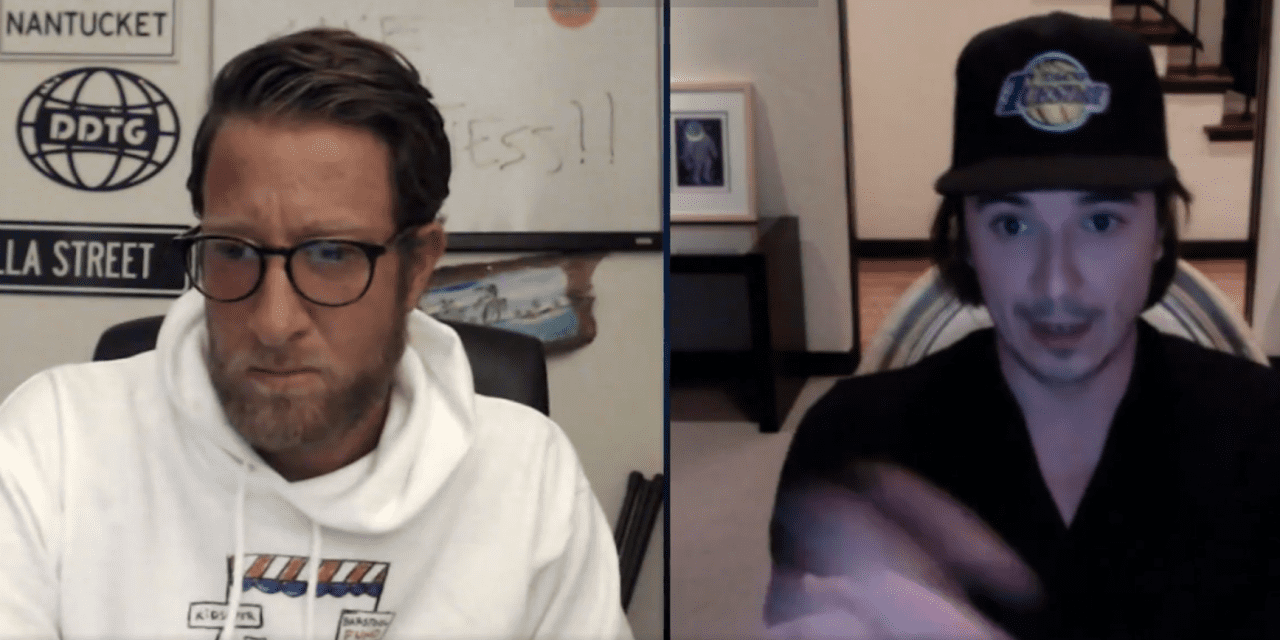

It’s hard to find two people who better embody the retail boom than Vlad Tenev, the co-CEO of the popular online broker Robinhood, and Dave Portnoy, the brash founder of Barstool Sports who started investing when the COVID-19 pandemic was stopped. the sports world.

Portnoy interviewed Tenev about the GameStop GME Tuesday night,

saga already chewed by the House Financial Services Committee.

The interview began with the man who calls himself Davey Day Trader and a Taco Tuesday hat-clad Tenev asked if he knew everyone hated his guts, as Robinhood’s decision to restrict trading at GameStop basically ended the short squeeze momentum in that trade. Tenev was asked about the discrepancy between his participation in CNBC and denying there was a liquidity problem, and revealed in an interview days later that the brokerage faced a $ 3 billion margin call at 3am.

Tenev said it was not, as Portnoy described it, a 180 degree shift. “Putting it on a liquidity issue is selling it both over and under,” he said. Tenev said Robinhood was not the only company to do limited trading in video games retailer GameStop, cinema chain AMC Entertainment AMC,

and other popular stocks, what it calls a “systemic problem.”

When he flatly asked if Robinhood would have regulated trading in GameStop and other popular Reddit stocks without the 3am call, Tenev admitted that it wouldn’t. “If we had a lot more headroom, we probably would have let things go,” he said. And Tenev admitted that the company would have faced a liquidity problem the next day had it not acted. Tenev defended his CNBC interview, saying he was “running on fumes” as he tried to raise $ 3.4 billion in capital to restrict trade.

Portnoy also urged Tenev whether Robinhood should have restricted both sales and purchases – so as not to crate stocks – to which Tenev replied that margin requirements would not have been helped by restricting sales.

Watch the entire interview here.

CNBC star Jim Cramer shared his thoughts on the interview.