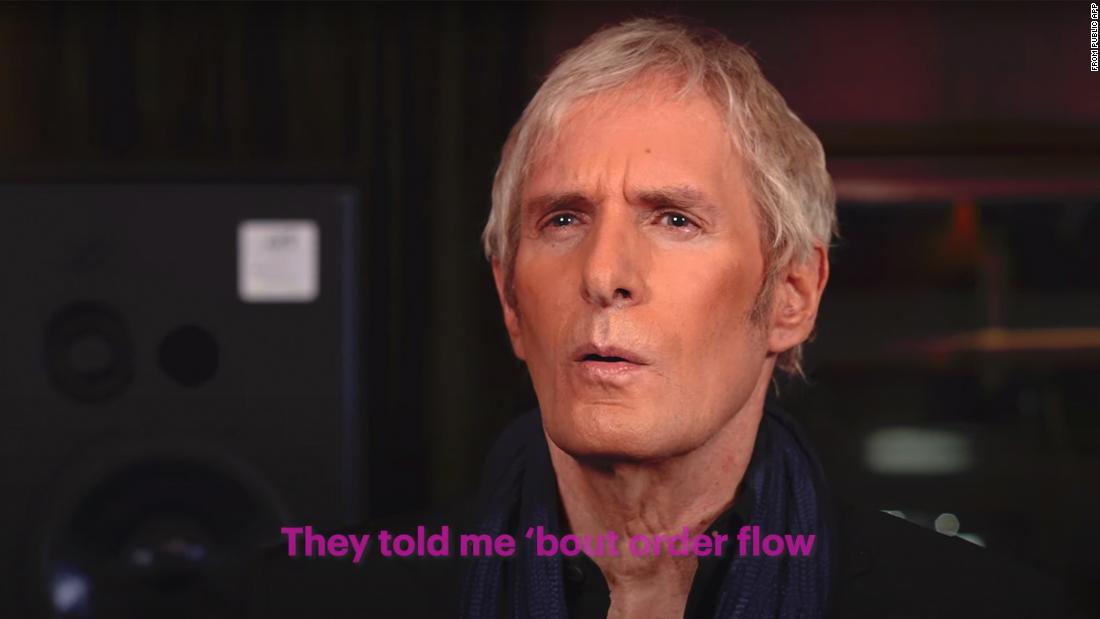

“I could hardly believe what I saw on Reddit today,” he sang. ‘I was hoping I could get it straight from you. They told me about the order flow so I googled, now I know. I think I should find someone new. ‘

Bolton continues, “So tell me all about it. Tell me who you sell my transactions to. ‘

The criticism of pop culture underscores the tremendous attention being paid to how Robinhood and other brokers have adopted commission-free business models. Critics say trading isn’t really free and fast Wall Street trading firms are getting the better end of the deal.

During the introduction to its issue, Bolton pointed out that Public.com says it does not sell transactions to third parties.

‘I know a thing or two about falling apart. And I’m here to help, ”said Bolton.

Robinhood has consistently championed the use of payment for the order flow, which accounts for more than half of the company’s revenue.

In the first half of 2020 alone, Robinhood estimated that its customers received more than $ 1 billion in price improvement – the price they received compared to the best price on a public exchange.

Citadel Securities, the high-speed trading firm to which Robinhood sends many of its orders, has similarly championed the practice.

“It is a major reason why private investors today can trade for free or at low commissions,” Citadel Securities founder Ken Griffin said at the hearing.