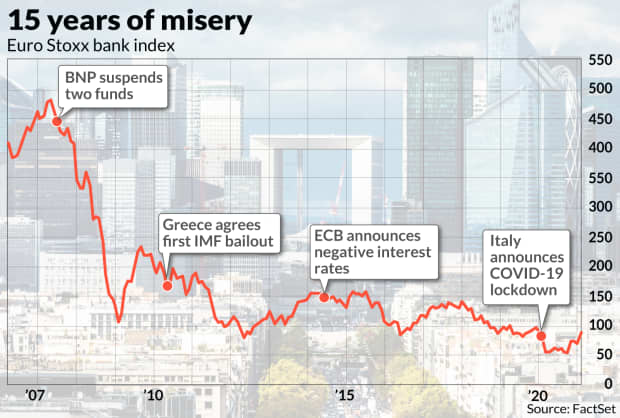

It has been a pretty tough 15 years for the leading eurozone banks.

The bad times were horrifying – the 2008 financial crisis, the Greek debt crisis and now the COVID-19 pandemic. But even the good times weren’t that great, with lenders in the 27-country group facing a backdrop of negative interest rates and stagnant local economies. From the highest point in 2007 to the lowest point in 2021, the Euro Stoxx bank index SX7E,

collapsed by 89%.

But suddenly there is life in the group led by the French BNP Paribas BNP,

The Spanish Banco Santander SAN,

Italy’s Intesa Sanpaolo ISP,

and the Dutch ING INGA,

thanks to the rise in bond yields. France’s 10-year return TMBMKFR-10Y,

now regularly flirts with positive territory and Goldman Sachs expects the German benchmark rate TMBMKDE-10Y,

which has been negative for nearly two years could reach zero by the end of the year. Since just before the US elections, on Oct. 29, the sector has gained 71%.

It was just bad news and even more bad news for eurozone banks.

So the question is whether this bounce is real or not. There have been other times when the sector has seen major upward moves, particularly in 2009, before going back again.

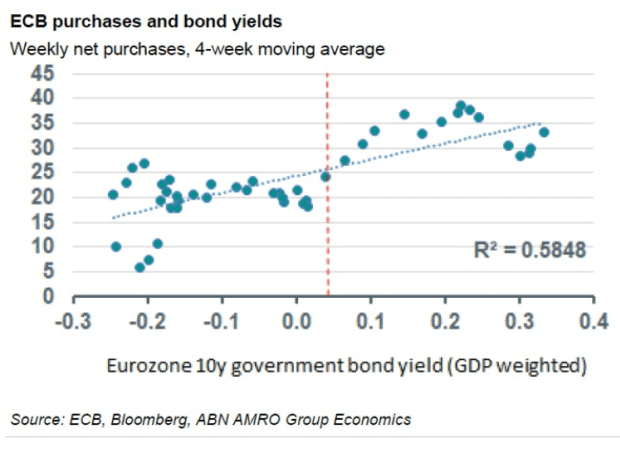

And there is a counterbalance. The rise in bond yields has fueled the ire of the European Central Bank, which, contrary to the US Federal Reserve, believes the moves could hamper economic recovery. ECB President Christine Lagarde, Chief Economist Philip Lane and Board Member Isabel Schnabel have all voiced concerns about the rise.

Thursday’s ECB meeting offers Lagarde another opportunity to moderate the rise in bond yields, if not announce action. Analysts say the central bank still has more than enough firepower under the existing authority to pick up its bond buying activities under the Pandemic Emergency Purchase Program.

The current yield is roughly where the ECB has accelerated purchases in the past, notes Nick Kounis, head of financial markets research at Dutch bank ABN Amro. “We think that increasing the pace of net asset purchases is the first and most obvious point of appeal for the ECB,” he said.

An active ECB could therefore jeopardize the early recovery of eurozone bank stocks.

“They are cheap, the question is whether style value will continue to gain traction and be helped by a cyclical recovery for European banks. A steeper curve would help, but in all likelihood the ECB will step in this week to mitigate it, ”said Sebastien Galy, senior macro strategist at Nordea Asset Management.

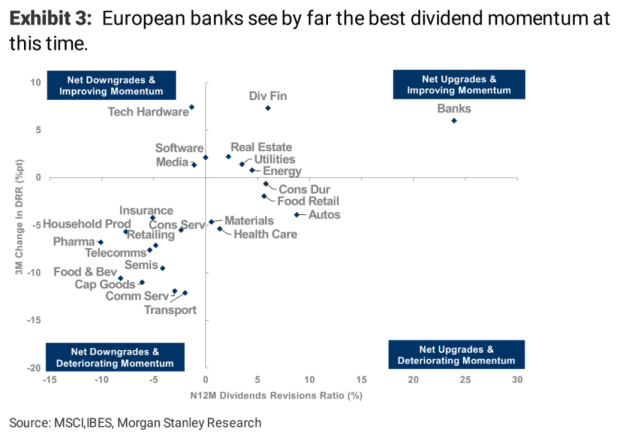

There is more to the eurozone banking story than bond yields. Dividend payments are virtually banned by the ECB until the end of September, but analysts are now setting expectations for payouts, data from Morgan Stanley shows.

And, as Galy said, the valuation is undemanding. According to FactSet, banks in the Eurozone are trading at 0.6 times book value. Compare that with the US, where the SPDR S&P Bank ETF KBE,

has a bookable price of 1.2.