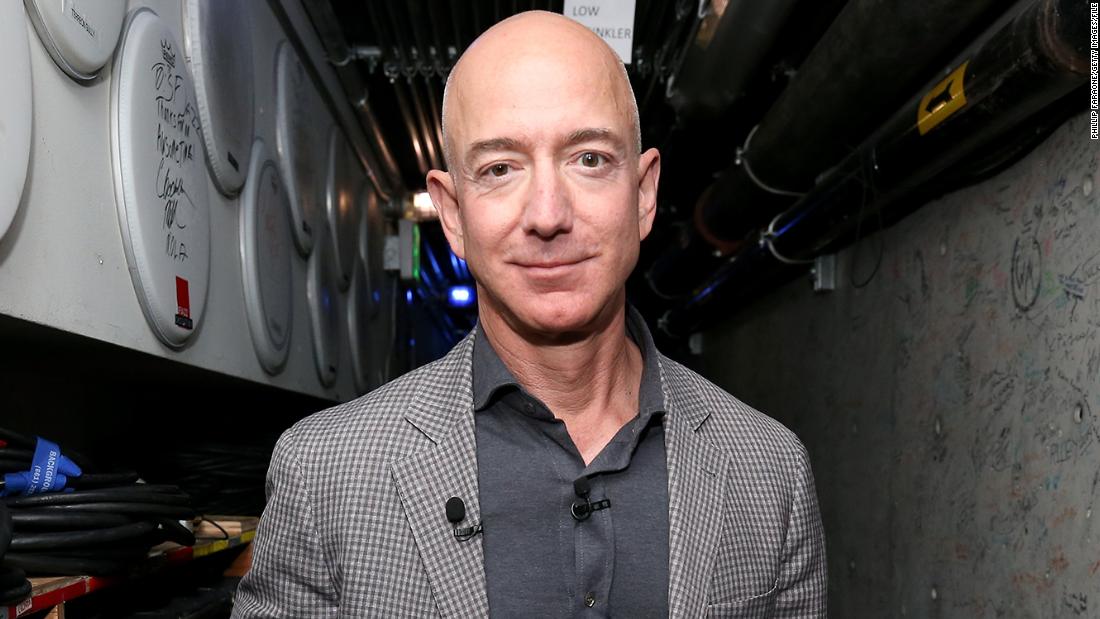

“We support the Biden administration’s focus on making bold investments in US infrastructure,” Bezos said. “Both Democrats and Republicans have supported infrastructure in the past, and now is the right time to work together to make this happen. We recognize that this investment requires concessions from all sides – both in the details of what is included and how it’s paid for. “

In 2019, then-former Vice President Joe Biden

called out Amazon for its history of using tax credits and deductions to lower its corporate tax bill. The company fired back saying, “We pay every cent we owe,” and that it had paid $ 2.6 billion in corporate tax since 2016.

And last year, then-presidential candidate Biden said again that Amazon should “ start paying their taxes, ” as part of a broader criticism of large, successful companies. Amazon has repeatedly stated that it follows all applicable tax laws.

The company also recently spar with Senator Elizabeth Warren, who has advocated raising taxes on large corporations. Last month, Warren said in a

tweet: “Big corporations like Amazon report huge profits to their shareholders – but they exploit loopholes and tax havens to pay next to nothing in taxes. That’s just not right.”

Amazon responded to her,

saying: “You make the tax laws @SenWarren; we just follow them. If you don’t like the laws you’ve made, definitely change them. Here are the facts: Amazon has paid billions of dollars in corporate tax for the past few years alone. ”

For the 2017 and 2018 tax years, Amazon’s financial records showed that it expected to receive money back from the federal government, not that the money owed income tax. For the 2019 tax year, Amazon said it owed more than $ 1 billion in federal income tax, according to a figure that was just over 1% of its profits, according to experts.

In 2020, Amazon paid $ 1.7 billion in federal taxes, the company said

said in his response to Warren. Net income for the year was $ 21.3 billion.

While it has already received some criticism, the Biden administration’s infrastructure plan may be compelling enough to convince more business leaders to sign up in support of the tough corporate taxes.

Bezos said in his statement, “We look forward to seeing Congress and the government come together to find the right, balanced solution that will maintain or improve the US competitiveness.”

And he is not alone. Rick Rieder, Chief Investment Officer Global Fixed Income at BlackRock, the world’s largest asset manager, said reversing Trump-era corporate tax cuts will not hurt the economy – and could even be positive for growth.

Rieder told CNN Business last month that he thinks the US economy can “certainly” withstand higher corporate taxes, and suggested that raising the corporate tax rate could help ensure that economic profits are more evenly distributed among businesses and employees.

“The US economy is amazingly resilient,” he said, “and will in fact perform well if you get some of this income redistribution and consumption in an easier and better place, especially for lower and middle incomes.”

CNN’s Brian Fung and Matt Egan contributed to this report