Hong Kong’s tax hike on stock trading was a “useful catalyst” that helped fuel a healthy correction for the city’s markets, says Tim Moe of Goldman Sachs.

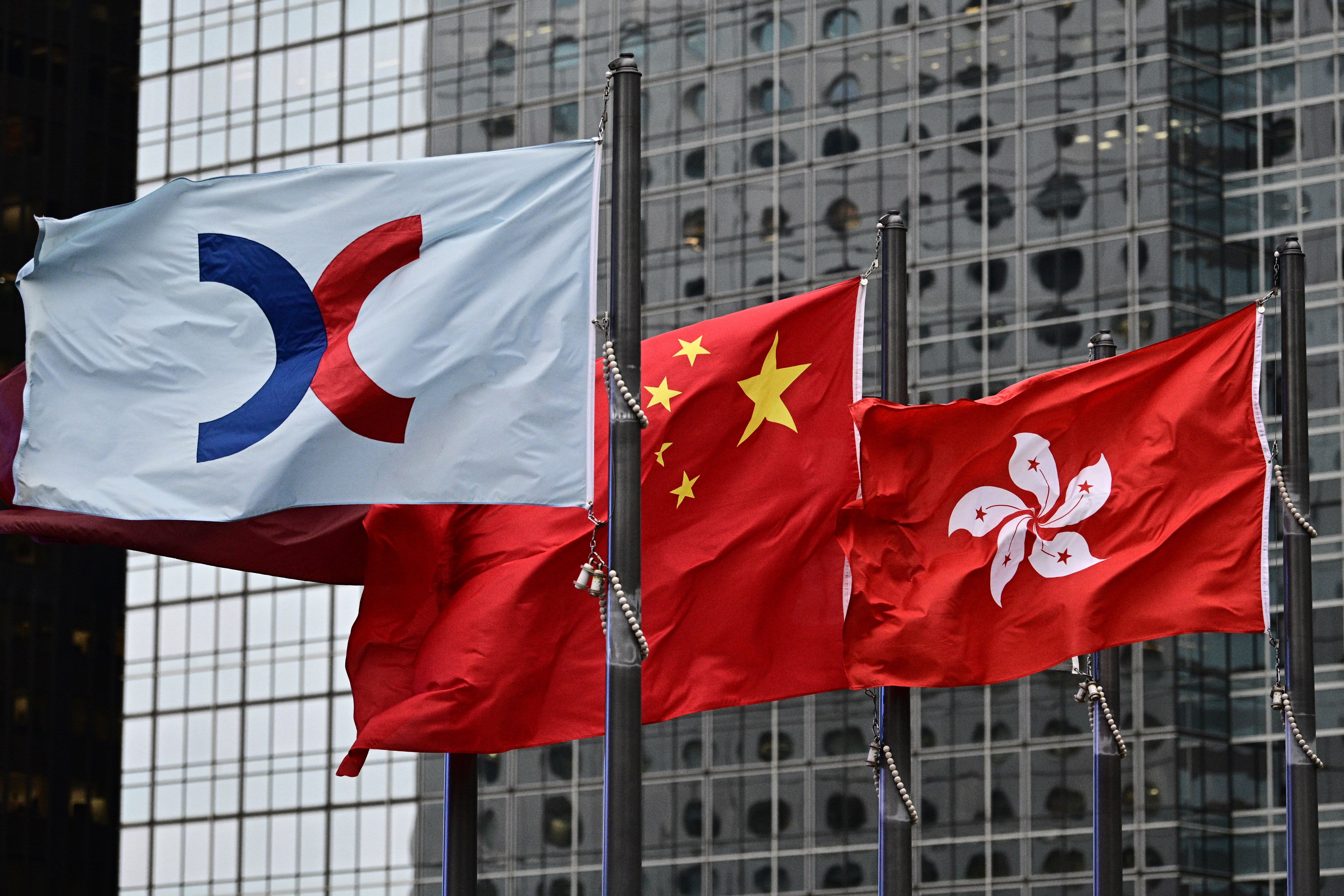

The government announced in its budget on Wednesday that the stamp duty on stock transfers will be increased from 0.1% to 0.13%.

The move led to a sharp sell-off in broader markets on Wednesday, but stock prices partially recovered on Thursday.

The Hang Seng index rose about 1.5% during Thursday afternoon trading, after falling about 3% the day before.

Meanwhile, Hong Kong Exchanges and Clearing showed more losses as it fell about 1.4% and fell further after the previous day’s plunge of more than 8%. The HKEX operates the city’s stock exchange and on Wednesday posted an increase of more than 20% year-over-year in 2020 earnings attributable to shareholders.

“I think it’s important to note that the overall increase, I mean yes, it sounds like 30% a big number, but it’s really 3 cents for every hundred dollars traded – that won’t be the only or enough fundamental reason for people to make an investment decision, ”said Moe, co-head of Asia macro research and chief Asia-Pacific equity strategist at the US investment bank.

We believe that the increase in stamp duty was kind of a useful catalyst for a market that had done very, very well.

Timothy Moe

Chief Asia-Pacific Equity Strategist, Goldman Sachs

“We believe the stamp duty increase was kind of a useful catalyst for a market that had done very, very well. It’s probably a little bit above the skis in terms of positioning, rating and we’ve got what you might call a healthy correction, ”he told CNBC’s“ Squawk Box Asia ”on Thursday.

Despite Wednesday’s sharp losses, the Hang Seng index is still up more than 9% for the year as of Wednesday’s close.

In January, Moe told CNBC that investors in mainland China have contributed significantly to the “very strong start” of Hong Kong equities in 2021.

Looking ahead, the Goldman Sachs strategist said Hong Kong markets are likely to continue their upward trend once this period of sales recedes.

“What we would see things is kind of a healthy clean-up of some over-stretched positioning, some of the favored heavily-held stocks that have been sold,” Moe said. “We think once we get through this kind of positioning, it becomes clear that the market … can continue to have some rising profits later this year.”

Subscribe to CNBC PRO for exclusive insights and analysis, and live programming of working days from around the world.